Experian has released its latest State of the Automotive Finance Market Report for Q2 2022, a quarterly report on the latest trends and analysis of the US automotive finance market. Today on Inside Automotive, we’re pleased to welcome back Melinda Zabritski, Senior Director of Automotive Financial Solutions for Experian, to take a closer look at the key findings.

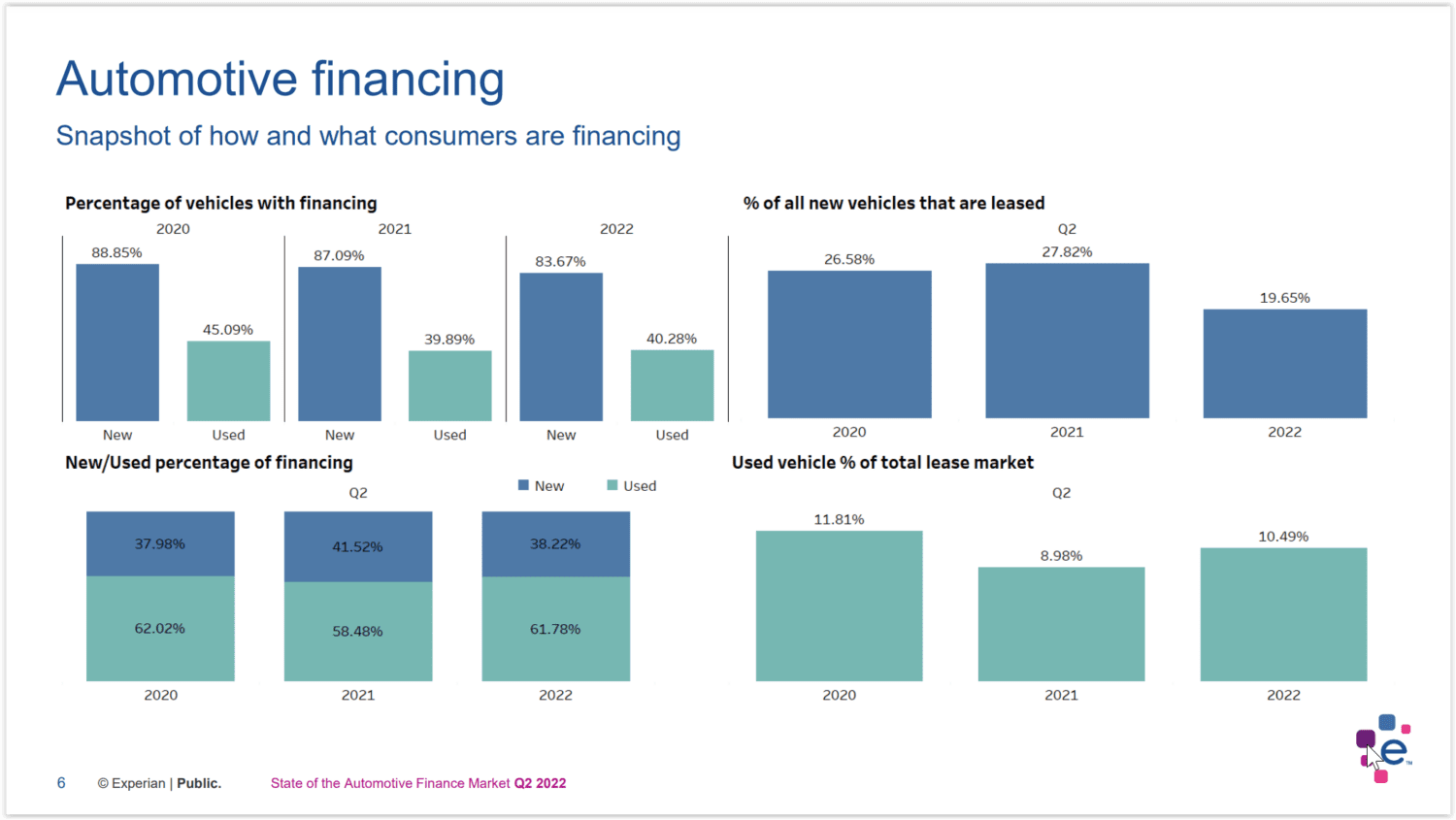

Zabristski says the automotive market has been the most interesting over the last few quarters—because of the supply shortage. There was tremendous demand in Q2 of this year, but automakers struggled to produce consistently. In response, much of the market’s attention shifted to used vehicles; however, car loan amounts and monthly payments reached record highs.

Extended automotive finance payments have also been climbing. On the new vehicle side, extended terms tapering off, but with used vehicles, the demand, option values, and loans are still going up.

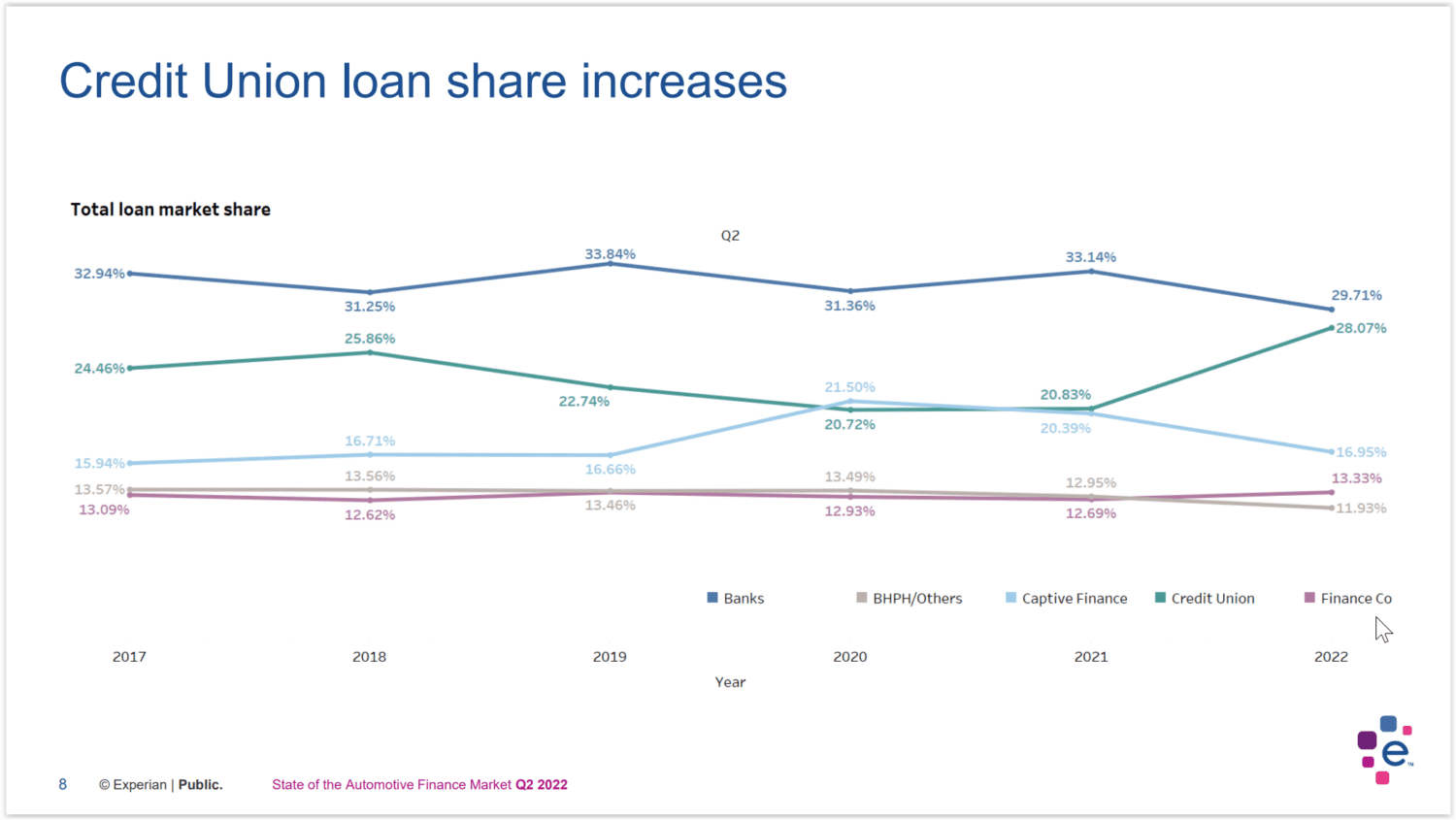

Credit union market share doubled for auto financing—in fact, Zabristski says they are “just a tad behind banks when it comes to loans.” This uptick in market share is due to bank-rate increases, leading consumers to seek better deals from credit unions.

What about delinquency rates? Was there an increase in payments? Zabristski says that year-over-year, there were lower delinquency rates in 2020 and 2021. But overall, she is used to seeing delinquency rates increase, but it’s still several basis points lower than in 2018 and 2019.

Zabristski expects these trends to continue throughout the year, but she adds that the delinquency rate will likely stay where it is right now, with a slight increase predicted due to larger payments.

She points out that she doubts loan amounts and payments will decline, especially in a raised-rate environment. She says we can expect similar (if not the same) trends for the next four or even five quarters, which is shocking to many.

“It’s such a different market at the moment,” Zabristski says, “If we compare with, say, 2009, we see that in today’s industry, nothing has been so strongly sustained. With so many quarters of inventory issues combined with high demand, it can be quite eye-opening, even for experts.”

In 2007, monthly payments of $400 on a new car, and in today’s market, the monthly price of a new vehicle is $677, more comparable to a mortgage.

Did you enjoy this interview with Melinda Zabritski? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Did you enjoy this interview with Melinda Zabritski? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.