Welcome back to the latest episode of The Future of Automotive, with Steve Greenfield, Founder and CEO of Automotive Ventures, where we put recent automotive and mobility news into the context of the broader themes impacting the automotive industry.

As we wrap up yet another year, I wanted to take this segment to observe and recap some of the biggest stories of 2023 from across the automotive industry. There’s been no shortage of interesting news this past year that’s been worth tracking.

1. Autonomy’s Failure

First up, 2023 turned out to be the year of massive failures for autonomous vehicles.

Two months before Cruise’s driverless cars were yanked off the streets in San Francisco for rolling over a pedestrian and dragging her about 20 feet, California regulators said they were confident in self-driving technology and gave the company permission to operate its robotaxi service around the city.

That approval was a pivotal moment for the self-driving car industry, as it expanded one of the biggest test cases in the world for the technology. But now, following the horrendous Oct. 2 crash that critically injured a jaywalking pedestrian (and Cruise’s initial misrepresentation over what happened that night) officials here are rethinking whether self-driving cars are ready for the road, and experts are encouraging other states to do the same.

The company suspended all driverless operations around the country to examine its process and earn back public trust. CEO and Co-Founder Kyle Vogt resigned. It then laid off a significant number of Cruise’s executives and employees.

Cruise has nine months of cash left, and one major investor, Honda, does not plan to put up more money.

Cruise has lost more than $8 billion since 2017.

Tesla is having its own autonomous issues.

The company is limiting the use of its Autopilot driver-assistance software as part of a 2 million-vehicle recall, one of the first results to come from an ongoing multiyear investigation by the National Highway Traffic Safety Administration.

The recall restricts the use of Autosteer: specifically, NHTSA says the way Tesla’s cars check to see if drivers are paying attention to the road while using Autosteer is insufficient.

To fix this, Tesla will soon ship an over-the-air software update that will add “additional controls and alerts” to encourage drivers to stay alert while using Autosteer and, crucially, place “additional checks” on activating the software in places where it’s not supposed to be used.

The promise of full self-driving autonomy on public roads has never materialized. And with this year’s setbacks to both Cruise and Tesla, it seems like we’re even further from that ultimate goal.

2. UAW Victory

Next up, the United Auto Workers campaign against the Detroit three automakers can be described as one thing for the union: a big big win.

But the deal portends difficult times ahead for the Detroit Three with the new pacts expected to push the companies’ labor costs higher than initially expected when talks began.

The deals struck in late 2023 are the richest contracts since at least the 1960s. The wage increases alone over four years total more than workers received in the past 22 years.

Coming off this big win, the UAW signaled the next step in the union’s campaign to capitalize on its success in bargaining with the Detroit Three: launching organizing drives at Toyota, Tesla, and other nonunion U.S. auto factories.

Riding high on historic contract wins against Detroit’s automakers, UAW President Shawn Fain is confident he can take on Tesla and its anti-union Chief Executive Officer Elon Musk.

And that’s a great transition to our next story of 2023.

3. Musk’s Dominance

2023 has to have been the year of Elon Musk.

To a large degree, Elon Musk is X, formerly known as Twitter, where, for either personal or financial reasons — maybe both — he appears to regard controversy as currency.

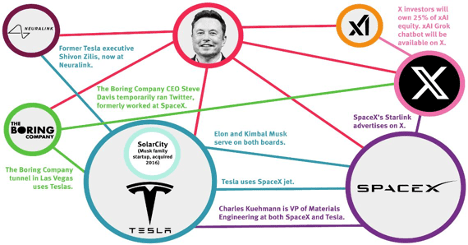

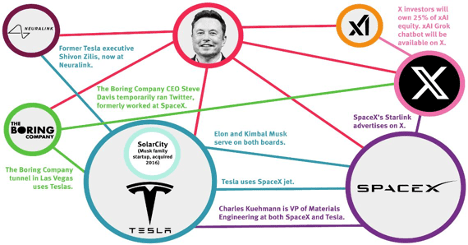

Elon Musk leverages his companies to “scratch the back” of others. The porous boundaries between the many companies Musk leads or controls (a half-dozen by last count) allow personnel and board members to freely float between them. Musk companies are often customers of other Musk companies.

Musk’s Tesla seems to have won the standards war with their NACS charging standard, in an environment where J.D. Power surveys show more than one in five chargers don’t work. It wasn’t a coincidence that by year-end the vast majority of legacy automakers announced that they would ensure their future electric vehicles (EVs) were reverse-compatible with the Tesla charging standard.

But giving Tesla too much visibility and control into charging competitors’ cars, may prove to be an area where competitive automakers need to proceed with caution. For example, near the end of the year, Tesla says it will charge drivers an additional $1 per minute to juice their EV batteries beyond 90%, but only when stations are “busy.” It would be a bad day if Tesla ends up either throttling charging speed or charging significantly more for other automakers’ vehicles to charge on the Tesla network.

Elon Musk’s SpaceX made significant strides this year, and according to insider share sales, maybe already valued at $175 billion or more.

SpaceX’s two-stage Falcon 9 rocket is able to launch a kilogram into low-Earth orbit for just about $1,500, a 10 to 20 times decrease in cost in roughly as many years. That’s due to its partial reusability — a breakthrough that’s helped SpaceX dominate commercial launchpads in the US.

FAA data reveals that SpaceX has completed 281 licensed launches since 2000 — 9-times as many as Jeff Bezos’s Blue Origin and Richard Branson’s Virgin Galactic have managed combined.

SpaceX is discussing an initial public offering for its fast-growing Starlink satellite business as soon as late 2024, in a bid to capitalize on robust demand for communications via space.

SpaceX started launching Starlink satellites in 2019. As of November 2023, it consists of over 5,500 mass-produced small satellites in low Earth orbit that communicate with designated ground transceivers. Nearly 12,000 satellites are planned to be deployed, with a possible later extension to 42,000.

Starlink has reached breakeven cash flow, a milestone for the space-based internet provider.

Elon Musk’s artificial intelligence company xAI is seeking to raise $1 billion in funding from equity investors. xAI has already raised nearly $135 million. Musk created xAI early in 2023 to try to compete with other generative AI companies, including OpenAI, where Musk was a co-founder.

And if all of that didn’t keep Elon busy enough, Neuralink, the company Musk founded that’s developing implantable chips that can read brain waves, raised an additional $43 million in venture capital in late 2023.

Neuralink hasn’t disclosed its valuation recently. But in June, Reuters reported that the company was valued at about $5 billion.

Founded in 2016, Neuralink has devised a sewing machine-like device capable of implanting ultra-thin threads inside the brain. The threads attach to a custom-designed chip containing electrodes that can read information from groups of neurons.

But enough about Elon Musk. On to another big story in 2023: the EV Slowdown.

4. EV Slowdown

EV market share did rise to 7.4% of the U.S. market through Q3 of 2023. A year earlier, EV share was sitting at 5.2% of all new passenger vehicle sales.

A year back, Tesla had nearly two-thirds of the EV market as legacy brands and startups were still ramping up production. Fast forward to today and Tesla’s share fell to 57.4% through September of this year as EV rivals chipped away at the leader.

The outlook for EVs isn’t quite as bright as it was even just six months ago. It seems that the early adopters have already satisfied their demand, and incremental sales are getting that much harder.

Despite battery-electric vehicles’ growing popularity, 85% of their buyers also have at least one gasoline-fueled vehicle. Just 4% own only an EV.

A study from S&P Global Mobility revealed that the fuel type loyalty rate for mainstream brand EV households was sitting at 52.1% through July this year: meaning that the next vehicle purchased by an EV household is equally likely to be an internal combustion car.

Auto dealers across many parts of the country say EVs are becoming too hard a sell for buyers worried about the range, reliability and price of these models.

Late in the year, 3,900 automotive dealers across the country wrote President Biden that EVs were piling up unsold on their lots. They asked for relief from his onerous and unrealistic EV sales mandate.

With automakers set to release a barrage of new electric models in the coming years, concerns are mounting among auto retailers about whether the technology will have broader appeal given that many customers are still reluctant to make the switch.

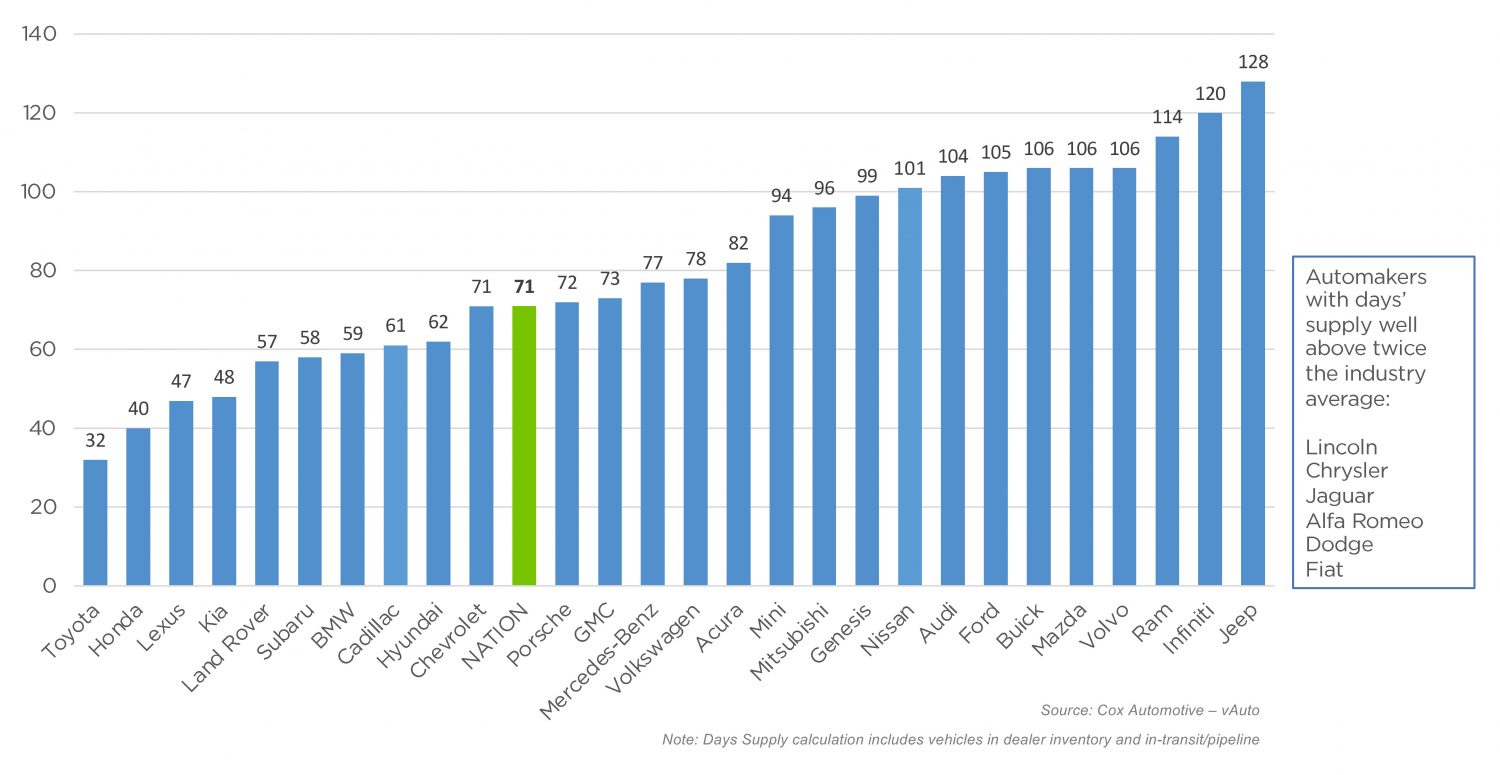

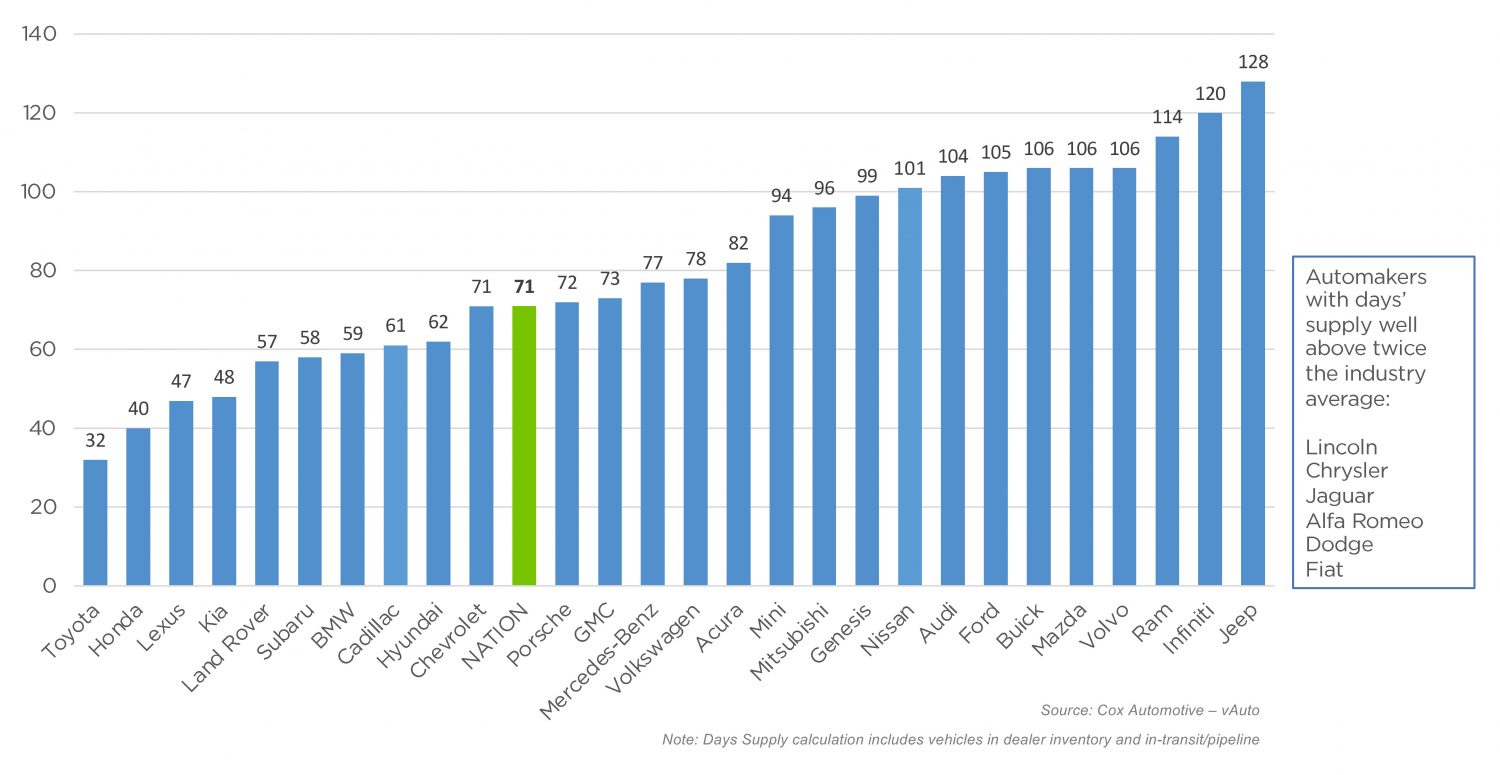

New EV supply on dealership lots at the end of November was at 114 days, more than double the supply of 71 days for the total U.S. supply of available unsold new vehicles.

And the legacy automakers are taking note and action as well.

Slowing demand for EVs has prompted GM and Ford to postpone billions of dollars in investments as the automakers decide they don’t yet need additional production capacity.

Ford announced plans to cut the output of its electric F-150 Lightning pickup by half next year because of changing market demand, a steep pullback of a high-profile nameplate the automaker spent most of this year working to build in larger numbers.

Ford’s electric division recorded a nearly $37,000 operating loss per battery-powered ride sold in Q3, 51% worse than last year. The company has forecast a full-year pretax loss of $4.5 billion for the Ford Model E unit. Thank goodness the automaker has a very profitable internal combustion engine division delivering Mustangs and F-150s.

In addition to the automakers, the current EV charging model isn’t profitable. Startups that have shaped the nation’s charging infrastructure, such as ChargePoint, EVgo and Blink Charging, all reported recent large losses. They are reliant on a number of factors outside of their control to earn a profit, including on-time EV launches, especially for commercial vehicles; smooth and rapid infrastructure expansion with coordination between utilities and local municipalities; regulatory approvals and more.

One last thing to mention on EVs: Keep in mind that EV sales really are a tale of two cities. It’s Tesla vs. the sea of other players.

As of the end of the year, Tesla comprises more than half of all new vehicle EV sales.

Automotive Ventures Update

Finally, 2023 has been a great year for Automotive Ventures.

We continue to build our brand and positioning as the global seed-stage mobility investor partnering with exceptional founders.

We’ve now made 27 investments out of two funds, including the DealerFund, which closed in April of 2023. And we are about to start raising our third fund.

We continue to uncover amazing companies and their amazing founders.

Thanks for your support as we continue to build the Automotive Ventures brand and presence.

Companies to Watch

Every week we highlight interesting companies in the automotive technology space to keep an eye on. If you read my weekly Intel Report, we showcase a company to watch, and we take the opportunity here in this segment to share that company with you.

ScoutIt

Scoutit is an early-stage company that aims to be the complete solution for EV batteries’ end-of-life management.

ScoutIt provides a service to find the most suitable option for EV battery second life, connecting suppliers of exhausted batteries with repurposers and end-users.

The company provides one complete platform for battery trading, sustainable battery energy storage and the circular economy.

EV battery owners can monetize the sale of end-of-life batteries while avoiding substantial recycling costs. Regulations impose the correct disposal of used batteries. Based on batteries’ health, they can be recycled, repurposed or reused, maximizing value throughout the whole life cycle.

If you’re a vehicle maker or auto dismantler, ScoutIt can help you dispose of your exhausted batteries in a profitable way, monetizing from waste and gaining carbon credits.

If you struggle to find steady, consistent battery supply to build your products, or if you are struggling to find buyers for your solution, ScoutIt has got you covered.

If you’d like to learn more about ScoutIt, you can check out their website at www.scoutitweb.com.

If you’re an AutoTech entrepreneur working on a solution that helps car dealerships, we want to hear from you. We are actively investing out of our new DealerFund.

If you’re interested in joining our Investment Club to make direct investments into AutoTech and Mobility startups, please join. There is no obligation to start seeing our deal flow, and we continue to have attractive investment deals available to our members.

Don’t forget to check out my book, “The Future of Automotive Retail,” which is available on Amazon.com. And keep an eye out for my new book, “The Future of Mobility”, which will be out at the end of the year.

Thanks (as always) for your ongoing support, and we look forward to working closely together with you to create the future of this industry.

Thank you for tuning into CBT News for this week’s Future of Automotive segment, and we’ll see you next week!