Such is the case with Experian’s release of its State of the Automotive Finance Market Q2 2022 report. The exhaustive document explores recent happenings with automotive lending, now with more than $1.3 trillion in outstanding balances.

Continued growth in used cars

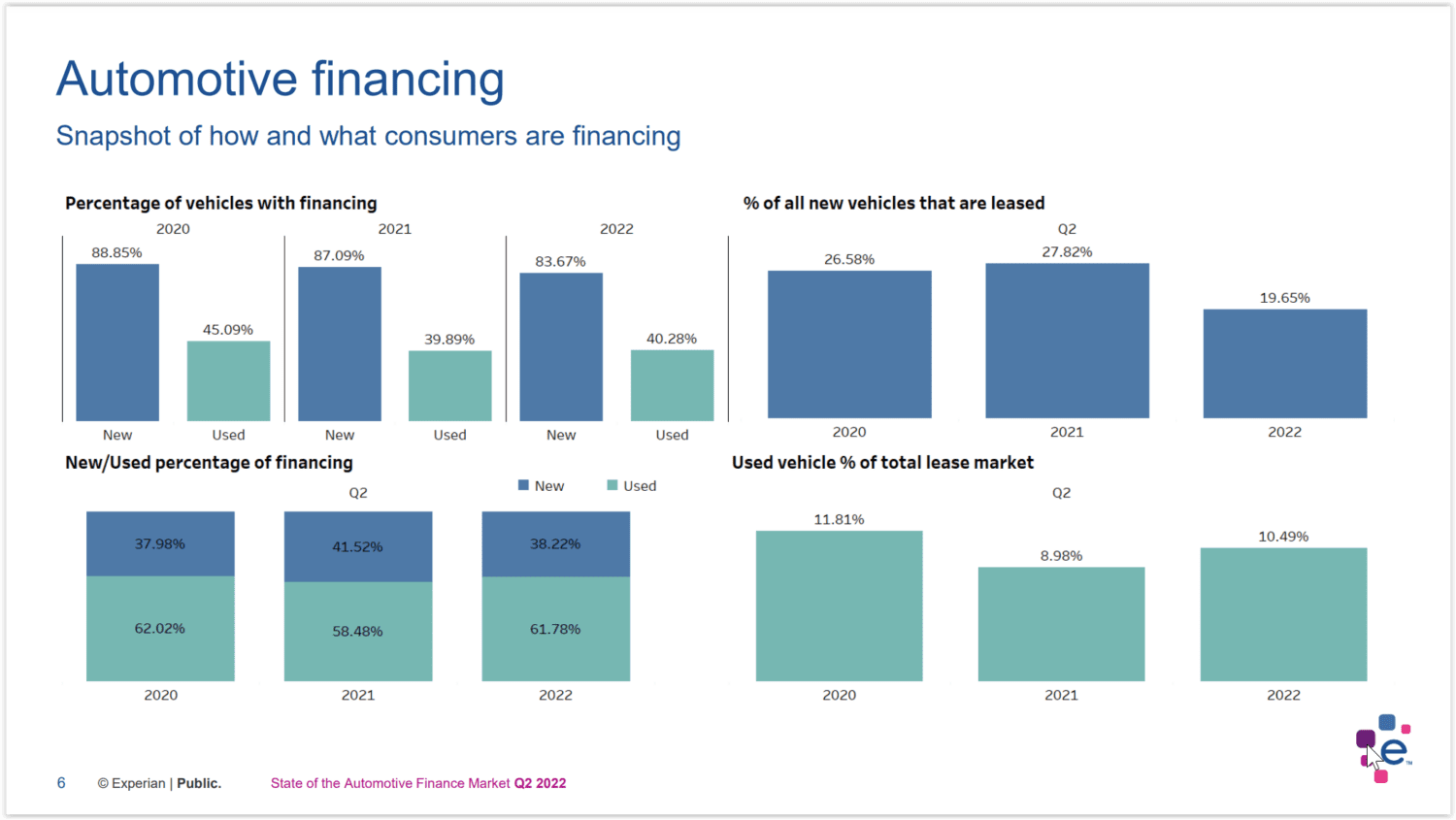

Perhaps the most significant result from Experian’s report is that more consumers choose pre-owned vehicles over new ones. Over 61% of all Q2 vehicle financing was for a used automobile, a 3% increase from the same time last year. These numbers bring to life the ongoing issues with new car inventories.

Buyers at all credit levels participated in the move to pre-owned, with the most significant occurrence happening for near-prime consumers (77.69% in Q2 2022 versus 72.3% in Q2 2021). Similarly, 89.29% of Q2 2022 subprime car shoppers bought a used vehicle; this compared to 86.28% during the same period last year.

“Between the inventory shortage and rising vehicle costs, consumers are looking to make the most cost-effective decision, which is often a used vehicle,” remarked Melinda Zabritski, senior director of automotive financial solutions for Experian.

Affordability plays a role in car shopping

While a car buyer’s ability to pay for a new ride has always been a factor in the purchasing process, such an element is even more relevant today. The increase in used car retails and reduced flexibility with new vehicle prices have caused changes in loan fundamentals.

In Q2 of 2020, the average new car loan was $36,117 but fast-forward to the last quarter, which jumped to $40,290, an 11.5% increase. There was also a rise in interest rates for a new car loan over the same period. Two years ago, the average consumer took out a loan with a 3.95% borrowing cost. This rose to 4.33% in the last quarter.

So, it’s no surprise that the typical monthly payment jumped. Experian reports that the average lease payment for Q2 2022 is $540, compared to $459 two years earlier. However, this $81 spread isn’t as significant as what’s going on with loans. New car loan borrowers from the last quarter pay an average of $667 per month versus $570 for a similar loan two years ago; that’s a $97 difference.

To put this amount in a real-world perspective, the extra cost of a car loan is more than half of what the typical household spends on utilities, according to energystar.gov. No wonder loan terms are getting longer for borrowers in the near prime and higher risk tiers. The average Q2 2022 near-prime borrower has a loan approaching 75 months.

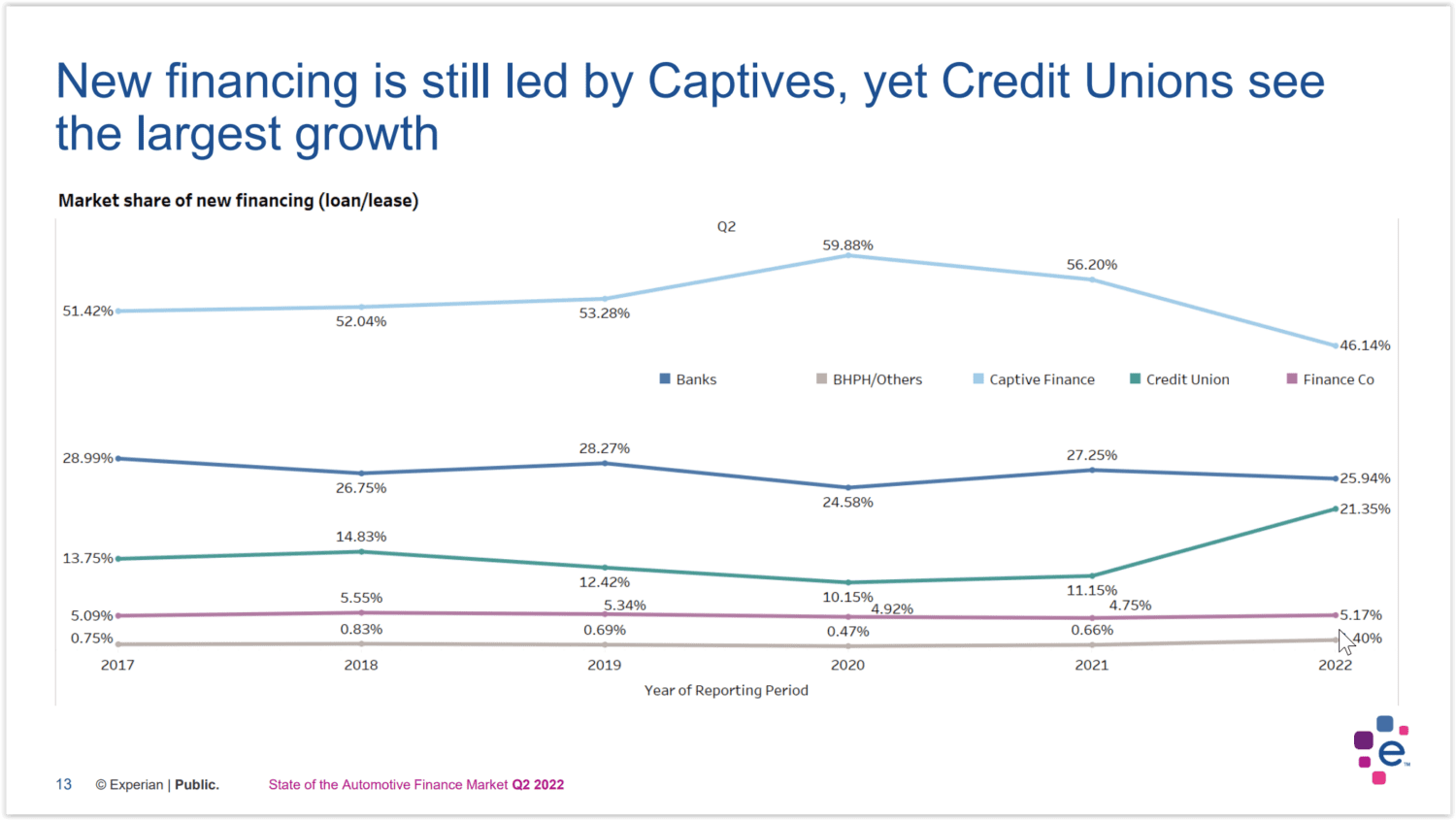

Credit union loans gain traction

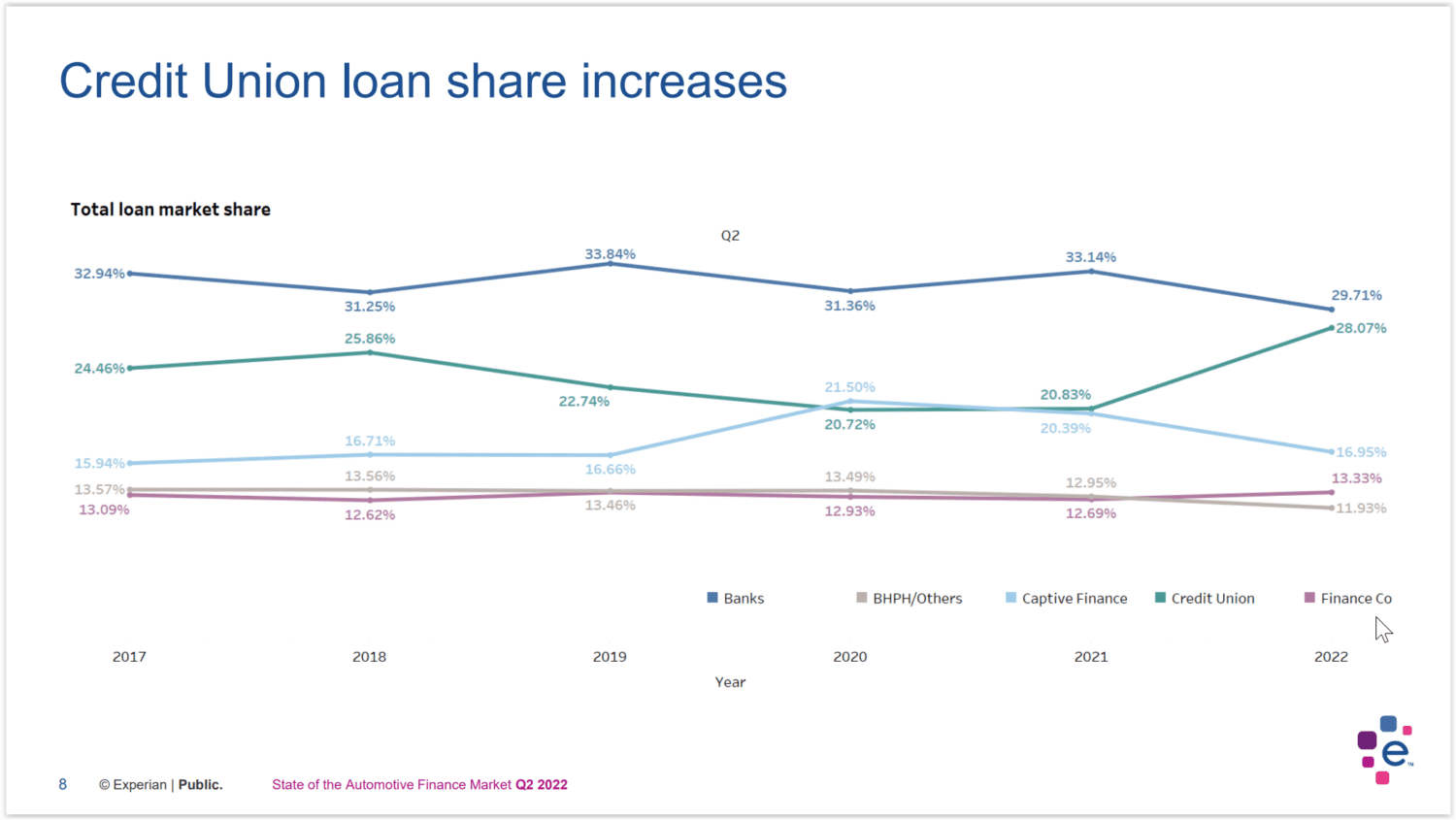

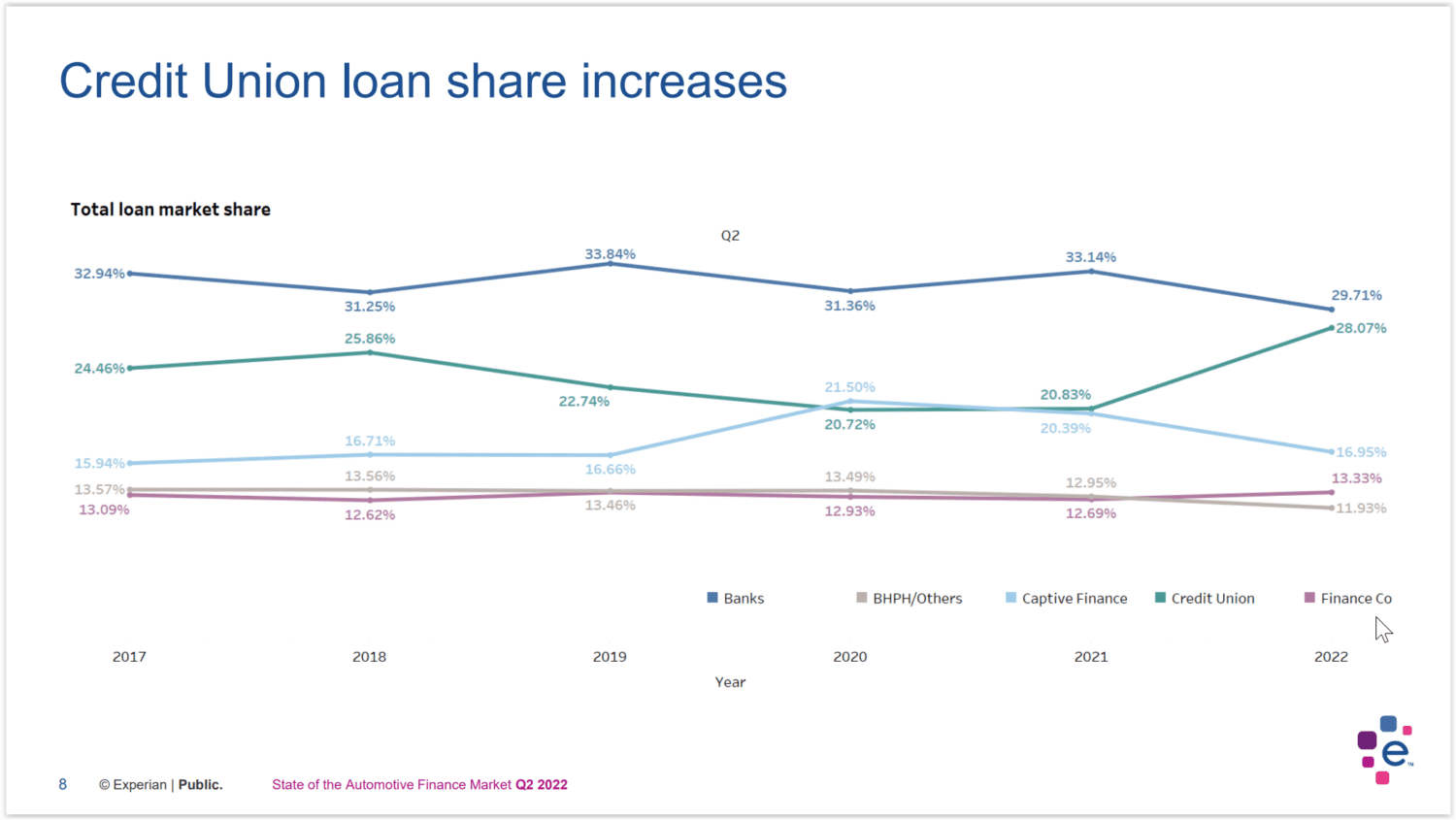

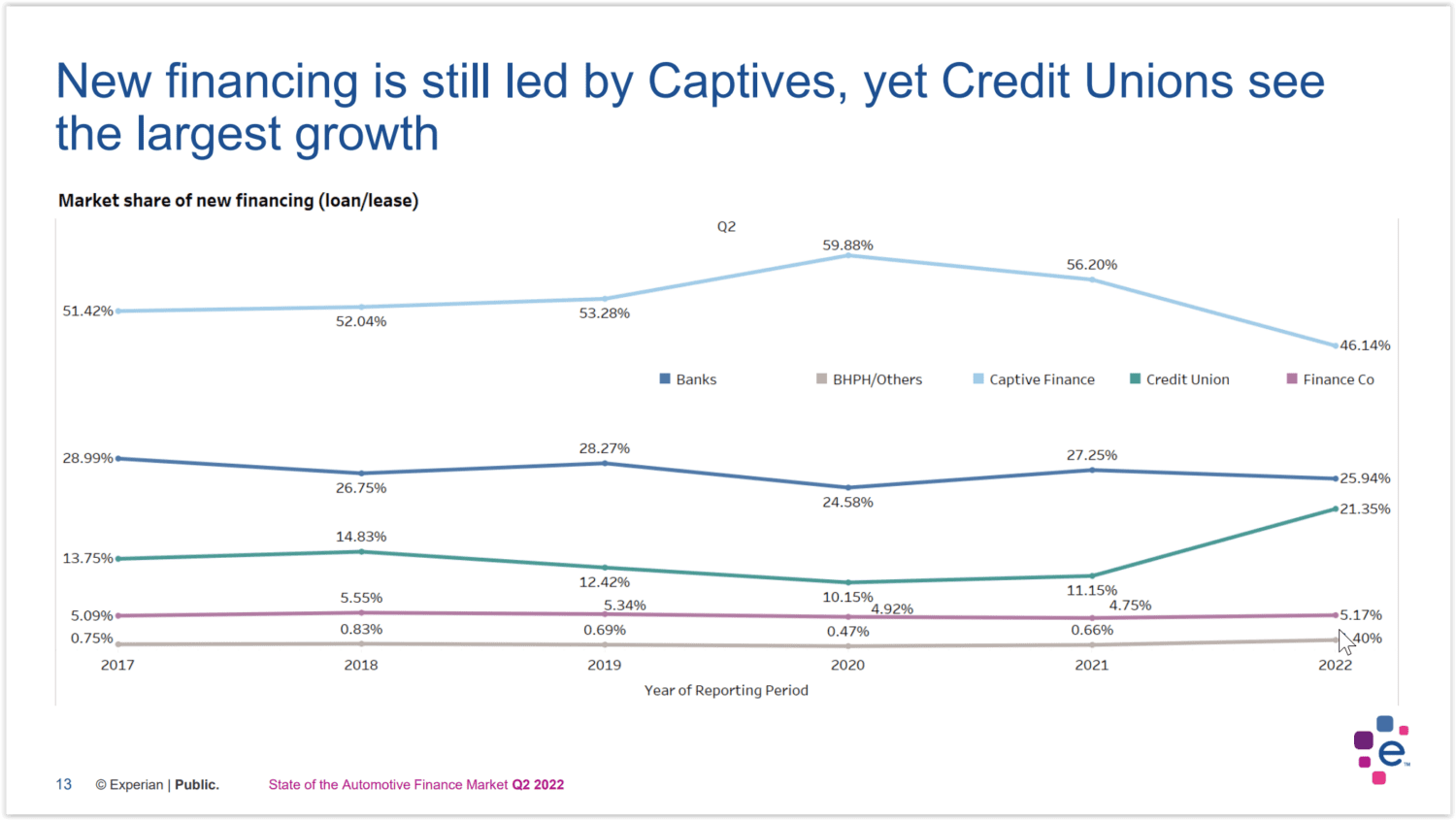

Another eye-opener in the data is the rise of credit unions as a funding source, with these Q2 2022 loans at a five-year-high. 25.81% of loans from this period came from a credit union, compared to 21.13% during Q2 2017.

This increase came at the expense of banks and captives, which saw declines in loan originations. For instance, Q2 loans via captives plunged from 28.47% in 2021 to 22.64% this year.

Selling in a dynamic market

Surviving, and we’ll even say thriving, in today’s automotive marketplace involves recognizing the ever-changing world of the consumer. Experian’s report calls out particular focus areas for franchised dealers.

- Used Cars: The increased demand for pre-owned vehicles means savvy dealers must maintain a compelling inventory despite acquisition challenges.

- Affordability: Consumers respond to rising vehicle prices and interest rates by shelling out more each month and stretching out loan lengths. In particular, this most recent Q2 saw growth in loans with 73- to 84-month terms. So, F&I staff shouldn’t hesitate to broach affordability options with shoppers.

- Loan Funding: The rise in credit union loans can affect the bottom line, particularly if funding comes from non-partnered institutions. Dealers must keep up with what borrowers are considering, especially if a captive isn’t competitive.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.