In last month’s article, “From the Fax Machine, to the future: Auto Finance Disruption Time is Here,” I revealed data that demonstrated how overdue disruption in the auto finance industry is, and the need for industry collaboration to solve it. I also pointed out that in order for that collaboration to happen, clarity around the obstacles preventing it is critical. Today, I want to focus on one of the most significant obstacles, made crystal clear by today’s affordability crisis: consumers care much more about payment terms than selling price and, agree both dealers and lenders, Digital Retailing’s inaccurate and misleading payment quotes to these payment-sensitive car buyers are having an adverse impact on the car buying/selling process.

Auto Dealers report that monthly payment amount is more important (46%) than the selling price, with only 31% stating price is more important.

Let’s dig deeper into data that points to the root cause of these inaccurate quotes, and uncover where the disconnects between how consumers want to buy, and how dealers want to sell, happens. Digital Retailing is a good place to start.

Despite conventional wisdom, today’s version of ‘Digital Retailing,’ is a mostly lead generation model rather than a deal generation model. While dealership websites and digital retailing tools have advanced stylistically, with elegant presentations of vehicle detail information and more transparency around purchase price, the substance of providing consumers real finance terms online, and upfront, in the sales process is lacking.

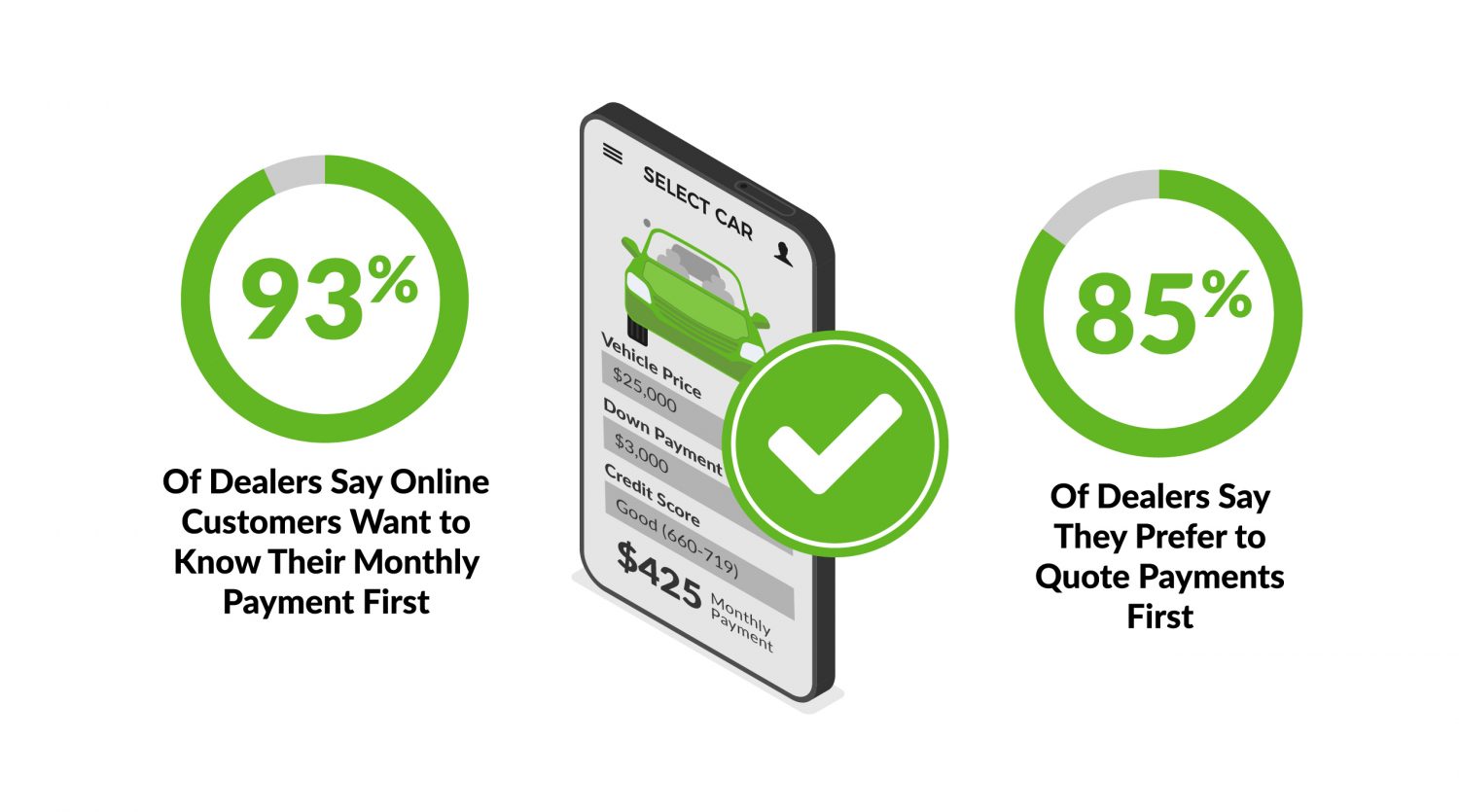

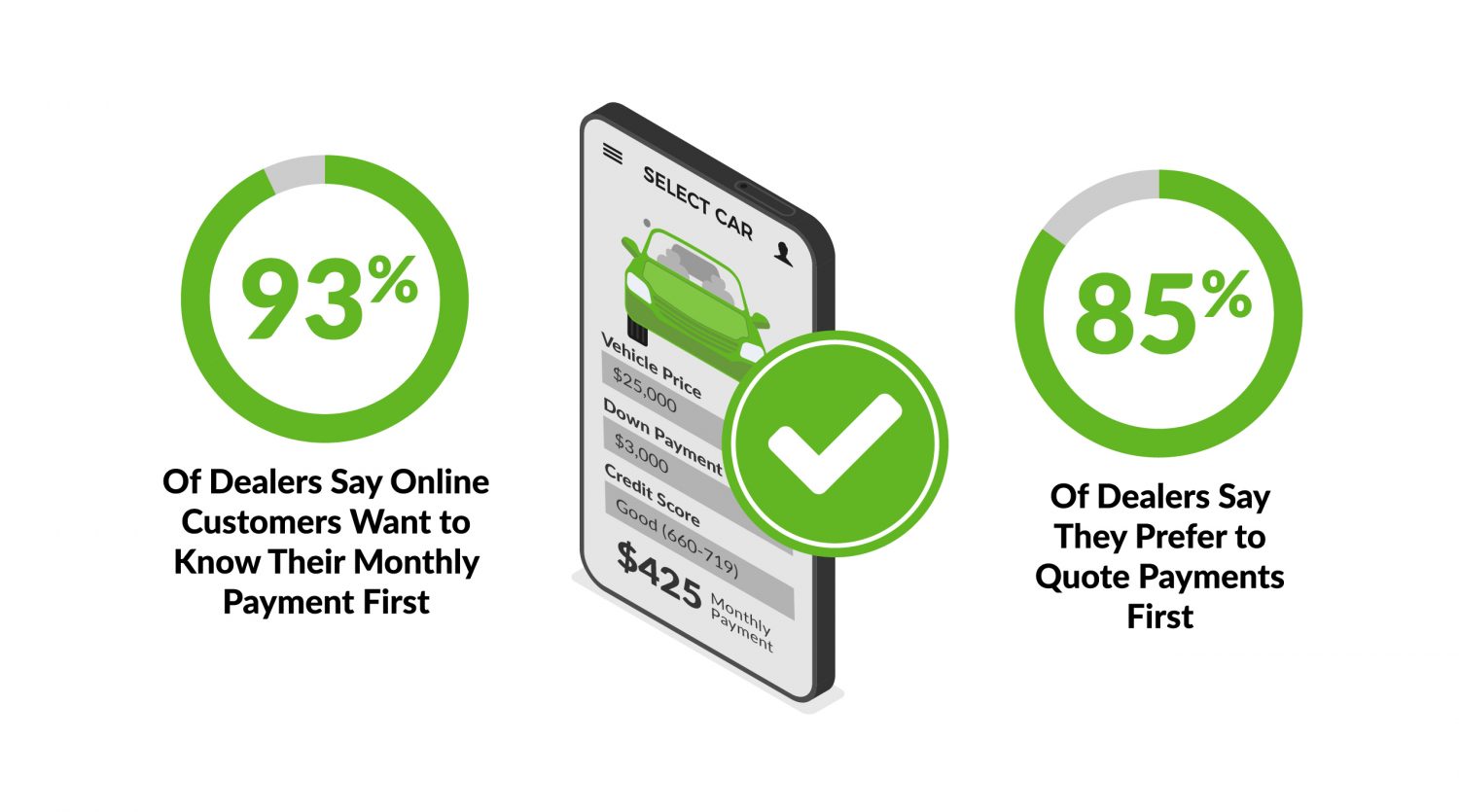

And this is so important because today’s consumers want to do more of the car buying steps remotely to save time at the dealership, and that means they want to know what their real payment terms are at the front of the process – as evidenced by the 93% who say they want to know their monthly payment at the beginning of their journey and the 85% of dealers who also want to quote payments early.

To meet this consumer preference, auto dealer websites and digital retailing tools offer a variety of finance tools — from letting customers desk their own deals, (which is silly), to estimating their own credit score (also silly) — that then calculate and present payments, terms and interest rates, that are, more often than not, disconnected from reality. This creates a happy illusion that the dealership is providing their customers with an accurate monthly payment, but the harsher reality is that “The Payment” is nowhere in sight, and won’t be until the consumer gets to the dealership. Worse still, this perpetuates the distrust consumers continue to have about the car buying process and is, I am afraid, compelling evidence that Digital Retailing has yet to mature beyond a lead generation model that prioritizes getting customer into dealership, rather than accurately pre-qualifying them.

But Digital Retailing is not the only one to blame for this, it is a decades-old problem: sales and finance have always operated in silos in the dealership with a sell first, finance last process. That same disjointed process has now been moved online, under the banner of digital retailing, with terms negotiated without the involvement of lenders or connection to their AI-based automated loan decision tools.

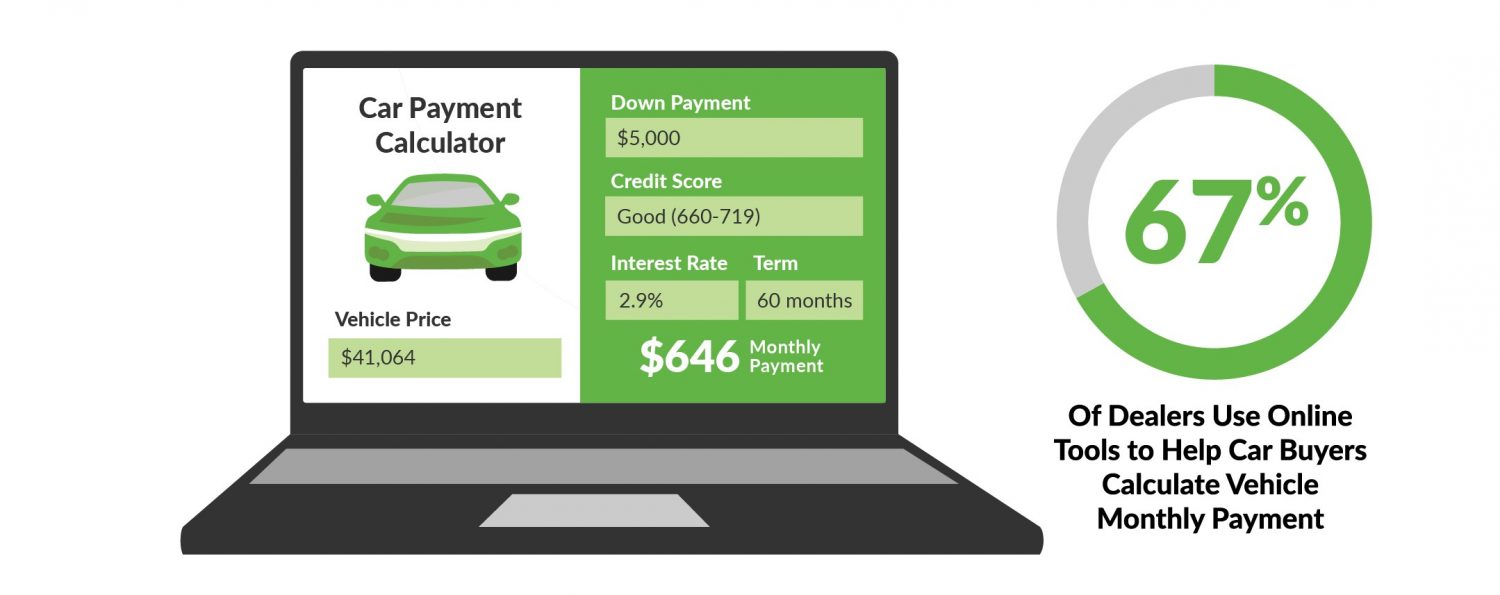

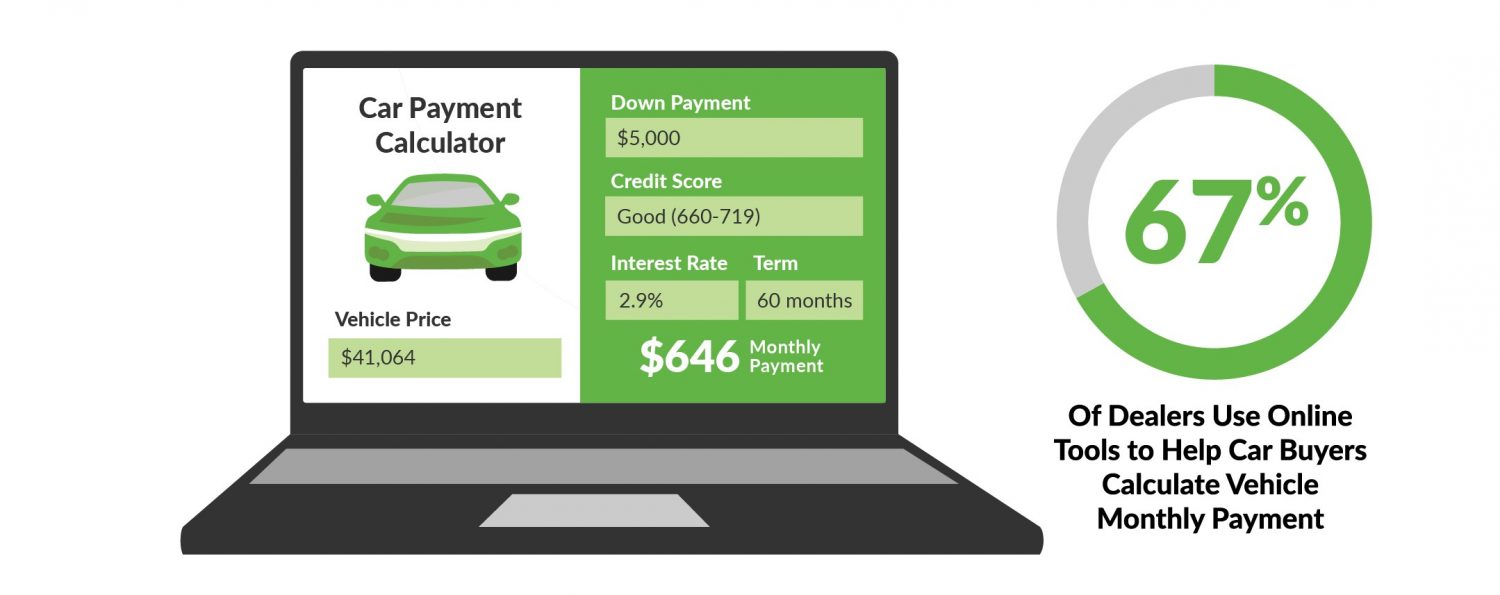

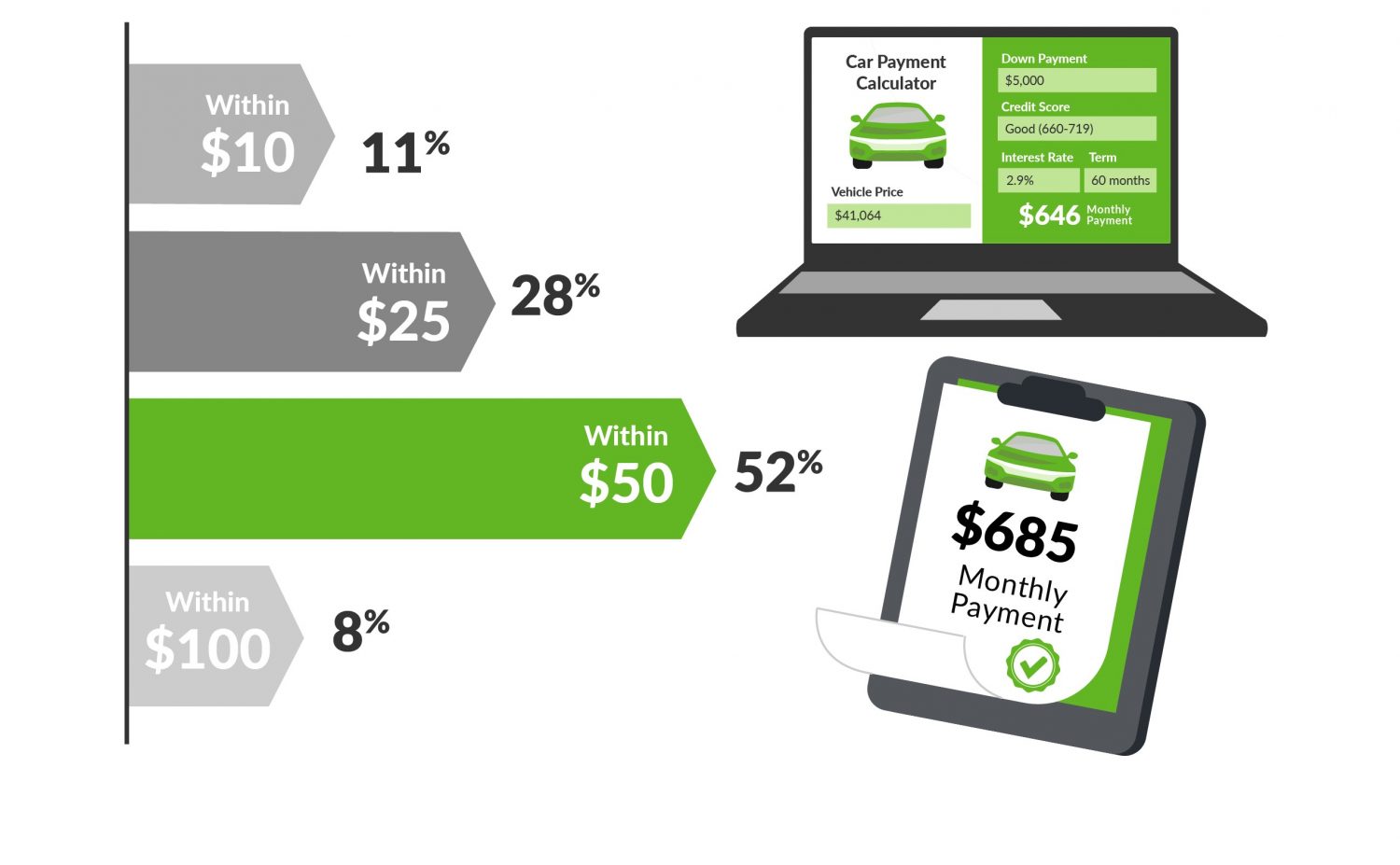

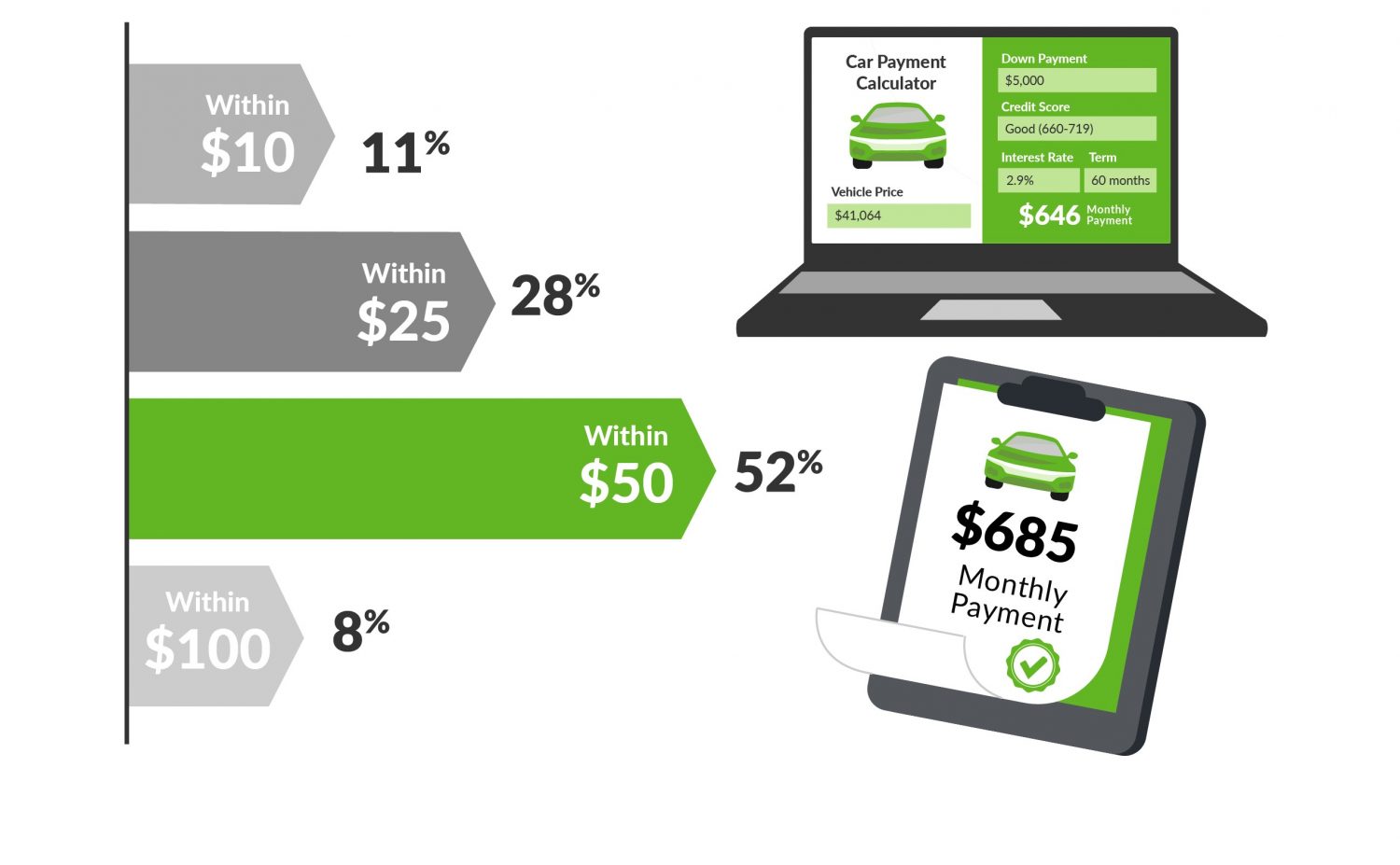

Digital retailing tools, however, contribute unqiuely to this problem through the use of online calculators that use customer-estimated or actual FICO credit score as the single attribute in determining customer qualifications to quote interest rate, term and monthly payment. These detached-from-reality quotes have the potential to alienate customers who believe them and then face a moment of truth on actual payment cost at the dealership. Because their monthly payment estimates are disconnected from real lender terms and consumer credit profiles, these online calculators are essentially digital retailing traps. And, given that affordability ranks as car-buyers’ top challenge, it is astonishing that over half of dealers are okay with this lack of accuracy: the majority report that it is okay for a monthly quote to be within $50 of the final contracted payment. For a 72-month term, that is misquoting up to $3600 over the life of the loan term. No wonder dealers are plagued with expensive rewinds & loss of F&I sales.

In addition to over-reliance on consumer provided FICO scores, the huge gap between online payment quotes and fundable contract terms is caused by their reliance on third-party data set tools that qualify the vehicle, not the customer in hypothetical scenarios. Not surprising as almost all Digital Retailing tools in the marketplace today lack access to consumers’ full credit file reports, or ability and stability attributes in their algorithms – which are the core elements lenders use in determining credit applicant qualifications and credit pricing terms.

The good news from our research is that both lenders and dealers agree that this problem exists, that it is having a negative impact on the purchase process and that they are mostly aligned on a solution. Is that solution disruptive? Potentially, but that is a good thing and we are on the cusp of it if lenders, dealers and industry finance players can come together. Join me next month, when we will dive a little deeper into data that demonstrates the impact of the above disconnects – and in future months we will tackle the solution. See you then!