Welcome to this episode of Inside Automotive with anchor Jim Fitzpatrick. Today, we’re pleased to welcome back Erin Kerrigan, Founder and Managing Director of Kerrigan Advisors, who discusses buy/sell market performance in the first half of this year. We’ll also dive into how this is currently affecting valuations.

The buy/sell market in the first half of 2022 is not letting up and increased by 16% compared to the first half of 2021. There were 167 dealership transactions, an impressive showing for the last 12 months, despite the many headlines in the news of the potential recessionary environment.

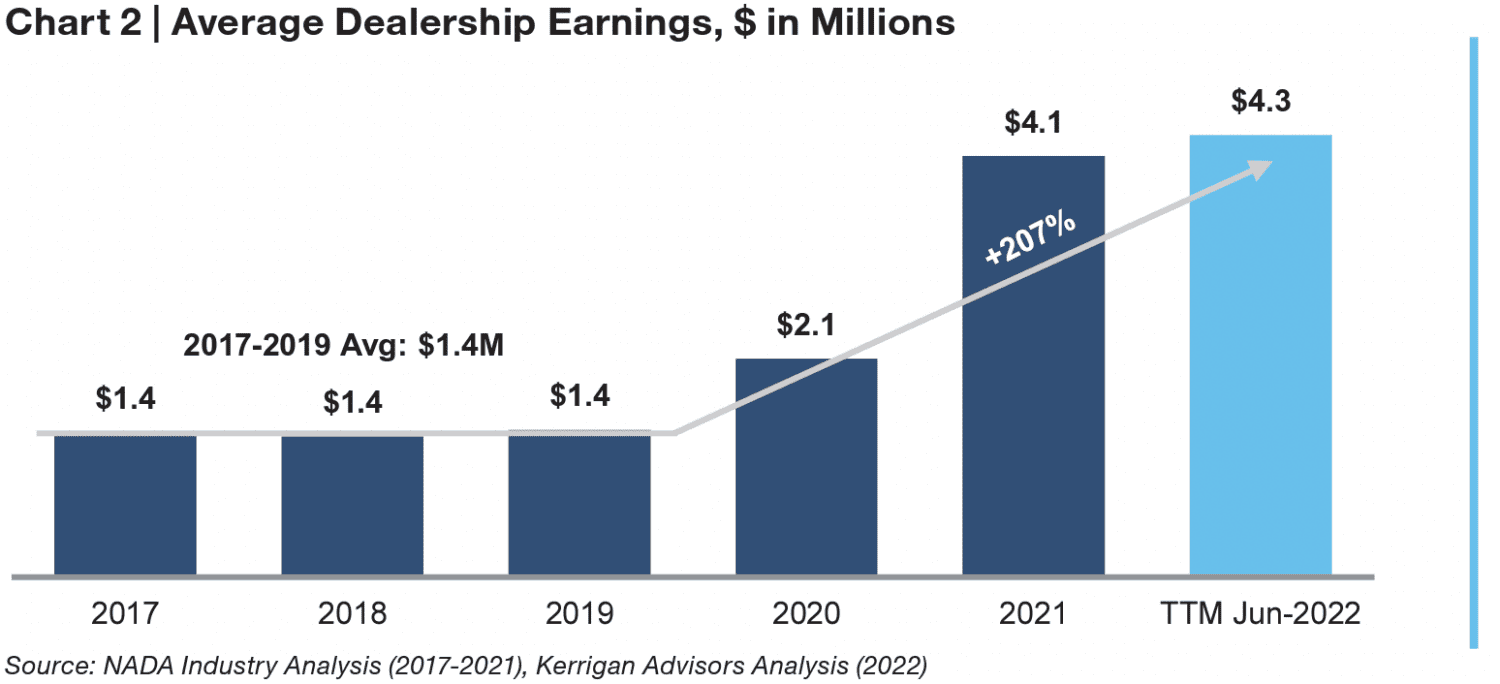

Given the record earnings that most dealerships have experienced, it’s certainly very challenging for buyers to figure out what to pay for a dealership. Kerrigan estimates that the average dealership earned in the last 12 months through the first half of the year was about 4.3 million, up 200% from the pre-pandemic average. The continuation of tremendously high earnings levels into 2022 makes it difficult to say what the new normal will be.

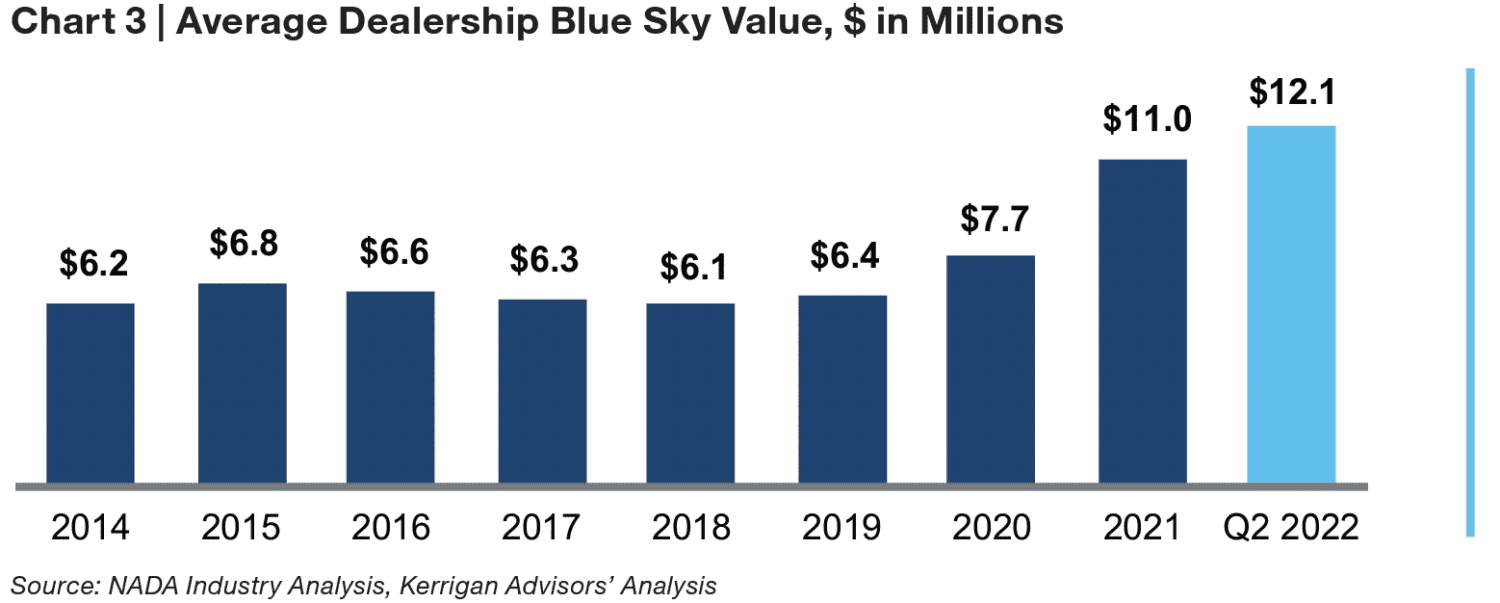

In the first half of 2022, 93% of buy/sell deals were completed by private buyers. The publics did 7%. So when the public’s valuations change, it doesn’t necessarily immediately impact the private dealers’ valuations. Even though the public companies’ earnings are so strong, their valuation multiples are considerably down. Kerrigan estimates their blue sky multiples at about three and a half times.

OEMs are announcing the potential to switch to an agency model or the potential to change the way they sell cars completely. Regarding electric vehicles, dealers will see a decline in their valuation expectation going forward, Ford being the most pronounced.

The remainder of 2022 will remain robust, says Kerrigan. Primarily driven by the amount of liquidity private dealers have. The pool of buyers continues to rise. The pool of sellers is also increasing, but not as fast as buyers. Last year, the average dealership returned 55% on equity. You can’t find that kind of investment anywhere else.

Download the Q2 2022 The Blue Sky Report® by Kerrigan Advisors here to learn more.

Did you enjoy this interview with Erin Kerrigan? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Did you enjoy this interview with Erin Kerrigan? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.