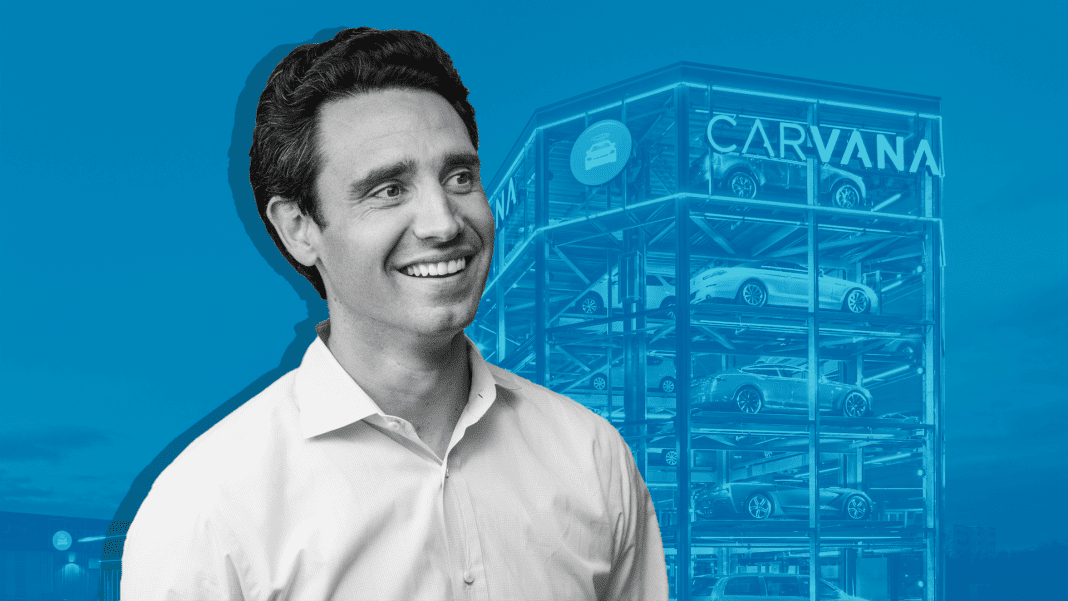

The second-largest online auto retailer Carvana highlighted plans to invest another half-billion dollars into its business model. The massive investment comes after a very successful year where the retail chain capitalized on the trend toward online sales that spanned all industries, marking a 37% growth in 2020 over their 2019 figures. Infrastructure additions are the core of their $500-million-dollar investment. Ten new reconditioning and inspection centers are in the works – the facilities where used car repairs and certification are completed, as well as the locations where photos are taken for car listings. Along with the new structures, Carvana plans to hire around 5,000 more employees, adding nearly 50% to their current workforce of 10,400. With 2020 being an extremely strong sales year, Carvana’s executive team is banking on customers continuing to pursue the online car sales model. Carvana Chief Financial Officer Mark Jenkins said, “A big part of it is the customer preference shift toward more comfort buying online, and that’s something we think will be here to stay.” In the full year results news release in February, Carvana founder and CEO Ernie Garcia remarked at the success their online sales platform had achieved. He said, “2020 highlighted the strengths of our business model and validated our vision for the future of car buying. We’re extremely proud of how our team navigated an unprecedented year of constant adaptation. Their exceptional execution and relentless focus on delivering the best experiences to our customers vaulted us to becoming the second largest seller of used cars in the country, another meaningful milestone in our march to becoming the largest and most profitable automotive retailer.”

Not without its challenges

Although the investment in infrastructure and staffing has been announced, Carvana still faces significant hurdles to overcome in its growth. The online retailer expects their facilities will be able to certify around 1.3 million used cars annually when they’re fully staffed and operating at full capacity, but both used vehicles and the technicians to recondition them are in short supply. Used car inventory at Carvana plummeted to 4,700 cars in July, down from 25,300 in April. After springing back to 12,800 in the fourth quarter, January 2021’s inventory sat around 9,500 cars daily. Strong customer demand is the driver for low inventory right now. Technicians remain an extremely hot commodity across the US. According to TechForce Foundation, the demand for auto techs outpaces the supply by almost three to one. An estimated 642,000 techs are expected to be needed by 2024, and trades schools aren’t onboarding and graduating students at anywhere near that rate. In addition to the pragmatic challenges, it’s also noteworthy that Carvana has yet to turn a profit. Despite a gigantic $5.6 billion revenue total in 2020, the annual net loss actually rose to $462.2 million – a loss that’s 27% higher than in 2019.

Did you enjoy this article from Jason Unrau? Read other articles on CBT News here. Please share your thoughts, comments, or questions regarding this topic by submitting a letter to the editor here, or connect with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook and Twitter to stay up to date or catch-up on all of our podcasts on demand.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.