According to an article on the Business Insider site, “Ford and Volkswagen have estimated that electric cars require 30% less labor than conventional vehicles.” It goes further to site predictions from the consulting firm AlixPartners “that 40% less labor goes into EV motors and battery pack than an engine and transmission.”

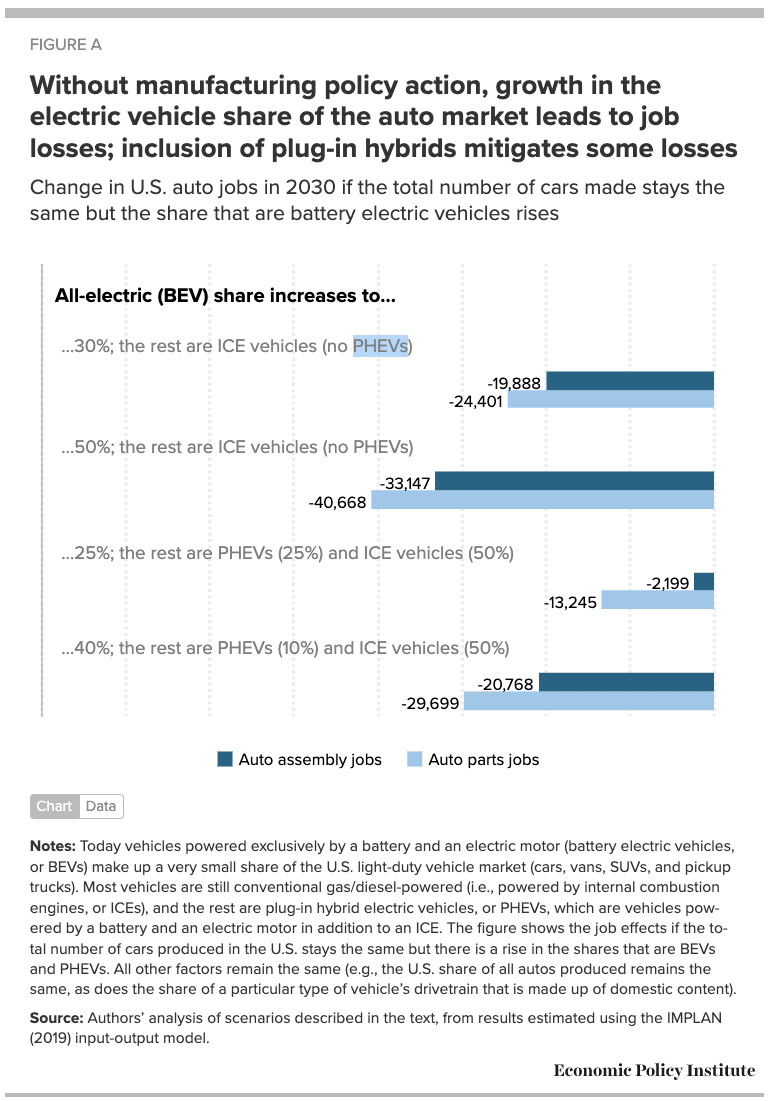

In a report issued last September, the Economic Policy Institute stated that employment would decline in the automotive sector without new policies supporting EV production. The group estimated the cost of inaction could be 75,000 jobs by 2030.

With President Biden’s signing of the Inflation Reduction Act, Federal grants and loans targeting increased domestic production of PHEV and BEV cars and trucks may reduce those projections significantly. There are also enormous financial incentives to encourage the further development of US-based battery production.

The Inflation Reduction Act has shifted focus from consumers purchasing electric vehicles to manufacturers, targeting a rapid build-out of a domestic electric vehicle production infrastructure while maintaining–and perhaps increasing–employment in the US automotive sector.

Here’s a summary of the three primary provisions in the Inflation Reduction Act targeting electric vehicle production.

Battery electric vehicles

There are some significant changes in how the Federal government will support the purchase of electric vehicles. Ignoring the awkward rules in effect until December 31, 2022, the following changes are in effect no later than January 1, 2023.

- An EV purchase credit remains at $7500 but with several new provisions. Electric vehicles produced in Asia, Europe and elsewhere outside North America are no longer eligible for the credit.

- There’s now an income limit to receive the tax credit, at $150,000 for single filers and $300,000 for joint-filing taxpayers.

- There are also limits on MSRP, topping out at $55,000 for cars and $80,000 for pickup trucks, SUVs and vans.

- New for 2023 is a $4000 tax credit for purchasing used electric vehicles.

- The 200,000 annual sales cap is being eliminated. All three US producers of electric vehicles– Chevrolet, Tesla and Toyota–had hit the cap, and incentives ceased for their customers. Tax credits start again in 2023.

To support the automotive industry’s conversion to electric vehicles, the bill includes $2 billion in grants to manufacturers to retool domestic plants for electric vehicle production. There are also up to $20 billion in loans available to build new production facilities.

Plug-in hybrid electric vehicles

The same tax credit rules for battery electric vehicles now apply equally to plug-in hybrid electric vehicles.

While it may appear unfair at first glance, as PHEVs still produce CO2 as part of the combustion process, consider this. The average driver in the US travels about 39 miles per day, according to Kelley Blue Book.

That means the average PHEV can cover most of that distance on battery power alone. Some do better. For example, the Ford Escape PHEV has an electric-only range of 37 miles. And as battery efficiency increases, so will the electric-only range of PHEVs.

So clearly, there’s an environmental advantage in having many Americans drive a PHEV in electric mode for their daily commute or rounds of errands.

There’s another advantage for PHEVs receiving the same credit as BEV cars and SUVs. PHEVs are significantly less expensive and faster to develop than an all-new BEV. Stellantis created the Chrysler Pacific Hybrid by adding electric motors to the drivetrain and stashing the batteries under the second-row seats (at the cost of losing the Stow’ n Go function). The trade-off resulted in an EPA electric-only range of 32 miles.

Battery production

The bill also includes incentives to move production from outside the US, primarily China, to new plants across the Midwest and the South, areas where unemployment is high and good-paying jobs few. The auto industry has already invested billions in these plants, and the Federal government is providing the following incentives to shift the battery supply chain to domestic production.

- A tax credit of $35 per kilowatt hour (kWh) for each U.S.-produced battery cell is about 35% of today’s average cost of producing a battery domestically.

- Another tax credit of 10% for modules, which are groups of batteries packed together for installation in a vehicle. Which, according to Bloomberg, covers a third of the cost of assembling a battery pack.

- There’s also an additional 10% tax credit for materials and minerals produced in the United States for battery production.

Going back to the 2021 report by the Economic Policy Institute, the group predicted that employment in the US automotive job sector could increase by 150,000 jobs in 2030. To do so, the report cited increased domestic production of electric vehicles to cover 50% of the US market.

Whether the provisions for increased electric vehicle and battery production in the United States included in the Inflation Reduction Act can assist manufacturers in reaching that goal remains to be seen. However, signs appear to be pointing in the right direction.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.