The ongoing conflict between Russia and Ukraine is causing significant disruption to many segments of the global automotive business, particularly in Europe. The crisis is amplifying supply chain problems as the start of the pandemic passes its third anniversary. At the same time, automakers have had to shift operations to cope with sanctions requirements and a changing production environment. Further, the vacuum left behind by Western manufacturers is being filled by Chinese companies.

A report from KPMG calls attention to this shifting automotive landscape; let’s explore the highlights and other key aspects.

Supply chain problems start at the beginning

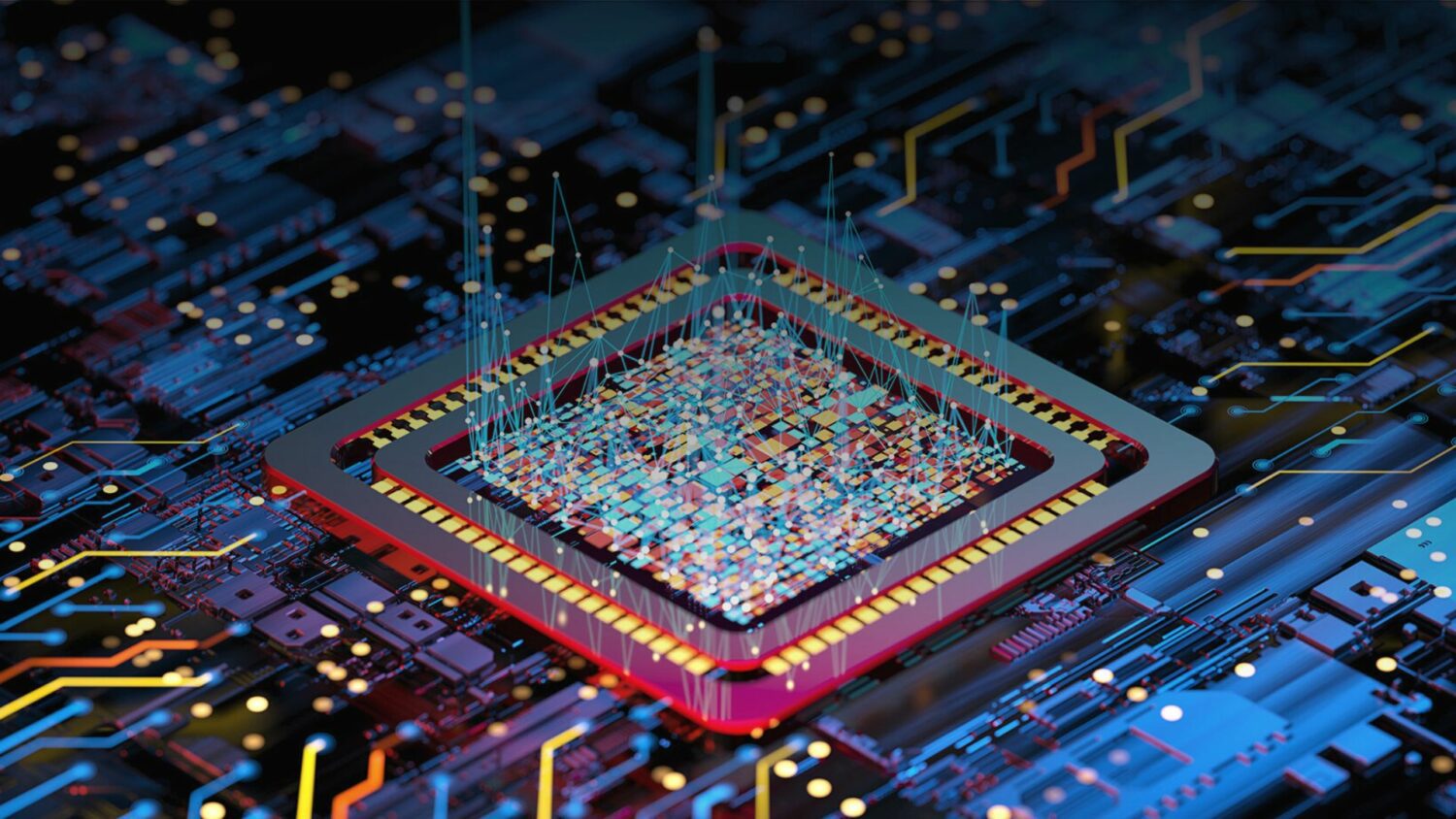

It restates the obvious that automotive production starts with raw materials, and Russia and Ukraine are at the center of things. Neon gas is essential to the production of semiconductors. As Popular Mechanics tells it, about 85% of these chips rely on neon to help guide ultraviolet laser etching during manufacturing.

Significantly, about a third of the world’s neon gas comes (or did) from Russia. To make matters worse, approximately half of the global supply of semiconductor-grade neon is produced by two firms in Ukraine, according to the UK-based Energy Institute. Since the start of Russian military operations in the Black Sea region, these companies have shut down their operations in Odesa and Mariupol.

Raw material challenges go beyond neon. Russia provides a third of the world’s palladium, a key element in catalytic converters, and is the third largest nickel producer. Palladium prices are down from the record high set at the start of the conflict but are still about 50% higher than five years ago.

Changes to vehicle production

Due to sanctions and public pressure, big players like Volkswagen, Toyota, Ford, and Renault have shut down (or sold) Russia-based factories, backed out of joint ventures, or stopped importing into the country. A pre-war Russian market sold 1.6 million vehicles in 2021, but war and economic factors axed this by almost 60% last year.

In addition, the struggle has a spillover effect on auto production in regional factories. KPMG cites assembly operations in the Czech Republic, Poland, Slovakia, and Belarus as facing disruptions. Ukraine is a major supplier of wiring harnesses; that’s just one example of automakers’ challenges.

To avoid supply chain bottlenecks, Volkswagen announced early in the war it was shifting production to the U.S. and China. Other manufacturers are employing similar workarounds.

However, production losses will undoubtedly put further pressure on an industry already facing a downturn in vehicle output due to the pandemic and supply chain problems. Toyota held a leading position in the Russian market only two years ago, standing toe-to-toe with AvtoVAZ, a leading domestic brand. Similarly, BMW’s 20-year joint venture with Avtotor, another Russian automaker, is over. Automotive News reports that Russian car buyers at one point could choose from 60 different brands; that number is now down to 14.

Used cars and China fill the void

Yet the departure of Western, Japanese, and Korean car companies has left a void that’s only bound to get filled in other ways. For instance, Russian consumers are shifting to used cars. Last year, pre-owned automobiles accounted for about 75% of passenger vehicle sales, compared to 55% in 2021. The changing Russian marketplace (once among the largest in Europe) has also caused second-hand car prices to rise by almost one-third, reports Reuters.

Chinese manufacturers are also stepping in to pick up some of the slack. Of the 14 car brands Russian car shoppers can choose from, 11 are Chinese (the rest are domestic). A Russian dealer group told Automotive News that Chinese vehicles account for 30% of the market but are rapidly rising. Without increased manufacturing by Russian automakers, Chinese car companies may eventually get 70% of new vehicle sales in that country.

Related reading:

Related reading: