Does anyone remember the last time there was major ‘disruption’ in communications between auto finance lenders and auto dealers? If not, let me refresh your memory, back about 20 years when information flow between lender and dealer consisted of reams of paper shooting out of fax machines, and the big players joined together to modernize those communications, replacing paper with digital—and perhaps saving a tree or two in the process. It was revolutionary at the time and, perhaps, seen as a harbinger of more auto finance disruption and innovation to come. But nothing significant came, and no, AI is not that disruption, at least not in a positive direction. And neither is ‘digital retailing’ which has not (yet) lived up to its promise. But, as a recent survey of auto dealerships and lenders indicates, the time for another disruption is here.

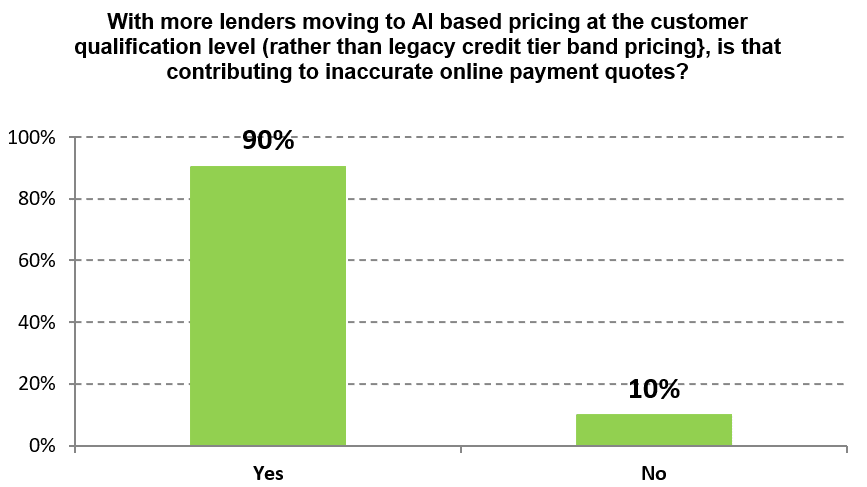

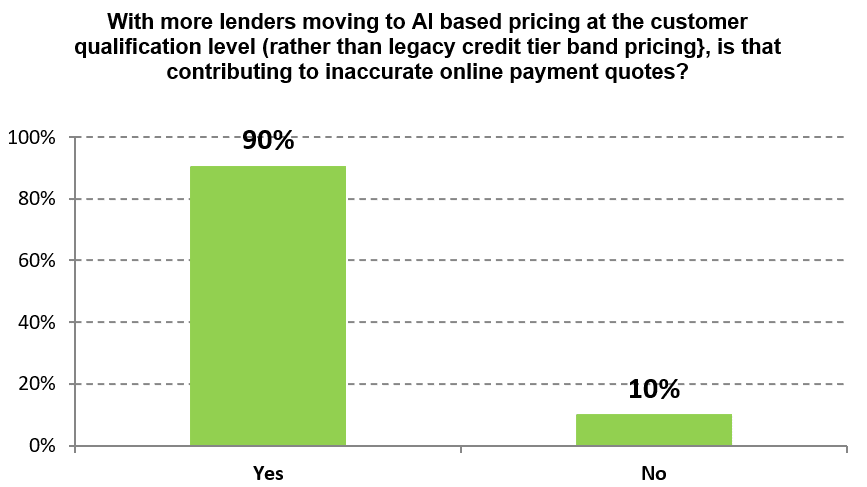

The survey, fielded online by eLEND Solutions at the beginning of the year, looked behind one of the main obstacles to the evolution of digital finance: inaccurate online payment quotes which are creating massive disconnects in the vehicle purchase process flow. It came as no surprise to learn that nearly 90% of dealers and lenders reported that inaccurate quotes were adversely impacting the buying experience. And, while the buzzy headline of our survey had to do with Artificial Intelligence, AI-based pricing to be specific, which 90% believe is contributing to inaccurate online payment quotes, the problems go well beyond the challenges of this rapidly ascending technology and rebound right back to lender and dealer—and something as basic as information access. For one, the lack of relevant, objective information available to generate accurate online payment quotes.

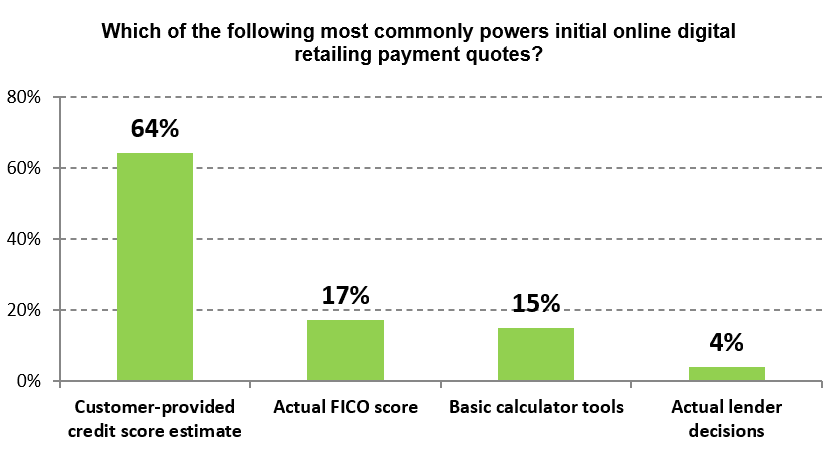

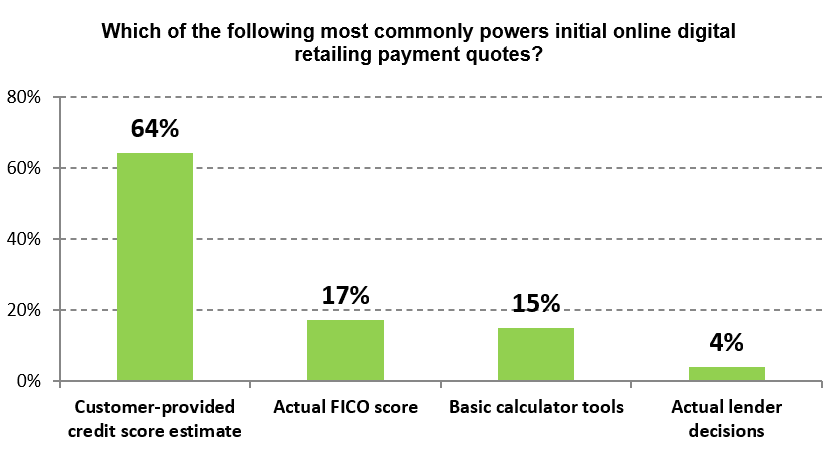

Astonishingly, when asked what most commonly powers initial online payment quotes, 64% of dealer/lender respondents in the survey, said they are primarily driven by consumer-provided credit score information, rather than actual FICO scores or lender-decisioning criteria, meaning dealers are essentially letting the customer determine their credit parameters. Only 17% cited the actual FICO score and a tiny 4% say actual lender decisions. Compounding this information gap, the majority (87%) report a reduction in lenders providing rate-sheet pricing bulletins, the very thing that dealers rely on to estimate the customer’s payment, meaning dealers are increasingly forced to rely on educated guesswork.

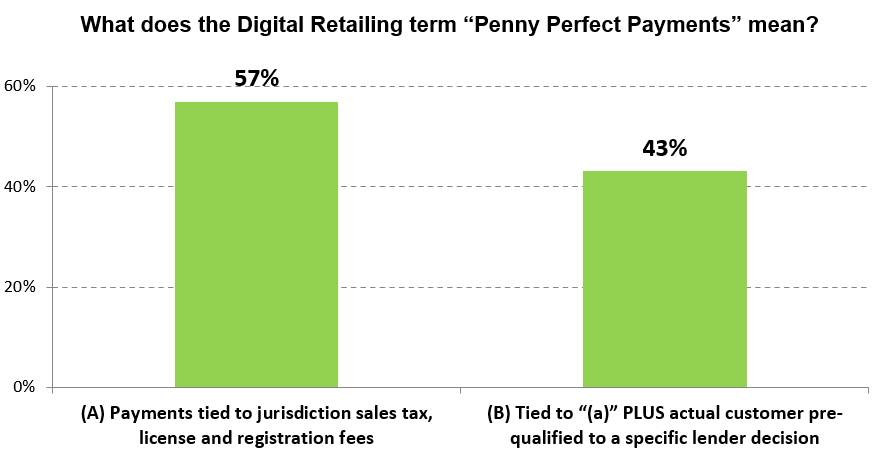

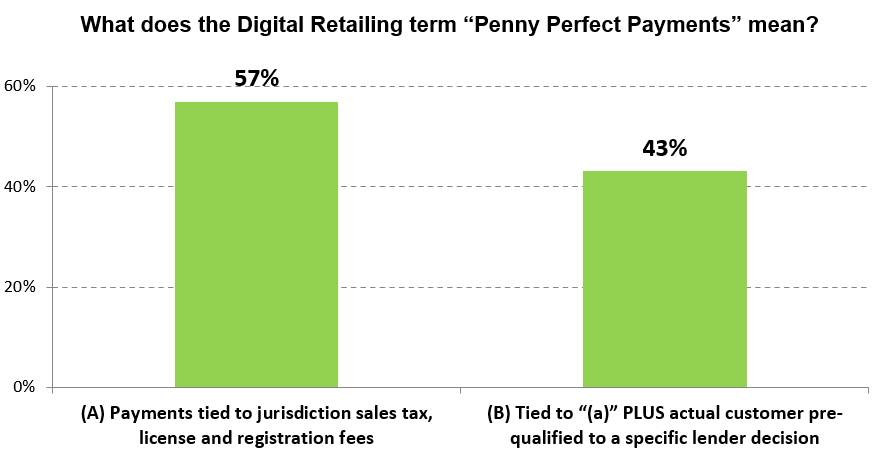

And it gets worse. When asked how they define a ‘penny perfect’ payment, 57% did not include an ‘actual customer pre-qualified to a specific lender decision’—only 43% included that in their definition. Adding further challenge is the fact that over half of lenders and dealers report that payment terms are negotiated with the online customer before a lender decision which is a bit like putting the cart before the horse, setting up for consumer dissatisfaction and deal rewinds.

So, is it any mystery why, for the vast majority, digital retail payment quotes match final lender decisions less than 25% of the time? Only 4% said that they match more than 50% of the time!

And the endgame of this information confusion? Mismatched deals as illustrated by the nearly three-quarters of dealers and lenders reporting that the desked-deal and final decision match 50% or less of the time.

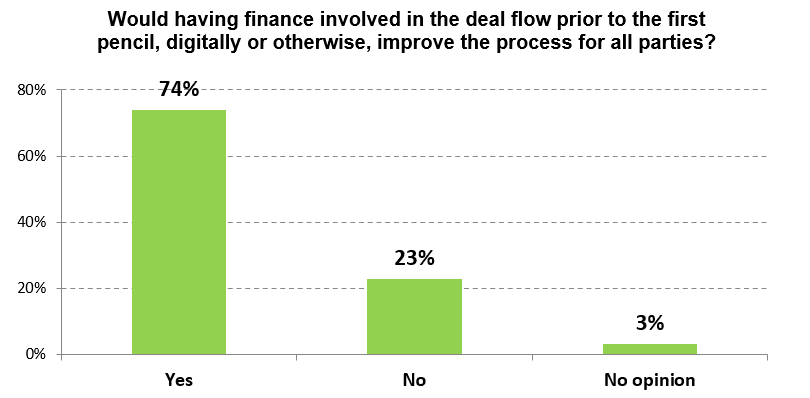

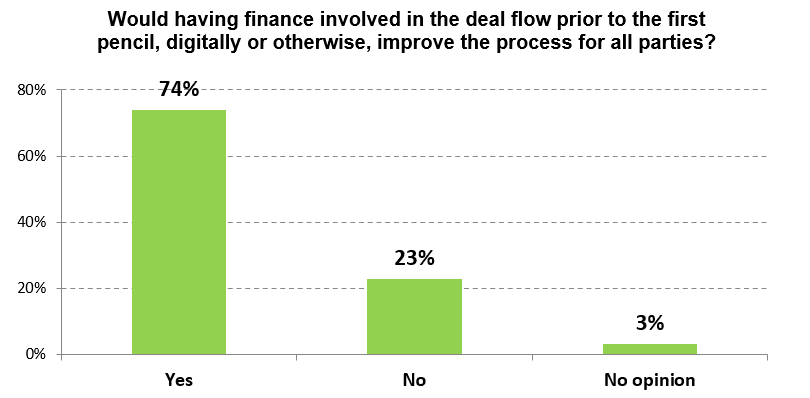

As our survey underscored, there is deep alignment between lenders and dealers on what the obstacles to accurate online digital retailing payment quotes are, and, fortunately, they are also aligned on the solution, which includes doing what may seem obvious—lining up finance with sales at the front of the deal. Over 70% agreed with this approach.

And the ‘AHA!’ moment in the survey? 94% say that pre-desking technology, integrated with lender-proprietary credit scorecard models, would improve the car buying/selling experience for all parties. This brings me back to the fact that disruption is long overdue in how lenders and dealers communicate in the purchase process. The technology is there to make this happen, but is the will there for all industry players to collaborate on ensuring that the information flow between dealers and lenders improves?

The clear alignment evidenced in our survey on both problem and solution makes me optimistic that the will does exist and that we are on the cusp of the next great disruption. In the months to come, right here on this channel, I will dig deeper into this data, looking one by one at the obstacles, and the specifics around how to eliminate them, as I continue to evangelize for our industry to come together and disrupt, to improve the auto finance processes—for all stakeholders. I hope you will join me.