Japan is joining South Korea and the European Union in pressing the US government to loosen new federal tax credits for electric vehicles found in the Inflation Reduction Act.

To qualify for the entire tax incentive under the new law, vehicles must use at least 40% of critical EV battery minerals manufactured or assembled in the US or with its free trade partners. A secondary requirement states that at least half the value of EV battery components must be manufactured or assembled in North America.

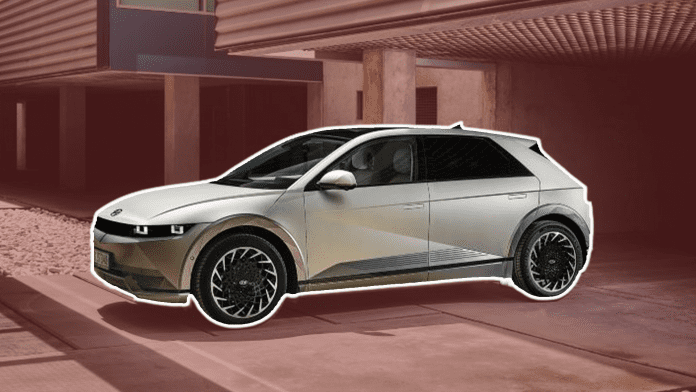

South Korean automaker Hyundai has previously expressed concerns over the restrictions, especially considering the company announced plans to build a $5.5 billion electric vehicle facility in Georgia before the law passed in August.

The European Union has also asked for special consideration from the US government to allow European automakers to qualify for the tax credit.

Now, a new report from the Kyodo News agency says Japan is expected to submit its own request to US policymakers, asking for added “flexibility” in the tax credit regulations and asking for its country to be included in the list of US free trade nations.

Also making news is a recent statement that suggests South Korea will ask for a three-year grace period to allow automakers to receive the credit while the Georgia facility is still under construction.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.