April 2023 is a tale of two stories. One indicates that buyers are continuing to benefit from increased inventory offerings, while the other shows there might be a slowdown approaching the latter half of Q2.

Nevertheless, April is a strong start for Q2. According to Cox Automotive’s projections, April is expected to finish with a seasonally adjusted annual rate or SAAR of 15.1 million, a notable jump from last year’s 14.3 million (likely due to the industry’s then lack of available inventory). But, the month-over-month (MOM) numbers indicate that economic concerns could cause turbulence.

Here’s what individuals can likely expect from April’s 2023 U.S. auto sales:

Year-to-Year and Month-to-Month Numbers Show Varying Stories

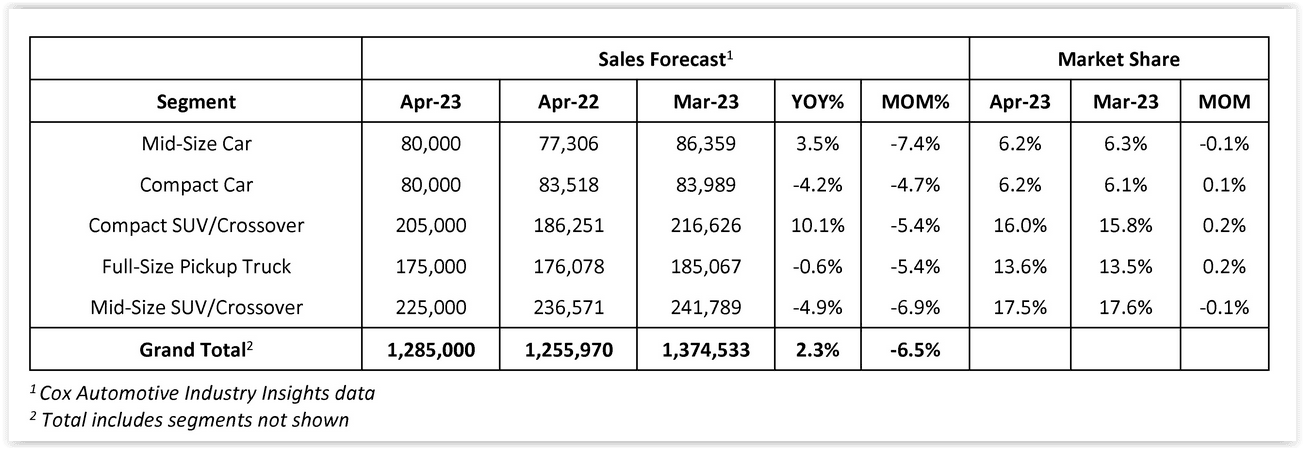

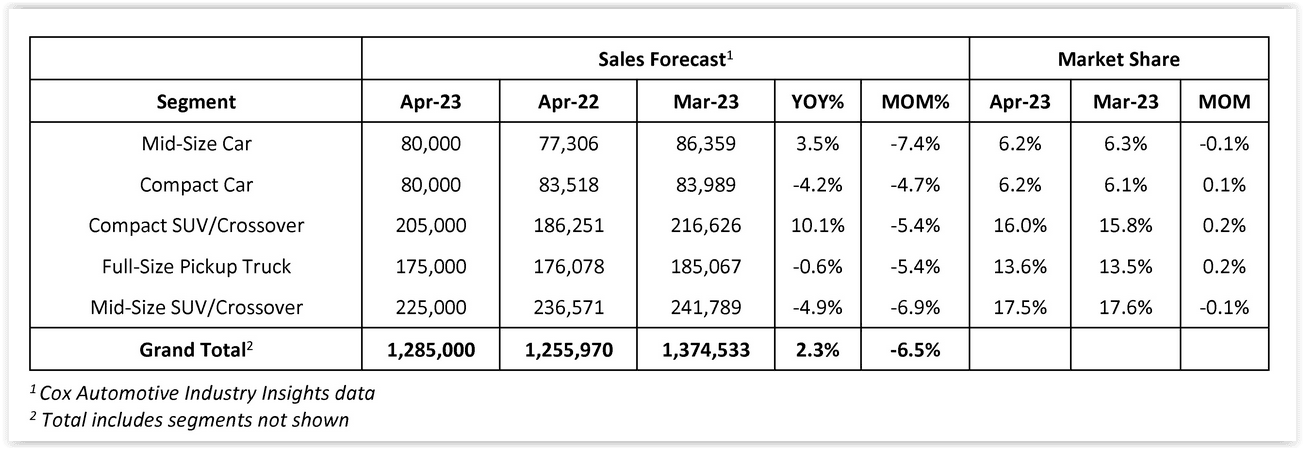

The year-to-year (YOY) new vehicle sales show that dealers are experiencing an overall better performance than in April 2022. April’s auto sales are projected to have a 2.3% rise compared to last year, likely due to increased inventory supply. However, from March 2023 to April 2023, sales might see a 6.5% dip. This coincides with predictions from Cox Automotive in Q1.

In a report from earlier this year, Cox projected that we could see slow or weak growth in the automotive sector due to high-interest rates and tightening monetary conditions from the Federal Reserve. We could see some of this play out, particularly with vehicle affordability continuing to be a looming issue where many individuals are being priced out of purchasing a new car.

SUVs and Trucks Still Reign Supreme

Many automakers are focusing on larger vehicles, which are also likely their most expensive cars. We’ve seen companies like Ford, Hyundai, and Chevrolet discontinue smaller vehicles and focus on producing SUVs and trucks. As a result, automakers and dealer profits will likely benefit from this choice if April’s numbers are exact or close to accurate.

According to Cox, compact SUVs, full-size pick-up trucks, and mid-size SUVs are projected to have the most significant market shares of auto sales at 16%, 13.6%, and 17.5%, respectively.

Compact SUVs and crossovers had the largest YOY forecasted sales at 10.1% (205,000 units vs. 186,251). Since these vehicles tend to have a higher cost than economy cars, this could likely be a factor in some of the affordability issues we’ve seen with consumers. As we continue to move into Q2 and even Q3, it’ll be interesting to see if any economic headwinds impact consumer preference for larger vehicles.

How Interest Rates are Impacting Dealers at the Start of Q2

According to Cox Automotive’s Auto Market Report for the week of April 25th, interest rates took a dip. Average rates for new vehicles were down to 8.89%, while used were 13.55%. While these numbers have slightly decreased from the previous month, they are some of the highest rates we’ve seen over the past few years.

Another report from Cox indicated that interest rates were a significant problem for dealer businesses. Fifty-five percent cited it as a primary concern. As a result, many might feel pressure to lower prices to balance out the increased pricing due to these interest rates. This balancing act might be one that dealers feel they need to do as we progress into Q2 and Q3.

Final Thoughts

April has shown that while sales numbers look relatively good compared to a year ago, there could be some dips on the horizon if the drop in auto sales compared to March is any indicator. Nevertheless, as automakers continue to prioritize more expensive newer vehicles, including EVs, and interest rates continue to rise, dealers may have to balance incentives and discounts with profits as we move into the next part of the year.