In May, the affordability of new vehicles experienced a slight improvement compared to previous months, according to new data from Cox Automotive. This positive trend was primarily driven by solid income growth, which helped offset the impact of slightly higher prices and interest rates. While prices and rates did increase, the rise in the average monthly payment was relatively small.

According to data from Kelley Blue Book, the average transaction price of new vehicles rose by 0.5% in May. This increase reflects the overall trend of prices in the market. Moreover, the typical interest rate for new-vehicle loans experienced a slight uptick of 3 basis points, reaching 9.57%. These factors, combined with other economic factors like inflation and limited credit availability, contribute to the ongoing affordability concerns consumers face.

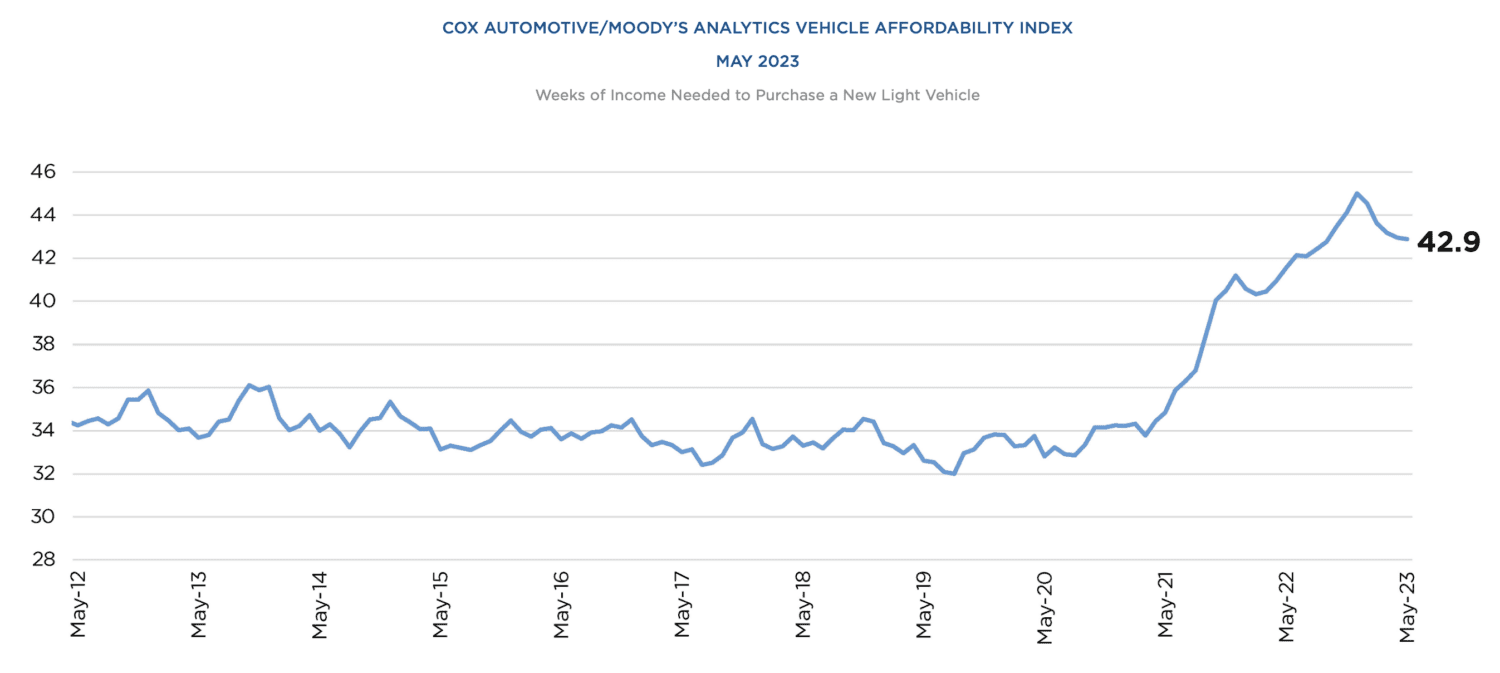

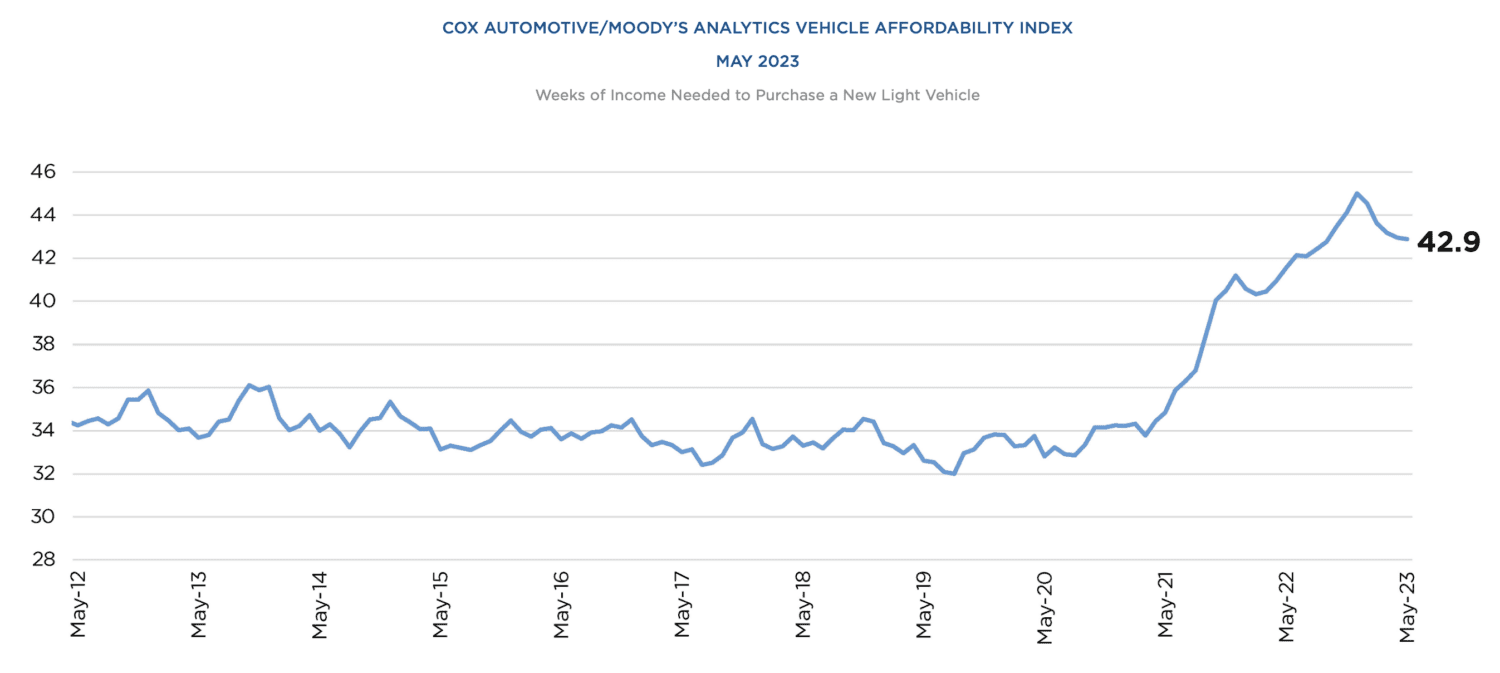

It took an estimated 42.9 weeks of median income in May to purchase an average new vehicle, marking a decline from the revised figure of 43 weeks reported in April. This means that consumers needed slightly less time to accumulate the necessary funds to buy a new vehicle.

To further support affordability, median income experienced a growth of 0.3% during this period. Additionally, manufacturers offered increased incentives to entice buyers, which made purchasing a new vehicle more financially feasible for consumers.

The estimated average monthly payment for new vehicles increased by a marginal 0.1% to $768 in May, up from the revised figure of $767 reported in April. However, it’s worth noting that the average monthly payment reached its highest point in December, peaking at $792.

“The Fed pausing rate hikes after 15 months doesn’t undo the numerous increases that have limited new-vehicle retail sales growth over the past year,” said Cox Automotive Chief Economist Jonathan Smoke. “However, the good news for consumers is that the rates they see on auto loans likely peaked earlier this year and may not move up despite the threat of another rate increase in July.”

Many potential buyers are still hesitant to return to new-vehicle storefronts due to the pressures of higher interest rates, inflation, and limited credit availability. As a result, they continue to rely on the used car market or wait for more favorable economic conditions before making a new-vehicle purchase.

It’s also worth mentioning that when comparing the affordability of new vehicles to the same period a year ago, the situation in May was worse. Back then, prices and interest rates were lower, making it easier for consumers to afford new vehicles. The estimated number of weeks of median income required to purchase an average new car in May was 3.1% higher than the previous year, indicating a notable decrease in affordability over time.