The pressure for convenient, online options has driven dealers to find new ways of doing business, while upholding their tried and true operations at the same time.

The result? A balancing act of providing unique experiences to match every buyer’s situation in order to maximize value. These accelerated consumer expectations will have a lasting impact on dealership operations for years to come, but how can dealers meet those expectations?

In a recent survey of 1,000 respondents, the current car buying climate was clearly defined. Based on the types of buyers, their behaviors, and their preferences, addressing the evolving, yet familiar, car buying landscape lends itself to only one option. But first, let’s break it down.

Starting with Research

No matter how consumers ultimately complete their purchase, nearly all start their research online. Almost a quarter of respondents spent less than three hours researching, and 40% made their purchase within one week of initial research.

This could indicate that once a consumer starts their buying journey, they already have an idea of what they intend to buy, who to buy it from, and the deal they’re hoping to get. These are pre-set expectations before they even make it to your showroom, or in some cases, your website.

In fact, this quick purchase pattern would theoretically lend itself to completing the purchase online, but the vast majority still visited the store to complete their purchase – 88.37%.

The takeaway: dealers have a short window of opportunity to engage and persuade potential buyers online.

Making the Sale – Online or In-Store

Online – 11.63% of respondents

Online buyers had three driving factors that made online buying more attractive: convenience, less pressure, and safety. Their satisfaction level was above average with a score of 7.97 on a 10-point scale. In fact, 64.41% intend to complete their next vehicle purchase online again.

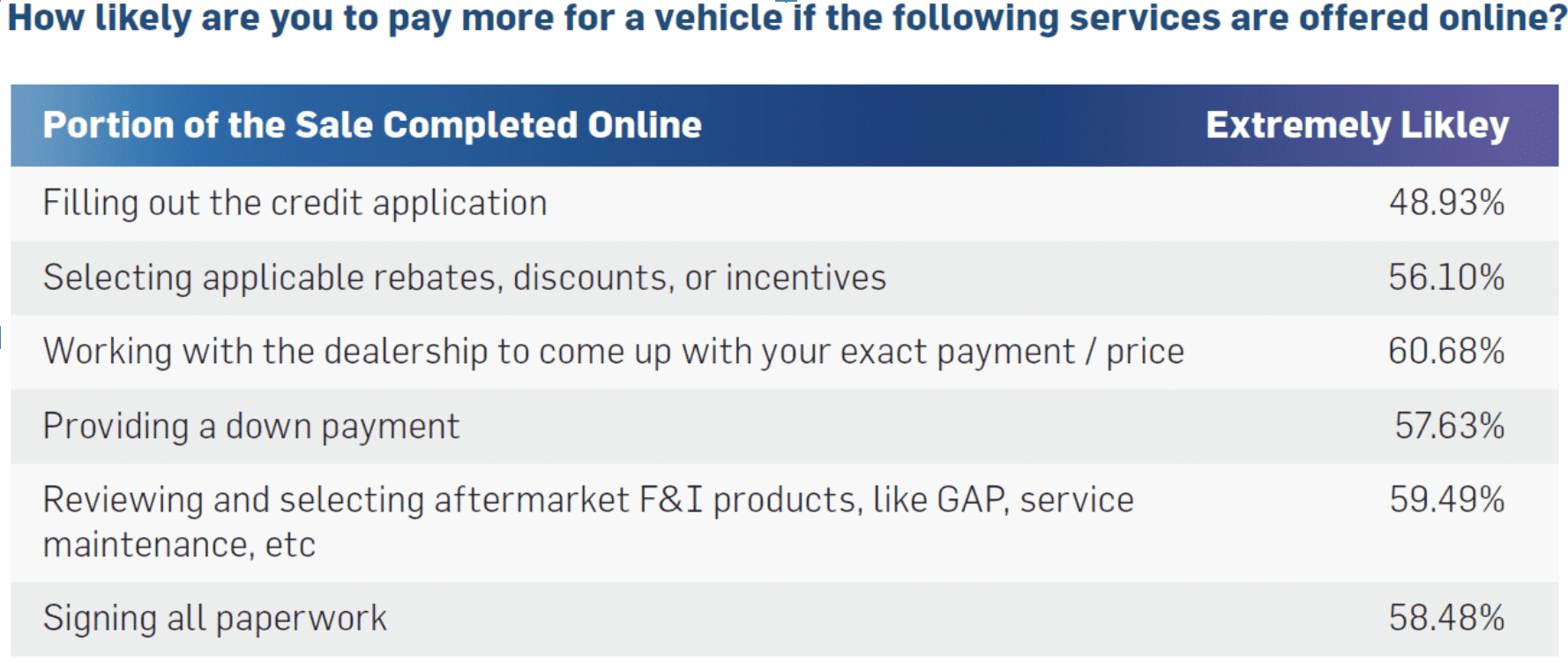

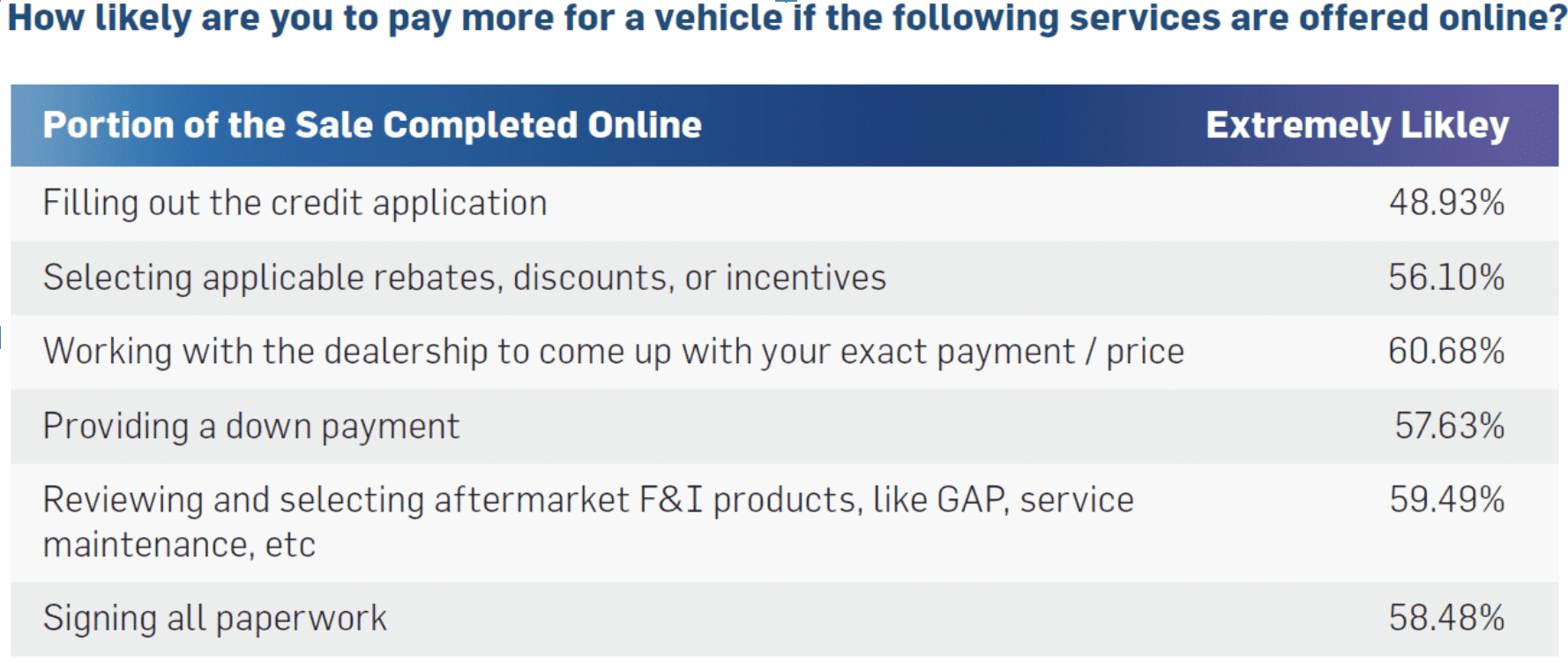

One surprising behavior about this group is they are generally more patient than in-store buyers. They are willing to accept longer wait times to receive a trade evaluation, negotiate price, select add-on products, and even sign paperwork. They’re also willing to pay more for these pieces of the transaction:

However, when we asked these online buyers if they had to visit the dealership for any reason at all, 77.59% said yes. Meaning of the total survey respondents, roughly 2% made their purchase completely online without ever setting foot in the physical dealership.

In-store – 88.37% of respondents

Online buying is growing in acceptance, but traditional, in-store buyers still make up the majority and nearly 75% plan to stick with that experience for their next purchase. Despite being highly satisfied with the in-store experience, there are still areas for improvement. In-store buyers indicated the time it takes to complete the transaction, as well as pressure from salespeople, can be turn offs to the overall experience.

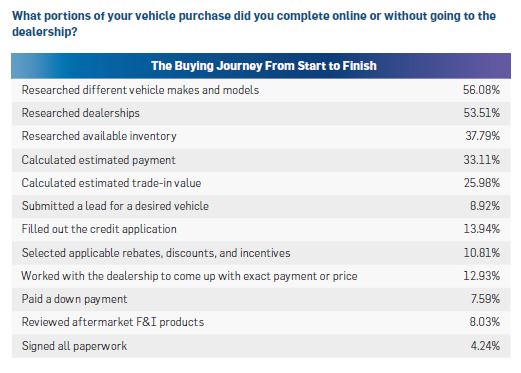

However, just because these respondents are classified as in-store buyers doesn’t mean they completed the entire transaction there. Most consumers are doing pieces of the transaction online.

When it came time to seal the deal, they opted for the in-store experience, mostly to complete a test drive (52.48%). When asked if there were any pieces of the transaction that must be completed in-person, nearly 60% said yes, there were. Main pieces included:

- The Test Drive: 39.43%

- The Trade In Inspection: 11.70%

- The Signing Ceremony: 10.37%

The takeaway with online and in-store buyers is clear: even with a growing demand for online experiences, the vast majority of consumers still want to visit the dealership for one reason or another. The key is knowing which portions of the vehicle sale the customer values having online versus in-store – and then being able to meet that need with an experience that is consistent and relevant no matter where the customer is.

The New Buying Experience

Is there such a thing as a distinctive in-store buyer or online buyer? 11% of respondents said they purchased online, but that was their perception. In truth, we know a much smaller percentage, only about 2%, actually completed the entire purchase without visiting the dealership.

On the other hand, in-store buyers definitely purchased in-store – but their experience didn’t start there. They did as much as they could online to speed up the process before making their way to the showroom.

What this leaves us with is a hybrid buyer. The vast majority of consumers blend the online and in-store experiences however it best fits their needs.

That transition can happen at any point in the buying cycle, so your dealership must make sure it’s seamless. No matter where the customer is, you need to provide the consistent experience consumers expect.

Ultimately, your dealership must find a balance between online and in-store buyers without sacrificing what’s important: control, profitability, accuracy, and efficiency.

Did you enjoy this article from Greg Uland? Read other articles on CBT News here. Please share your thoughts, comments, or questions regarding this topic by submitting a letter to the editor here, or connect with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook and Twitter to stay up to date or catch up on all of our podcasts on demand.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.