The 2023 Kerrigan Dealer Survey has been released, and it appears that most auto dealers are remaining positive about the buy/sell and M&A market for the coming year while others are less optimistic. The survey, which obtained responses from 650 anonymous dealers nationwide, was conducted between June 2023 to October 2023.

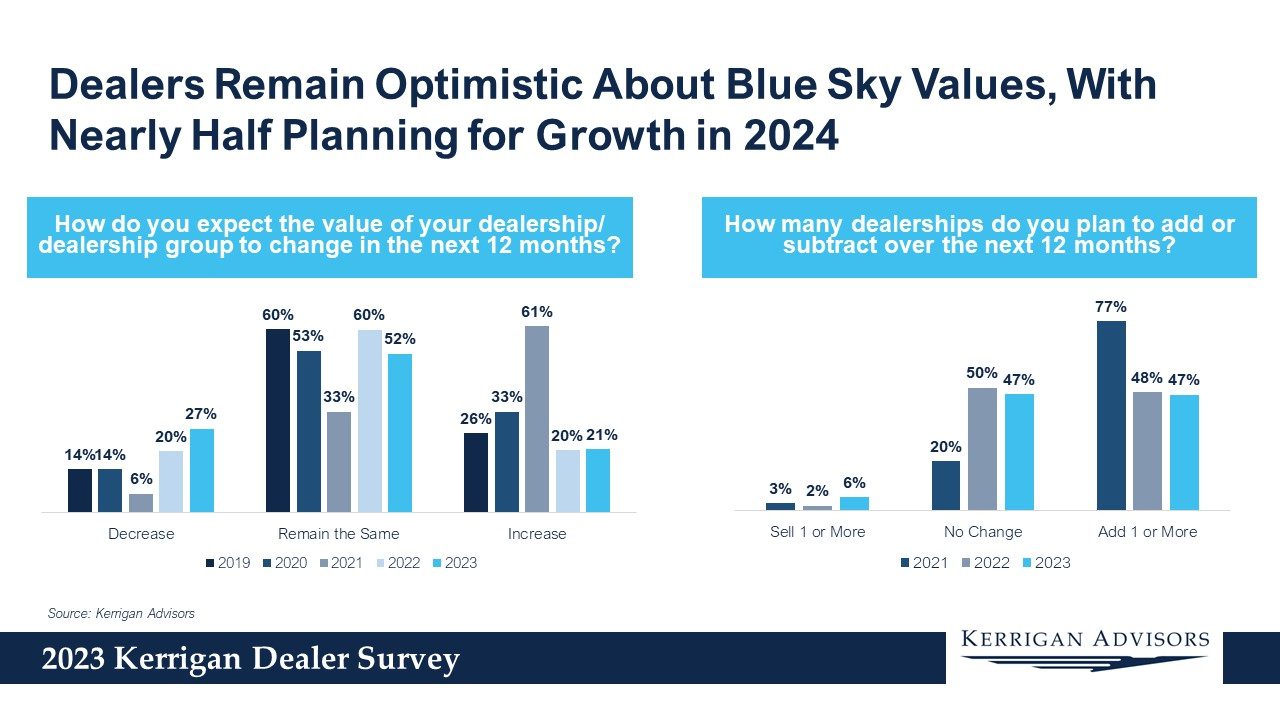

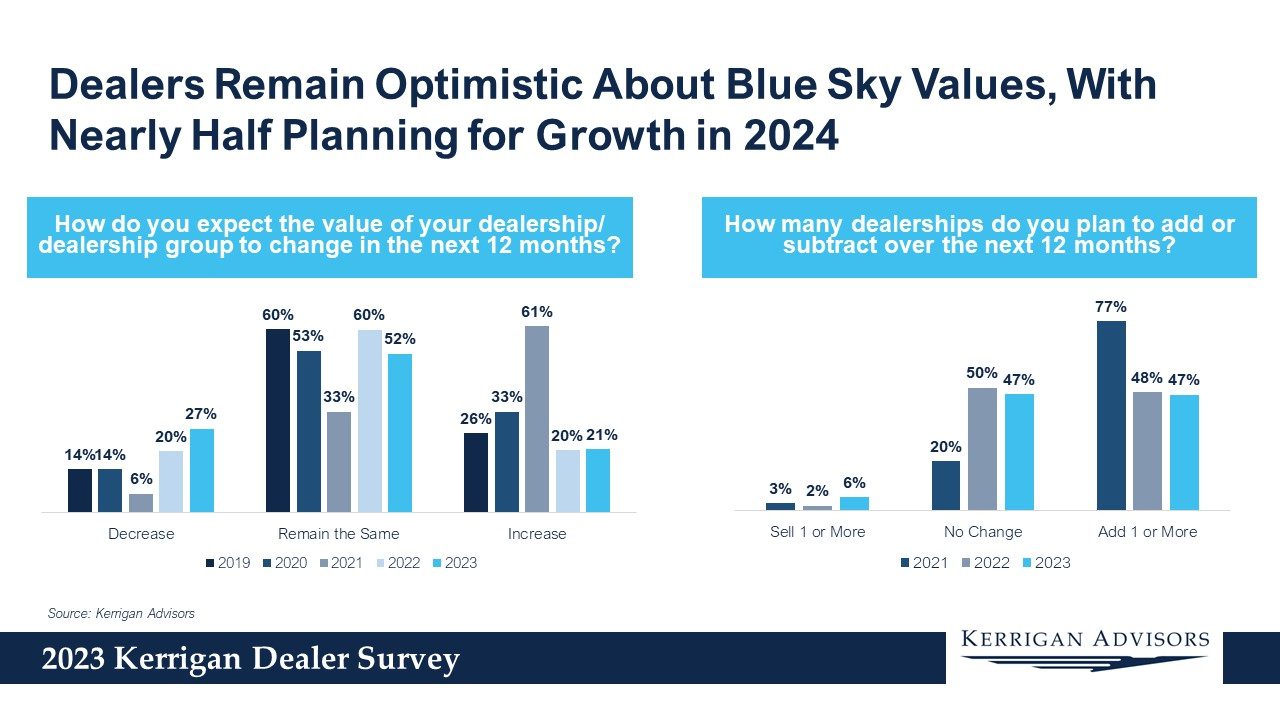

Over half of respondents (52%) indicated that they believe strong valuations will continue into the coming year with 21% also forecasting a valuation increase. Conversely, 27% of respondents said they project a decrease in overall valuation, which is twice as many compared to respondents in 2019 and 2020. Furthermore, while 15% of dealers said they expect profits to rise next year, 38% expressed less optimism, noting that they expect profits to fall throughout 2024.

Kerrigan Advisors’ report also notes that 6% of respondents have plans to sell their dealership next year, which is higher than the firm’s projection for 2023. On the contrary, 47% expect to keep the number of dealerships they have and 47% expect to add at least one more.

Dealer responses varied across brands, but survey results indicate that more dealers across all franchises expect to see a decline in value compared to 2022’s report. Kia, Hyundai, and Lexus had the highest expected valuation gains while Infiniti, Lincoln, and Ford had the lowest.

Kerrigan Advisors hypothesizes the overall responses regarding valuation expectations are “a reflection of the rising discontent within the dealer body regarding OEMs’ electric vehicle (EV) strategies and the burgeoning EV inventories on many dealers’ lots.”

When asked about possible OEM changes to the franchise model, it appears that the majority of dealers across various franchises are not overly worried about these changes affecting their future profits. Lexus had the most positive outlook on this metric, with only 5% of dealers indicating the planned changes will hurt profitability. Conversely, Ford dealers are much less enthusiastic about the brand’s planned changes, as 58% of them responded they are expecting the changes to harm profits.

Regarding franchise OEMs, dealers were also asked how much they trust them. Toyota received the highest trust rating (72%) whereas 48% of dealers reported “they had no trust in Ford,” which Kerrigan Advisors notes “is consistent with the expectation of a decline in future Ford dealer profits due to changes to the OEM’s retailing strategy.” Lexus, Subaru, Honda, and Porsche were the next most trusted franchises while Nissan, Lincoln, CDJR, and Infiniti saw the lowest trust rating after Ford.

Ultimately, the firm’s founder and managing director, Erin Kerrigan, said that 62% of dealers overall are remaining “bullish on the industry” and noted that “the positive sentiment is leading nearly half of all dealers to seek acquisitions and expansion, certainly an endorsement of the industry’s future.” She further noted that the high return on equity that dealerships see makes it understandable that “dealers are seeking to allocate their capital to dealership acquisitions even in today’s high interest rate environment.”