Update 11/28/22: Since Tesla CEO Elon Musk officially acquired social media platform Twitter, 50% of the platform’s top 100 advertisers appear to have stopped their ad efforts on the social media site, according to a report released last week by nonprofit group Media Matters for America.

These advertisers have accounted for about $2 billion in spending since 2020 and have generated over $750 million in advertising in 2022, as of November 21.

There are also a number of what the report calls “quiet quitters,” or companies that stopped their ad efforts for a “significant period of time following direct outreach, controversies, and warnings from media buyers.”

General Motors temporarily paused paid advertising on Twitter just days after Musk assumed ownership of the company in a $44 billion acquisition deal. In an email to TechCrunch, GM confirmed the decision and called it a “normal course of business with a significant change in a media platform.”

“We are engaging with Twitter to understand the direction of the platform under their new ownership,” the email read. The company did say it would continue its customer care interactions on Twitter.

Ford quickly followed suit. Forbes confirmed at the end of October that Ford is “not currently advertising on Twitter,” said spokesman Said Deep. “We will continue to evaluate the direction of the platform under the new ownership.”

The report goes on to say that despite the losses, Musk has continued his “rash of brand unsafe actions — including amplifying conspiracy theories, unilaterally reinstating banned accounts such as that of former President Donald Trump, courting and engaging with far-right accounts, and instituting a haphazard verification scheme that allowed extremists and scammers to purchase a blue check.”

Update 11/3/22: Once the acquisition was complete, employees expressed concern about losing their equity compensation if they were fired or laid off before their stock options vested in early November.

However, according to Twitter employees and internal communications viewed by CNBC, employees said they were reassured by managers that they would not lose that compensation and that the company’s payroll department would be processing their vested stock as early as November 4.

Musk has previously said that Twitter is overstaffed and has already fired several top executives, including the CEO, CFO, Policy Chief, and others. No word from Twitter yet if those employees will be compensated for shares about to vest.

Twitter is known for paying a high amount of its compensation through stock options. For the first six months of 2022, Twitter recorded a stock-based compensation expense of $459.5 million, up from $289.1 million compared to the same period last year.

Musk and Tesla have faced lawsuits several times in the past from former employees who claim they were fired just before their shares were vested. In 2009, in the case of Martin Eberhard v. Elon Musk et al., a former Tesla Chief Information Officer made a statement in a deposition saying Musk and other Tesla executives at the time tried to attribute cuts to “performance and management accountability” because they “did not want to say in public that Tesla was making cuts for financial reasons.”

Another lawsuit involved about 50 Tesla employees who claimed the company had terminated them without paying the equity compensation that they had been promised in job offers. The employees won the case, but Tesla later managed to overturn the decision on appeal.

Musk was scheduled to meet with Twitter employees on November 2 but canceled the meeting unexpectedly.

Update 11/1/22: Early in November, Musk tried to reassure the fears of companies advertising on the platform by posting a note to his personal Twitter account with the headline, “Dear Twitter Advertisers.”

“There has been much speculation about why I bought Twitter and what I think about advertising,” Musk wrote, adding that “most of it has been wrong.”

“The reason I acquired Twitter is because it is important to the future of civilization to have a common digital town square, where a wide range of beliefs can be debated in a healthy manner,” Musk wrote. He also said Twitter cannot become a “free-for-all hellscape, where anything can be said with no consequences,” and added that the platform must show Twitter users “advertising that is as relevant as possible to their needs.”

“Low relevancy ads are spam, but highly relevant ads are actually content!” Musk wrote.

Update 10/28/22: Musk officially took control of Twitter, firing key executives while offering little explanation of how he plans to realize the goals he has set for the social media giant.

He tweeted, “The bird is freed” after completing his $44 billion acquisition, referring to his wish to see Twitter loosen its restrictions on content.

According to sources familiar with the deal, Musk dismissed Twitter’s CEO Parag Agrawal, CFO Ned Segal, and Legal Affairs and Policy Chief Vijaya Gadde. He claimed they had misled him and Twitter’s investors over the prevalence of fake bot accounts on the platform.

The sources added that Agrawal and Segal were escorted out of Twitter’s San Francisco offices when the agreement was finalized.

According to Musk, Twitter’s content moderation procedures would be reexamined in the interest of “free speech.” Musk has also stated that he disagrees with Twitter’s policy of permanently banning users who persistently break its rules. Many are now wondering if previously banned and controversial individuals will reappear on the platform.

Additionally, he sent an open letter to Twitter’s advertisers in which he expressed that he doesn’t want the platform to be a “free-for-all-hellscape where anything can be said with no consequences.”

Musk previously paid a visit to Twitter’s corporate headquarters in San Francisco this week, leading up to the potential closing of his $44 billion acquisition deal of the social media platform.

Musk posted a video of himself strolling into the offices of Twitter’s headquarters carrying a kitchen sink, with a caption that read, “Entering Twitter HQ – let that sink in!” He also changed his public profile descriptor on Twitter to “Chief Twit.”

Entering Twitter HQ – let that sink in! pic.twitter.com/D68z4K2wq7

— Elon Musk (@elonmusk) October 26, 2022

According to sources, Musk reassured employees he was not planning on laying off 75% of the staff after assuming ownership of the company during the visit, despite allegedly saying so last week. A layoff of that size would equal around 5,600 Twitter employees.

Twitter and Musk have been at odds since April, after Musk reportedly backed out of a planned $44 billion purchase of the social media company, claiming Twitter misrepresented the number of active profiles.

The Delaware Court of Chancery has set a date of October 28 for the two parties to reach an agreement. Failure to do so would mean a trial scheduled for November regarding the matter would move forward.

Update 10/17/22: An unsealed court filing from Twitter claimed that Musk is under federal investigation for his conduct during a takeover bid for the social media company earlier this year.

Attorneys for Twitter wrote in the filing that Musk’s lawyers claimed “investigative privilege,” attempting to avoid turning over documents related to the lawsuit, including drafts of a May 13 email to the Securities and Exchange Commission and a presentation to the Federal Trade Commission.

“This game of ‘hide the ball’ must end,” the filing read before calling on Delaware Chancellor Kathaleen McCormick to order the release of relevant documents.

Musk’s attorney, Alex Spiro, fired back by saying that Twitter executives were actually the ones under federal investigation and referring to the recent court filing as a “misdirection.”

Update 10/5/22: According to a regulatory filing, Musk has changed his mind once again and is proposing to purchase Twitter for $54.20 per share. After Bloomberg broke the story, Twitter stock rose more than 22%.

Tesla was up 5% on Tuesday morning. However, the EV maker’s stock erased nearly all of its gains after investors questioned the legitimacy of the announcement. Trading was eventually suspended.

According to the SEC filing, Musk wrote to Twitter on Monday to inform the firm of his intention to carry out the transaction that was agreed upon on April 25, when the deal was initially announced.

In a statement, Twitter acknowledged receiving the letter and stated, “The Company intends to close the transaction at $54.20 per share.”

According to CNBC sources, a deal might be reached as soon as this Friday.

Update 9/27/22: Musk was supposed to spend the next two or three days responding to questions from lawyers for the social media platform Twitter. However, CEO Parag Agrawa abruptly postponed a deposition that was part of Twitter’s lawsuit against Musk, angering the billionaire’s legal team, according to persons familiar with the matter who spoke with Insider.

In a deposition that was due to begin at 9 am local time on Monday in San Francisco, the Twitter CEO was expected to be questioned for a total of ten hours. Musk’s partner at Quinn Emanuel Urquhart & Sullivan in New York, Alex Spiro, was scheduled to interview Agrawal in-depth. Twitter’s legal team emailed Musk’s side on Sunday to cancel Agrawal’s deposition due to “personal reasons.”

The deposition was planned to last until Wednesday if necessary and would not be public. Musk will still be deposed sometime this week, though the date has been changed. His interview will also take place in person, though probably not in Delaware as originally planned.

In April, Musk agreed to buy the social media platform and take it private with an original offering price of $54.20 a share. Musk had mentioned plans to loosen the company’s content policing policies and make an effort to clear out fake accounts on the site.

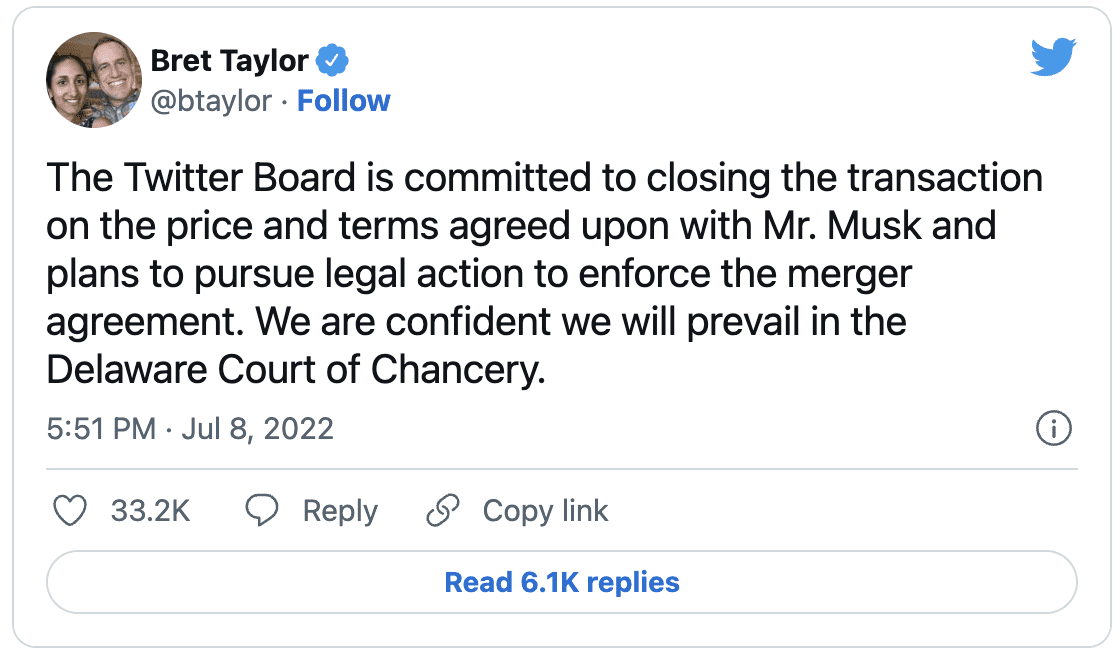

In July, just a few short months later, Musk said he wanted to back out of the deal, claiming Twitter misrepresented the number of factual accounts versus bots on the platform. Twitter promptly filed a lawsuit to force him to follow through on the acquisition at the original offer price, saying his claims were unfounded and that he was merely suffering from buyer’s remorse.

Update 9/13/22: Musk made a third attempt to call off a $44 billion acquisition deal with social media giant Twitter on Friday, saying that payments made to a whistleblower are grounds for canceling the deal altogether.

Musk’s legal team sent a letter to Twitter on Friday, saying that the company’s $7.75 million severance payment to whistleblower Peiter “Mudge” Zatko is a clear breach of the takeover agreement.

The letter is the third attempt from Musk to cancel the agreement, following a filing on July 8 with the SEC alleging the company had “not complied with its contractual obligations.” A second letter was sent on August 29, citing the allegations made by Zatko about “extreme, egregious deficiencies” in the company’s security, privacy, and content moderation were also grounds for cancellation.

Twitter responded to the new letter, saying the company intends to enforce the agreement and close the deal with the original terms. The company will meet to vote on whether to approve or reject the takeover bid from Musk.

“As was the case with both your July 8, 2022 and August 29, 2022, purported notices of termination, the purported termination set forth in your September 9, 2022 letter is invalid and wrongful under the Agreement,” read a letter sent to Musk’s representatives from Twitter’s legal team.

“Twitter has breached none of its representations or obligations under the Agreement, and following the receipt of the approval of Twitter’s stockholders at its September 13, 2022, special meeting, all of the conditions precedent to the closing of the Merger will be satisfied.”

The Tesla CEO and the social media company will head to trial on October 17 to resolve the matter unless they reach a settlement first.

Update 9/8/22: Musk won’t be able to postpone a crucial October trial over the disagreement, Chancellor Kathaleen St. Jude McCormick, the Chief Judge of Delaware’s Court of Chancery, ruled on Wednesday. However, Judge McCormick has allowed Musk to use the whistleblower’s claims as new evidence.

Twitter’s former security head Peiter Zatko, who is slated to testify before Congress next week about the company’s subpar cybersecurity policies, made the whistleblower allegations. According to Musk’s legal team, the assertions made by Zatko to American officials may support Musk’s claims that Twitter deceived him and the public about the issue with bogus and “spam” accounts the firm was having.

Zatko, a well-known cybersecurity specialist better known by his hacker alias “Mudge,” said that he was let go by Twitter in January after raising concerns about the company’s lax approach to user security and privacy.

The judge’s decision came after a lengthy session on Tuesday during which lawyers for Musk and Twitter sparred about the validity of Zatko’s accusations and the rate at which each side is gathering evidence in preparation for the trial.

Judge McCormick stated on Wednesday that the newly released whistleblower complaint offered Musk’s team justification to modify their countersuit, but she chose not to comment on the specifics.

“I am reticent to say more concerning the merits of the counterclaims at this posture before they have been fully litigated,” she wrote. “The world will have to wait for the post-trial decision.”

However, McCormick agreed with Twitter’s worries that putting off the trial would make it more difficult for the firm to resume operations.

Update 8/17/22: A Delaware Court has ordered Twitter to give Musk documents from a former Twitter executive, according to a court order issued earlier this week. The order requires Twitter to collect, review, and produce documents from former General Manager of Consumer Product Keyvon Beykpour.

He was described in filings as one of the executives “most intimately involved with” determining the number of spam accounts on the social media platform. Twitter has accused Musk of breaching his agreement to buy the platform, while Musk says Twitter misrepresented the number of its real and active users.

Beykpour left Twitter in April, shortly after Musk entered into a $44 billion acquisition deal to buy the company.

Musk later backed out of the agreement, accusing Twitter of misrepresenting the number of real active users on its platform. Earlier this month, he officially accused the company of fraud in response to Twitter accusing Musk of breaching his agreement to acquire the company at the agreed-upon price of $54.20 a share.

The request for access to documents and a list of employee names was given to Chancellor Kathaleen McCormick last week from Musks’ legal team. The judge has since denied the request for access to 21 other people involved with the company.

A Delaware Court has ordered Twitter to hand over documents from a former executive to Musk. The social media company was ordered to collect, review, and produce documents from Kayvon Beykpour, the former General Manager of Consumer Product for Twitter.

Musk has stated that Beykpour was a key figure in calculating the number of bots and fake accounts in use on the platform. Court filings from the case describe Beykpour as being one of the executives “most intimately involved” with determining the number of spam accounts active on the platform.

Beykpour left Twitter in April, shortly after Musk entered into a $44 billion acquisition deal to buy the company.

Musk later backed out of the agreement, accusing Twitter of misrepresenting the number of real active users on its platform. He officially accused the company of fraud earlier this month, in response to Twitter accusing Musk of breaching his agreement to acquire the company at the agreed-upon price of $54.20 a share.

The request for access to documents and a list of employee names was given to Chancellor Kathaleen McCormick last week from Musks’ legal team. The judge has since denied the request for access to 21 other people involved with the company.

Update 7/19/22: According to a report from Reuters, a judge will hear arguments today regarding Twitter’s request for a September trial in its lawsuit against Musk. However, Musk and his legal team have now requested the court to delay his trial. The filing of an extension would push the trial back to at least February 2023. The decision on whether or not this case will be extended takes place this week.

Twitter is suing Musk for not holding the end of their deal worth $44 billion to purchase the large social media company. The judge for the case recently notified both parties of the 90-minute hearing which will take place on July 19 at 11 am eastern time.

Reportedly, Musk terminated the planned purchase of Twitter due to false information about spam accounts and bots. He has stated that Twitter is now unfairly going ‘warp speed’ with this trial since they have been “dragging their feet for two months about the problems.” Musk’s lawyers believe they need more time to find substantial evidence to show Twitter’s false and spam accounts. Delaware Chancery Court’s Judge Kathaleen McCormick will decide on the trial date and potential extension.

Update 7/12/22: Musk announced late last Friday that he was terminating his agreement to purchase Twitter, citing the lack of information regarding the proportion of actual Twitter users who are bots.

According to Reuters, Twitter intends to sue Musk as soon as this week to compel him to finalize the transaction.

According to Reuters, Twitter intends to sue Musk as soon as this week to compel him to finalize the transaction.

In a tweet, Musk poked fun at Twitter’s attempts to pressure him into buying the firm.

Musk tweeted four pictures of himself laughing early on Monday, along with the following captions: “They said I couldn’t buy Twitter. Then they wouldn’t disclose bot information. Now they want to force me to buy Twitter in court. Now they have to disclose bot information in court.”

Following that, Musk tweeted a photo of actor Chuck Norris playing chess with just one pawn on his side of the board and all the pieces on the other with the caption “Checkmate.”

The agreement stipulates that Musk must pay Twitter a $1 billion fee if he cannot close the transaction due to events like the failure of the acquisition finance or opposition from authorities.

Twitter answered back accusing Musk of “knowingly” breaking the terms of the agreement to purchase the social media company.

Twitter stated in a letter to Musk dated Sunday that it had not violated the merger agreement, contrary to what Musk had claimed on Friday in order to terminate the acquisition.

Update 4/26/22: On Monday, Twitter announced that it had accepted Musk’s offer of $44 billion to take the company private. That means the world’s wealthiest and arguably most theatrical individual will soon have the power to affect conversation on the social network, which more than 200 million people utilize every day.

Musk identifies himself as a “free speech absolutist” who has blasted what he perceives as excessive moderation on social media sites.

“Free expression is the backbone of a functional democracy, and Twitter is the digital town square where things crucial to the future of humanity are debated,” he said in a statement announcing the purchase.

Musk has claimed that even though Twitter comments are sometimes controversial, they are still lawful and should not be erased.

Musk’s desire to change the engagement on Twitter is causing concern among social network experts. They claim this might empower harassers, trolls, and others who abuse the site to target specific individuals.

Currently, advertising accounts for about 90% of Twitter’s revenue, but the firm has struggled to lure advertisers to the platform, which frequently devolves into political firestorms and nasty online brawls.

The corporation will no longer be under the same pressure from shareholders to increase advertising income now that it is private. Musk has suggested that it switch to a subscription model.

Still unknown is whether or not Musk and Twitter will re-instate former President Donald Trump. Musk has not publicly stated if he will allow the former President to return to the platform after he was permanently barred for using language that violated the site’s rules and allegedly fueled the siege on the U.S. Capitol on Jan. 6.

Update 4/15/22: Twitter’s board of directors has taken measures to block Musk’s proposed takeover offer, in a huge setback to the billionaire’s aspirations to seize full financial control of the platform.

In a press release, the company’s board of directors stated that a “shareholder rights plan” was adopted “after an unsolicited, non-binding proposition to buy Twitter.”

This plan, known as a poison pill in the financial sector, prevents hostile takeovers by allowing some shareholders to buy additional stock if an outsider tries to take control.

According to the proposal, Twitter’s board of directors wants to battle Musk’s move to acquire control of the firm, as previously reported. Twitter’s CEO, Parag Agrawal, had stated that the business was still weighing Musk’s offer. The strategy was also disclosed in a file to the U.S. Securities and Exchange Commission and will be in effect for one year.

Update 4/14/22: Last week, Musk was the subject of headlines after purchasing a 9.2% stake in Twitter, which gave him stocks worth almost $3 billion. Twitter subsequently announced Musk would be joining its Board of Directors. Former Twitter CEO Jack Dorsey released a statement saying he was “happy” about the situation and that Musk “cares deeply about our world and Twitter’s role in it.”

That plan derailed when Musk declined to join the board the same week.

Musk is taking his investment in Twitter even further and is now offering to purchase 100% of the social media platform for $54.20 per share. According to a regulatory filing this week, he sent Twitter’s Chairman, Bret Taylor, a letter stating that he believes in Twitter’s “potential to be the platform for free speech around the globe” and that “free speech is a societal imperative for a functioning democracy.”

Musk’s full offer was to “buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before [he] began investing in Twitter and a 38% premium over the day before [his] investment was publicly announced.” He referred to this as his “best and final offer” and noted he would “reconsider [his] position” as a shareholder in the social media platform if it is not accepted.

The letter further stated that it is critical for Twitter to become a private company, as soon after purchasing his shares, he “realize[d] the company will neither thrive nor serve this societal imperative in its current form.” He ended his letter with, “Twitter has extraordinary potential. I will unlock it.”

Twitter is valued at around $37 billion, and Musk’s offer this week would value Twitter at approximately $43 billion. Last fall, Musk surpassed Amazon’s Jeff Bezos and is now the richest person in the world.

On Thursday, Twitter released a very short press release regarding Musk’s offer and said it had “received an unsolicited, non-binding proposal” from Musk and that it will “carefully review the proposal to determine the course of action that it believes is in the best interest of the Company and all Twitter stockholders.”

Of course, Musk has a widely discussed Twitter presence, as he has continuously accused the social media platform of restricting free speech. On March 25th, he posted a Twitter poll asking if followers “believe Twitter rigorously adheres” to its free speech principle. He followed up the tweet with a comment, stating, “The consequences of this poll will be important. Please vote carefully.”

As of April 14th, over 70% of followers responded “No.”

Musk has also faced regulatory issues related to his Twitter posts, including his 2018 tweet about possibly making Tesla a private company. Regulators discovered he did not have the funding to do so, and the Securities and Exchange Commission imposed a rule stating that Tesla’s attorneys must pre-approve any Twitter posts related to financial matters regarding his companies.

Did you enjoy this article? Please share your thoughts, comments, or questions regarding this topic by connecting with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook, LinkedIn, and TikTok to stay up to date.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.