Throughout the past few years, there has been a lot of conversation surrounding new car inventory and prices. Now that we’re in the first quarter of 2022, what key things can dealers do to stay ahead? Today on Inside Automotive, we’re joined by Brian Finkelmeyer, Senior Director of New Vehicle Solutions at Cox Automotive, to discuss new car trends for 2022.

From Finkelmeyer’s perspective, the automotive industry is in a circular pattern of low new car inventory and high consumer demand. Many car dealers are still running with single-digit day supplies and the recent U.S.-Candian border protests are slowing things down further. On the demand side, Finkelymeyer says there has been a little softening of consumer sentiment that is likely caused by the global economic hardships surrounding Russia’s invasion of Ukraine.

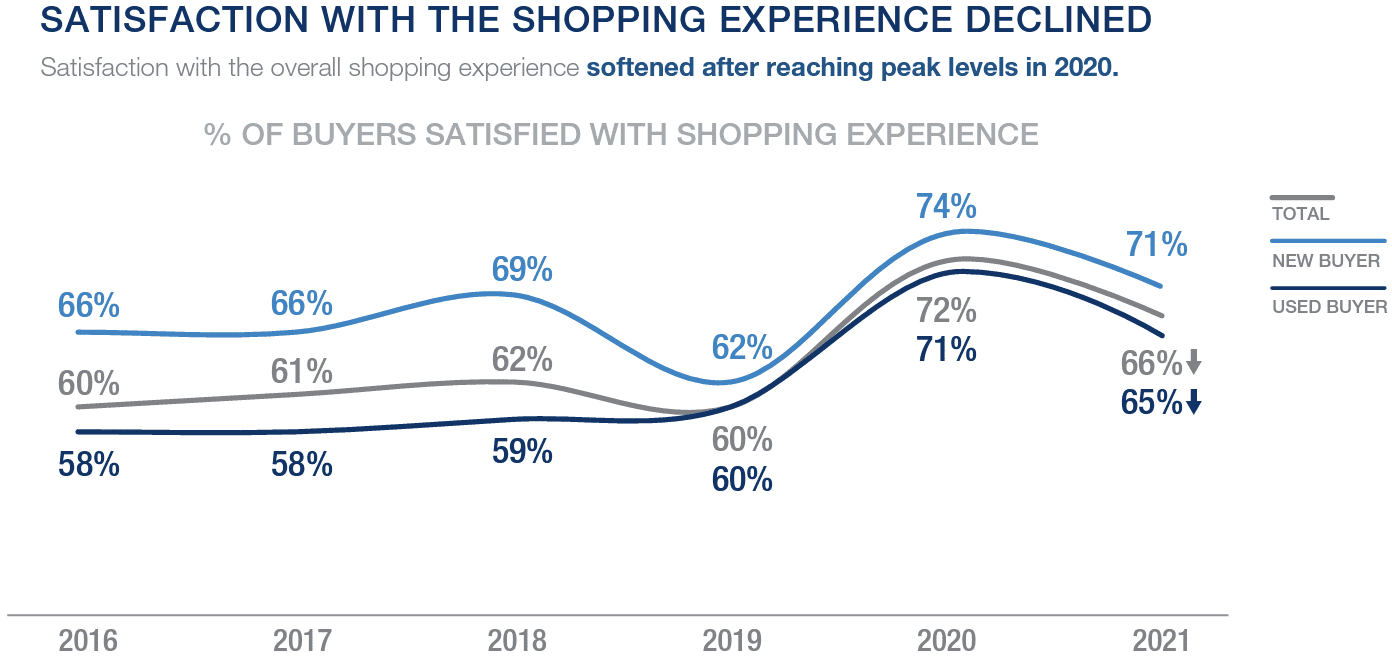

Consumers still seem to be more than willing to pay full sticker price, or close to it, for new vehicles. In fact, data reveals that pre-pandemic, 75% of new car buyers paid below MSRP for their vehicles. Today, 75% are paying exactly the MSRP or above. Despite this, Cox Automotive’s 2021 Car Buyer Journey Study revealed that consumers are still more satisfied with their shopping experiences than they were pre-pandemic.

Consumers still seem to be more than willing to pay full sticker price, or close to it, for new vehicles. In fact, data reveals that pre-pandemic, 75% of new car buyers paid below MSRP for their vehicles. Today, 75% are paying exactly the MSRP or above. Despite this, Cox Automotive’s 2021 Car Buyer Journey Study revealed that consumers are still more satisfied with their shopping experiences than they were pre-pandemic.

Industry experts including Cox Automotive’s Chief Economist, Jonathan Smoke are saying supply conditions will improve but maybe not for at least six to eight more months. Car dealers will need to be strategic in order to gain a foothold with their inventory for the Spring selling season. Finkelmeyer says car dealers should consider these three things when it comes to managing inventory right now.

- Gross profit vs. turn. Manufacturers are rewarding dealers who turn and earn the fastest. Button up on your reporting the day before the allocation runs.

- Be mindful of aging vehicles and inventory updates on your website. On average, 15% of inventory shown on a dealer’s website is 90 days or older.

- Around 42% of dealers’ used car inventory comes from trade-ins and new car sales. It is a critical piece of the business that helps generate the overall profitability of a store.

The EV market is still small but it’s a fierce and feisty segment. In January of 2022, around 4.1% of new vehicle sales were EVs. This will be an exciting year for the industry, says Finkelmeyer. A number of EV launches are scheduled to take place, but consumer adoption is still questionable. Many of these launches are for full-size EV pick-ups. Will that be enough to sway the average consumer? Only time will tell.

One of the more interesting developments with Tesla is their take over of the luxury market in 2021. Tesla outsold Lexus, BMW, and Merced-Benz despite not being available for purchase or delivery in every state. It is certainly shaping up to be a fascinating year in automotive.

The 2022 NADA Show is right around the corner and Finkelmeyer is excited to get back to in-person events. On the agenda for Cox Automotive is new product launches from vAuto including ProfitTime® GPS, which helps car dealers optimize their used vehicle acquisition strategy. vAuto is also expanding its ProfitTime® and Conquest™ platforms with Intelligent Promotion to simplify car dealers’ digital merchandising efforts. Cox Automotive isn’t stopping there though, the company also announced its new wholesale market solution, Upside™, earlier today.

Click here to learn more and schedule your personalized consultation today!

Did you enjoy this interview with Brian Finkelmeyer? Please share your thoughts, comments, or questions regarding this topic by submitting a letter to the editor here, or connect with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook and Twitter to stay up to date or catch up on all of our podcasts on demand.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.