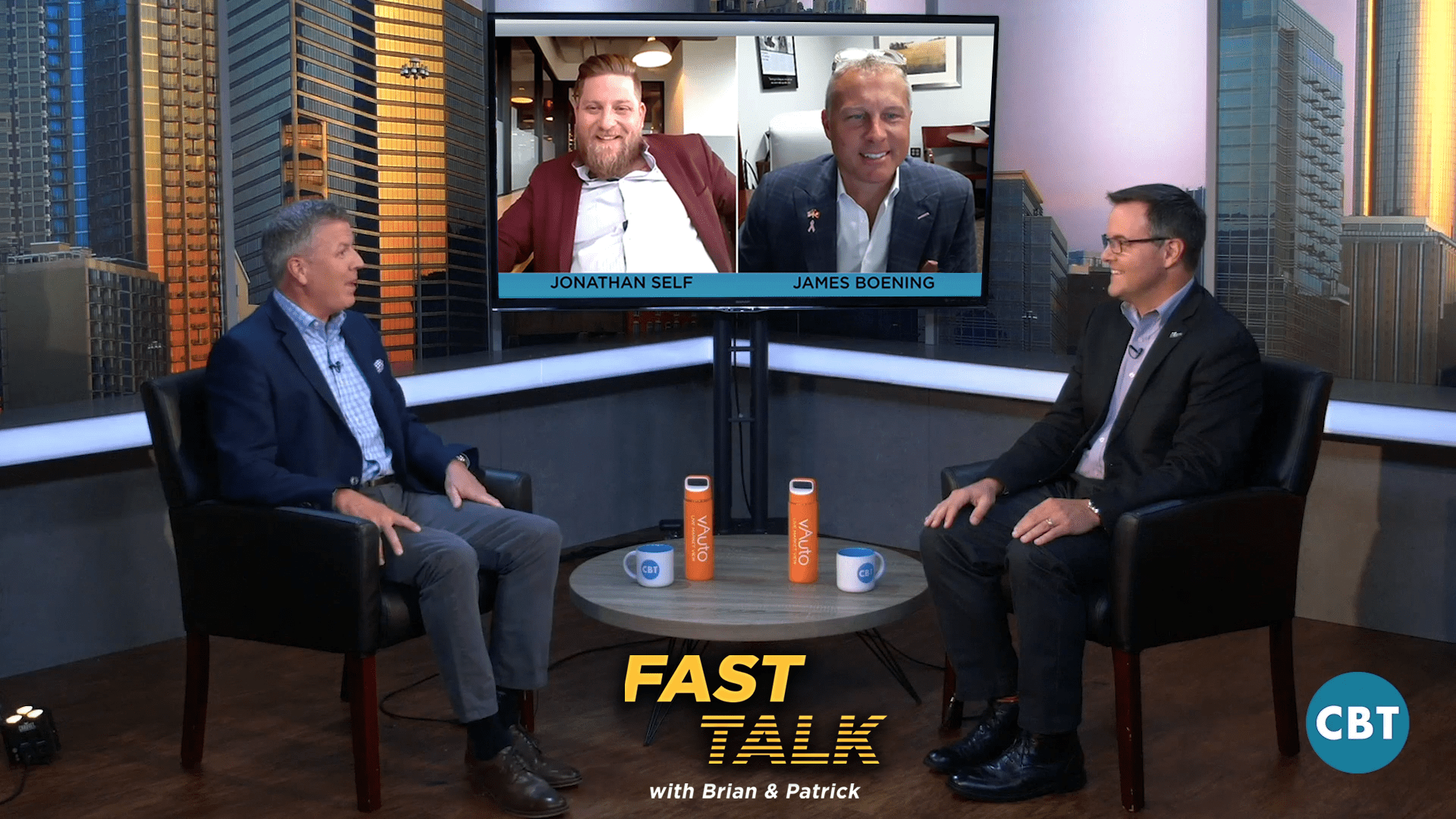

In this segment of Fast Talk, vAuto’s Brian Finkelmeyer and Patrick Janes discuss the challenges dealers face when it comes to inventory management; both new and used. To take a deep dive into this topic, the pair also welcome Jonathan Self, Founder of Stratiga Group, and James Boening, General Manager at Ourisman Lexus Rockville. To hear more check out the full episode above.

VIDEO TRANSCRIPT:

You’re watching Fast Talk with Brian and Patrick, sponsored by vAuto.

Brian Finkelmeyer: Hi and welcome to Fast Talk, a show where we investigate the biggest challenges facing today’s dealers. Today we want to take a deep dive in the inventory management, both from the new and used car side of the business. First up, I’m going to turn it over to Patrick, who’s going to talk about how you can engineer your used car inventory for greater success. Patrick.

Patrick Janes: Thanks Brian. When it comes to used car strategies, coming out of the prime selling season, I ask dealers all the time what is your dealer day supply target this time of the year? For most, it’s between 45 or 60 days, but most importantly you must manage it by segment and price band. Balancing your stocking plan to align with your market sales will reduce aging in vehicles that sold well during the past several months but tend to shift while seasonality comes into play. Managing market day supply is critical during this shift. Market day supply for all-wheel drive in some markets will tighten, while sedan market day supply may increase. This can vary by market, and with the volatility caused by the affordability gap between new and used it could go on a whole different direction.

Patrick Janes: I think back to the full size SUVs, when gas prices were $4 a gallon versus $2.50 a gallon. You couldn’t sell those things. Dealers must manage their local market data to determine the best used vehicle mix to maximize margins. Margin compression is real, with the cost of market averages leaving dealers with only a 10% margin after 30 days, based on VAuto dealer data. Here to elaborate further is Jonathan Self with Strategic Group. Jon, you live in the wholesale market every day. You’re buying tons of vehicles for a number of large volume dealer groups, including Friendly Chevrolet down there in Texas. You see firsthand how these vehicles perform when you bring them in the inventory. How do you manage your stocking plan and balance your inventory?

Jonathan Self: That’s a great question, Patrick. The first thing we look at is market day supply. As you said, we then break it down even further into segment and price band, and then we determine how the dealers are performing in those price bands based on market sales and percentage of dealer inventory. So, it’s a combination of both market day supply and dealer day supply targets, because at the end of the day you want to balance your inventory and get ahead of the curve.

Patrick Janes: You mentioned market day supply in your decision making, but how important is that in acquiring a vehicle at auction or pricing it to sell after it’s already been in inventory?

Jonathan Self: Market day supply, Patrick, is the single most important thing I want to know about a vehicle because it’s going to determine what our current pricing model is going to be and then what our exit strategy is going to be on day one. When we’re pricing those vehicles based on market day supply, the percentage of market is going to be different on both the cost to market objective and a price to market objective.

Patrick Janes: VAuto’s founder Dale Pollak likens used cars in inventory to raising children. Good parents want to add value under their care and they also want to make sure they leave the nest, in some cases, sooner than later. As for a used car, we know sooner is best. Are there any tips you can share to make sure your children are making progress?

Jonathan Self: Absolutely. Once again, balancing your inventory, looking at what your market sales are versus your stocking strategy and your sales. But, one little trick that I’ve learned, and I did this as a dealer, and I do this now whenever I’m consulting with clients, is to track market day supply every week, every time you change the price. The easiest way to do that is to go to your tag section at the very bottom in VAuto and tag that market day supply. That way, whenever you go to do a price change the next week, you can compare those two numbers and say is market day supply going up or is it coming down? That’s going to help you determine what the demand in the market is, as well as what should I price this vehicle at.

Patrick Janes: John, that’s awesome. I’ve worked with a lot of dealers who struggle with, hey, when I bought this car, it seemed like a really fast moving vehicle, but now I’ve had it in my inventory for 45 days and something has changed. I think being able to tag that historical reference really puts the car into perspective and lets you know what you really have to do, whether to pull the price lever or to change the merchandising. It’s brilliant, John. I really appreciate that tip.

Brian Finkelmeyer: In new car inventory management, the new car hold and expense is the fastest rising line item on a dealer’s financial statement. NADA is reporting up over 130% versus just a year ago. We’ve also seen that market day supply continues to creep higher as overall retail sales remain somewhat soft. As we prepare ourselves for the final quarter of this year, I thought it would be great to speak with one of the leading dealers in the country about how best to manage your new car inventory. I’d like to introduce James Boening, who’s the executive manager from Lexus of Rockville. James, welcome to the show.

James Boening: Yeah, thanks. I appreciate it. Honored to be here.

Brian Finkelmeyer: James, as you’re building out your allocation for the final quarter of this year, are you guys bullish about where things are headed for the end of the year or are you on more of a defensive posture?

James Boening: No, I mean, we’re bullish. November/December, I think, are going to be massive for us personally. I think that this market that we sit in has got a really big upswing. I can already feel it in October right now. It’s starting to pick up momentum. I just came from a Lexus manufacturer meeting, and they are going to be super bullish on trying to achieve their numbers. So, I have a feeling we’re going to have a lot of support and we’re going to be able to do a lot of volume.

Brian Finkelmeyer: That’s great. James, when you guys are working your allocation, I know Lexus makes it somewhat challenging. You can’t exactly spec out exactly every car you want, but they do provide you some degree of flexibility in how you preference your inventory. Can you talk to our audience a little bit about how closely you guys manage that process?

James Boening: We get an allocation twice a month from Lexus, and it’s pretty much like you said, almost set in stone. We can change color combos. We can’t really flip models. If we get a certain amount of our RX’s, we have to stay with what they’ve given us. Now, they’re pretty good on being able to see what we need and trends and where the market may be moving. So, they’re pretty good on giving us the right mix, but we can change some of that. But, we look at it every week. We’ve got a meeting every Tuesday at 11:45, and we sit and we go through our inventory. We look at, you and I spoke a little yesterday about carrying cost, and those are things we talk about. Those are things that are brought up in the meeting. This is stuff that we, all the way down to our inventory dealer exchange manager, that we look on. We’ve got too much of this. When someone calls for a car, tell them they got to take two of these. So, we are always looking at the inventory every week.

Brian Finkelmeyer: You touched on the importance of dealer trades, which is often an overlooked aspect of new car inventory management. Your dealer trade guy, can you talk a little bit more about that? About how you try to leverage those opportunities to increase the overall health of your inventory?

James Boening: One of the things that we do, and I’m sure there’s other dealers do it, we’re not unique to the industry, but we will … This is a good hybrid market. I’ll give you some for instances. We do really well up here in DC with the hybrid cars. There are other markets in the country that can’t sell a hybrid and they have inventory sitting around. We will literally get on the phone with the manufacturer and ask them, we need to know where the pockets are. We need to know where you’ve got a surplus. And we’ll get on the phone with the dealers and we’ll just seek these cars out. We’ll try to just buy them. A lot of times, if they have a surplus, they’ll allow us to buy those cars. Sometimes we’ve got to give something back. And I’m okay with that too, because if we can seek out an item that’s got a good turn and maybe give up something that has a slower turn that they’re turning better at. So, we build relationships with dealers all over the country and we really try to manage our inventory quite different than probably a lot of people do, but I’m sure other people do the same.

Brian Finkelmeyer: Yeah. James, one last question for you. As we think about the enormous carrying cost that dealers are incurring this year, as interest rates have gone up and overall price of vehicles continues to climb, how do you guys manage your aged inventory so that if a brand new Lexus RX 350 shows up, we want to make sure we’re selling the one that’s 300 days old, not the vehicle that’s three days old. Can you talk at all about any processes you have in place to make sure that your guys are focused on getting those oldest units out first?

James Boening: What we do in that same meeting every Tuesday is we print out the oldest new cars. This is probably a little old school kind of way with versus I try to be a little more cutting edge, but we literally print it out and we set the oldest cars, and it’s not even by model. We just put the oldest cars out, because maybe we can switch someone to a different model. So, we’ll print the oldest cars out, the 25 oldest cars, and we focus on those every week. It might end up being the same next 25 cars next week, but that’s what we focus on. So, every Tuesday, we come out of that meeting, we’ve got the 25 cars. It’s on every manager’s desk. It’s laminated, so it’s a hard copy, and we literally sit with the sales people. We don’t really spit those cars, but we incentivize the salespeople to help them move the inventory for us. So, it’s a focus. Is it a great, dialed in, perfect process? Probably not. There may even be a better way. But, that’s how we do it.

Brian Finkelmeyer: Well, it sounds like it’s working for you, James. I know you guys said you were having a great year and looking for big things moving forward.

James Boening: I just lost sound.

Patrick Janes: Brian, what I heard from both our guests today is discipline. Both of them use their data on a daily, weekly basis to really have the finger on the pulse of the market. I mean, some of those were some old school, simple little tactics that they’re taking, but the key is they’re doing them over and over and over. Wash, rinse, repeat, as they say. I was really impressed that they really stay focused on the data and the information to just make better decisions. That’s what I gathered from today.

Brian Finkelmeyer: No, I agree, Patrick. I’d say one of my big takeaways is that our inventory managers are really investment managers. It doesn’t matter if they’re managing their new car inventory or their used car inventory. These are truly people that are in control of the dealer’s money and need to be managing as such. I recently heard a great question that’s posed to dealers, which is do your new car and used car managers behave more like trust fund kids or like investment advisors? I think we can all agree we’d rather have our money being managed by an investment advisor than a trust fund kid.

Patrick Janes: Right.

Brian Finkelmeyer: Well, that’s a wrap for this episode. Thank you so much for joining us on Fast Talk with Brian and Patrick.

Patrick Janes: We’ll see you next time.

Thanks for watching Fast Talk with Brian and Patrick.