This month, the NHTSA approved adaptive headlamps, and many consumers will have the choice of paying a monthly subscription to add them, thanks to OTA updates. And a JD Power survey published in January found that 58% of people who use an automaker’s smartphone app wouldn’t be willing to pay for it. So, we may be about to ride a wave of subscription-based ways to add significant upgrades to a vehicle after purchase. But who’ll get the money? OEMs or dealers?

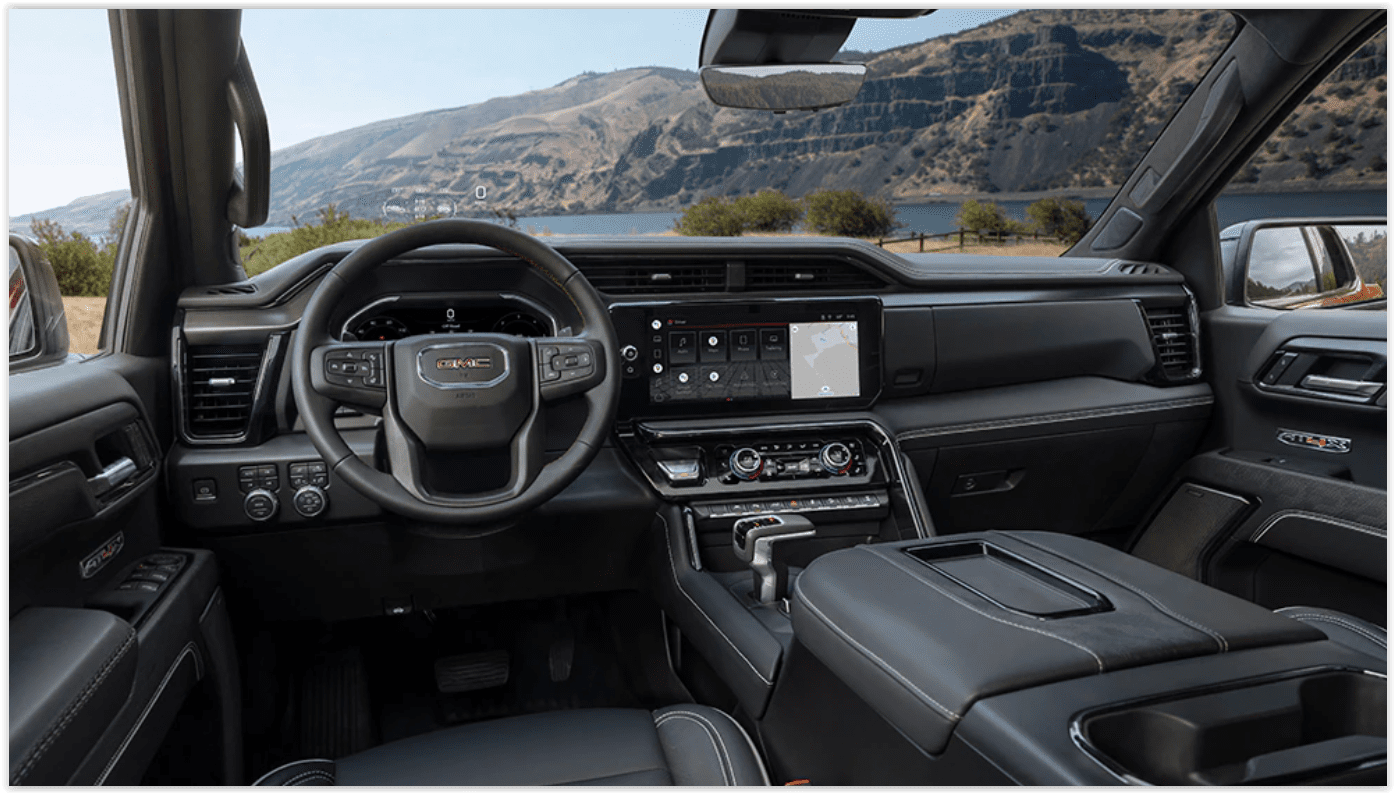

If you look at the 14 inches of LED screens inside the 2022 GMC Sierra and other current vehicles, it doesn’t take much thought to see a world of opportunity for subscription services. But there’s a fine line in what consumers will accept; just ask BMW about their ill-timed desire to charge $80 a year for Apple CarPlay. Some things are considered standard by the consumer, and the lack of understanding by an OEM can turn an opportunity into a PR disaster, as BMW experienced in 2019.

If you look at the 14 inches of LED screens inside the 2022 GMC Sierra and other current vehicles, it doesn’t take much thought to see a world of opportunity for subscription services. But there’s a fine line in what consumers will accept; just ask BMW about their ill-timed desire to charge $80 a year for Apple CarPlay. Some things are considered standard by the consumer, and the lack of understanding by an OEM can turn an opportunity into a PR disaster, as BMW experienced in 2019.

If OEMs build features into every vehicle that a subscription can tap, not only will they achieve good economies of scale, but they’ll also open the door for longer-term consumer satisfaction. For example, buyers who initially can’t afford to pay for heated seats, adaptive safety features, or sport modes can add those features during ownership.

Currently, many manufacturers or providing simple upgrades like remote start and unlock through apps, and buyers are gobbling them up. Of course, consumers are more than willing to add new capabilities, but OEMs would be wise not to charge for expected standard features like heated seats and other ‘price of admission’ items.

How Much Could OEMs Make on OTA Updates?

According to a recent Business Insider report, Stellantis says they could pull in an extra $20 billion in revenue from software services by 2030. And General Motors has plans to double its annual revenues to about $280 billion over the next decade through software upgrades. Assuming GM finds buyers, all of those EVs will need some sprucing up at some point.

If you’re a dealer who relies on profit margins from port-installed accessories and options, there has to be a question of how OEMs will share that extra profit. Of course, Tesla has been doing OTA upgrades that offer new functionality for years, but they don’t have dealers.

On the one hand, CSI scores are a good thing to have. But losing out to a high margin $10 a month software upgrade for sport mode capability instead of the consumer buying that same software upgrade through a dealership for $250 doesn’t sound appealing. So, you can be sure that savvy dealer groups are asking the hard questions and demanding answers about how this will affect after-sales margins.

Will Car Subscriptions Affect Consumer Perceptions?

One thing is sure, the OEM desire for recurring revenue that comes from software upgrades will push the idea of car ownership out of the consumer’s minds, and vehicles will become rentals.

The danger of providing basic transportation with the option to upgrade through subscription is that OEMs can lose their DNA — they’re no longer inherently unique.

Consumers will look to buy the vehicle with the best possibility of upgrades, not because of the car itself. And that turns the physical vehicle into a commodity with the OEMS as a software company. Is that what OEMs really want? Time will tell.

Did you enjoy this article from Steve Mitchell? Please share your thoughts, comments, or questions regarding this topic by submitting a letter to the editor here, or connect with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook and Twitter to stay up to date or catch-up on all of our podcasts on demand.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.