BURLINGTON, VT — July 8, 2025 — Widewail, the industry leader in review and reputation data for automotive dealerships, today released its Q1 2025 Automotive Voice of the Customer Report, analyzing more than 1.4 million Google reviews from nearly 18,000 U.S. car dealerships in the first quarter of 2025. The findings deliver an unprecedented look at how real customer sentiment is shaping the automotive landscape in a year of transformation. The report highlights a surprising surge from Ford, a major leap in EV retail execution, and the continued dominance of Lexus in customer perception. Widewail’s report reveals the growing influence of public customer feedback in shaping brand value, and how small operational improvements are paying off in big ways.

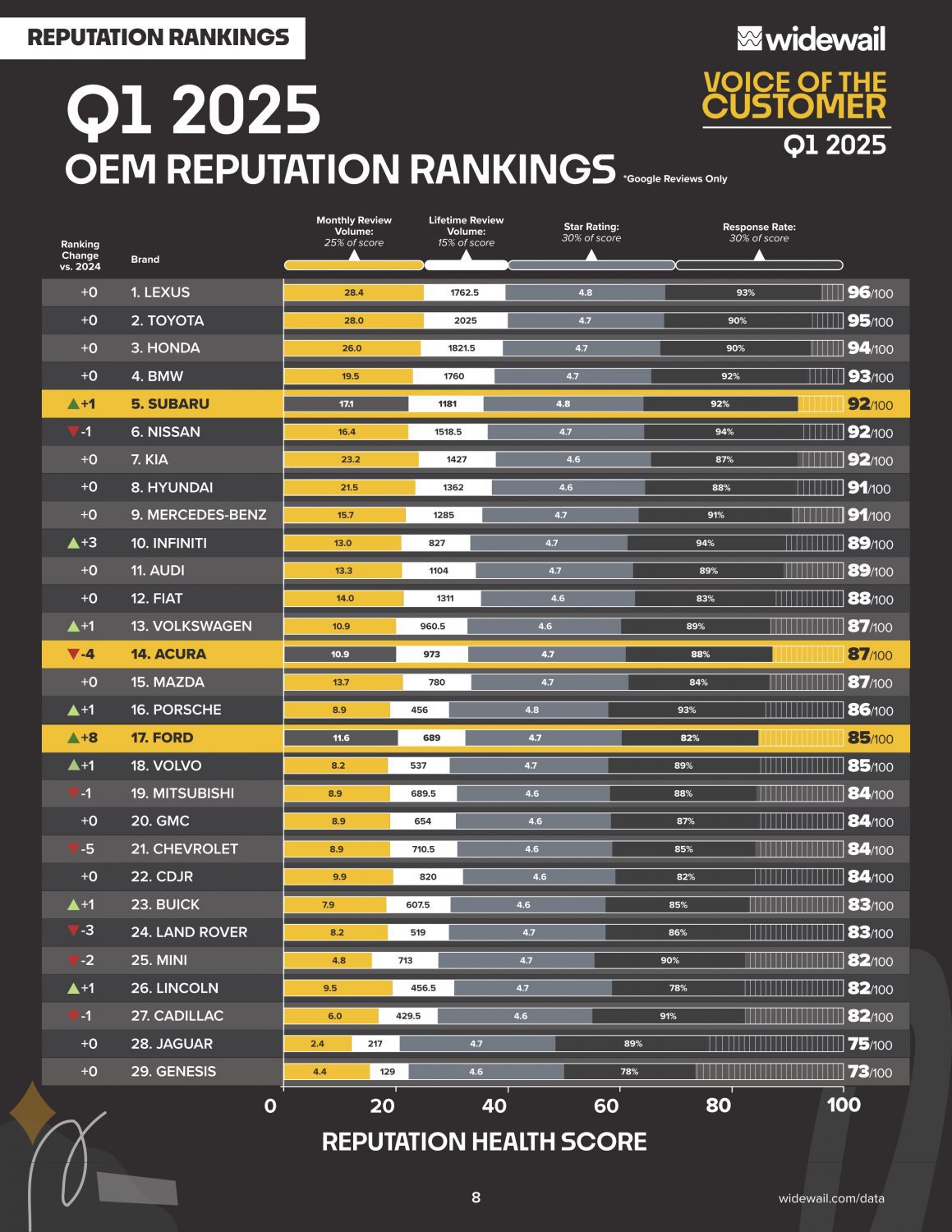

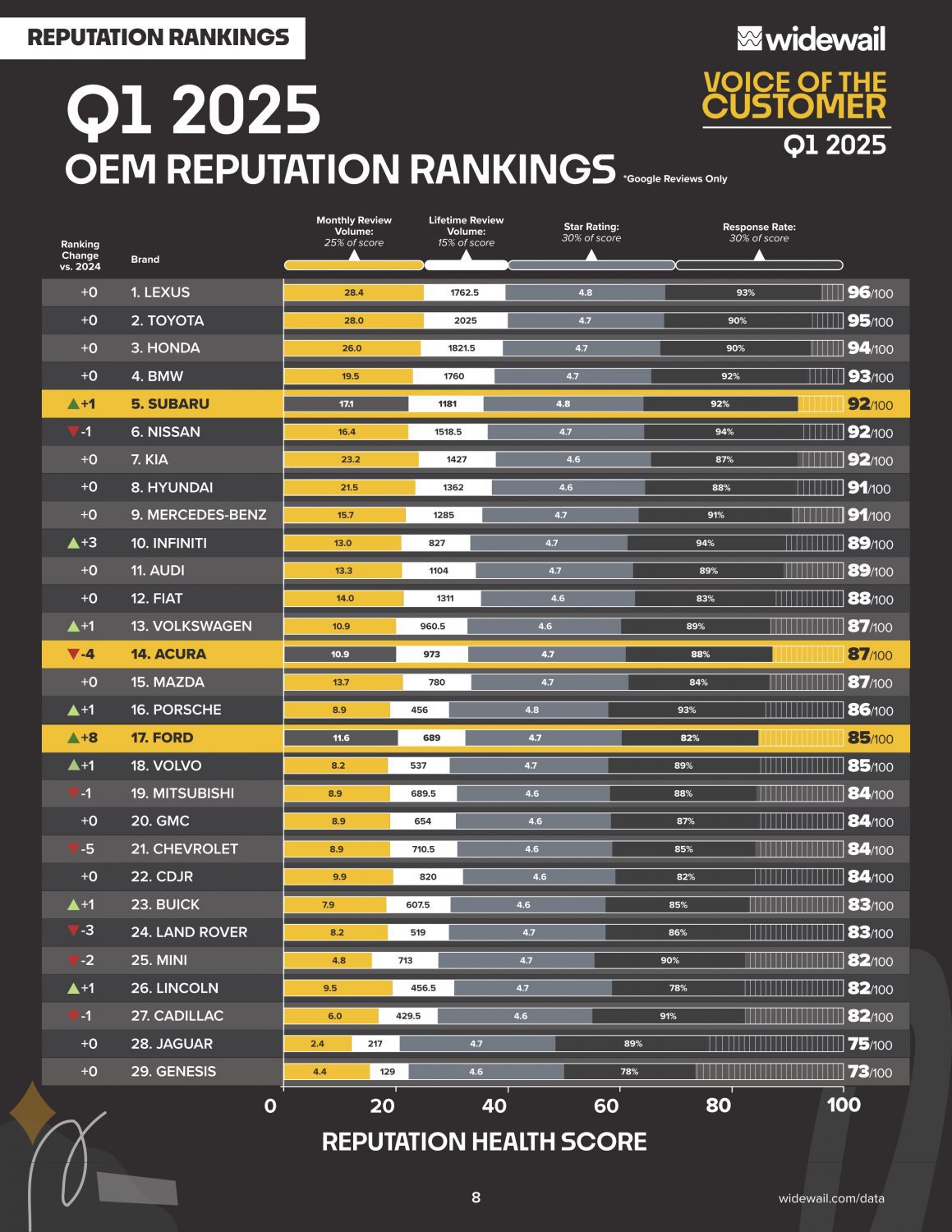

Ford Rises 8 Spots in Reputation Rankings

In one of the most impressive climbs of the quarter, Ford jumped from 25th to 17th in Widewail’s OEM reputation rankings, a striking shift that demonstrates just how tight the middle of the pack has become. A modest increase of just a few Google reviews per dealership per month propelled Ford ahead of key rivals like Chevrolet and GMC. Ford’s blend of strategic messaging and operational consistency is clearly resonating with consumers.

Notable performance gains for Ford in Q1 include:

- +22% increase in monthly review volume

- +0.1 bump in average star rating

- +11% increase in positive repair-related reviews

- +8% improvement in service communication

- +6.2% growth in overall service department positivity

“Ford didn’t overhaul its entire customer experience,” said Matt Murray, CEO, Widewail. “It simply nudged a few levers and the results speak for themselves.”

Yet, despite its rising reputation, Ford still lags in EV knowledge, with positive mentions of product knowledge 20% below industry benchmarks. Additionally, warranty complaints are 16% higher than average.

EV Sales Experience Gets Smarter, But the Curve is Still Steep

EVs have transformed how cars are built, but now they’re changing how cars are sold.

Last year, EV reviews were 76% more likely than ICE reviews to mention staff knowledge gaps, making it the largest disconnect between ICE and electric vehicle sales. However, in Q1 2025, dealers demonstrated significant progress.

Knowledge-related EV complaints have dropped 28% since Q4 2024, and the knowledge gap between EV and ICE transactions was nearly cut in half. Dealers appear to be investing in better training and education, and EV buyers are noticing.

Still, selling EVs remains a challenge. Battery questions, range anxiety, and charging logistics demand a more consultative sale than traditional models.

“We’re seeing a growing sophistication in how dealers approach EV buyers,” said Murray. “But the learning curve is still real. This is a retail revolution in motion.”

Lexus Remains the Reputation King

No brand commands more love from its customers than Lexus. In Q1, Lexus once again topped the OEM reputation rankings, with a 96/100 score, thanks to its unmatched blend of review volume, sentiment, and responsiveness. Its secret weapon? A customer experience that inspires organic brand evangelism.

In a sample of 1,000 Lexus reviews, the word “Lexus” was explicitly mentioned in over 80% of them, a staggering show of loyalty. For comparison, in a study of Ford reviews, the brand was only mentioned in roughly half.

Quick Lexus stats:

- Average Google rating: 4.8

- Review volume per rooftop: 28.4/month

- Response rate: 93%

“Lexus isn’t just delivering great service; they’ve created an experience people want to talk about,” noted Murray. “And that’s the holy grail of brand building.”

Subaru Quietly Enters the Top 5, Passing Nissan

While much of the industry chases scale, Subaru is proving that consistency beats volume. In Q1, Subaru overtook Nissan to break into the top 5 OEMs for the first time in Widewail’s ranking history .

With steady improvements in repair satisfaction, wait times, and overall friendliness, Subaru climbed thanks to just a +0.5 increase in review volume and a +0.1 bump in star rating. The brand’s vehicle sales were up 9% year-over-year in Q1, outpacing Nissan despite selling fewer total units.

“Subaru is showing that tight execution and thoughtful follow-through can outperform bigger brands,” said Murray. “They’re winning the long game.”

Genesis Stuck on the Bottom While Hyundai Thrives

At the other end of the spectrum, Genesis holds steady, ranking last in the analysis, where it has remained for the past two years. Despite a luxury badge and shared DNA with Hyundai, Genesis sits at #29 of 29, with a 73/100 reputation score.

In contrast, Hyundai is ranked 8th overall, a full 21 points ahead, showcasing just how much local dealership operations, not parent company affiliations, define public perception. While luxury brands like Genesis traditionally sell at much lower volumes than their mass market counterparts, being a luxury brand doesn’t automatically mean it’s impossible to rank higher, as evidenced by the high reputation rankings for Lexus and BMW.

“This is not a product problem; it is an execution one,” said Murray. “If Hyundai can do it, Genesis can, too. But something is clearly broken in the delivery.”

Tariffs Dominate Headlines and Begin to Echo in Reviews

Despite only 450 reviews out of 1.4 million mentioning tariffs, just 0.03% of the total, this represents a notable increase from Q4, where mentions totaled around 20, signaling that consumer awareness of trade policy is starting to filter into the dealership experience. For now, reviewers remain far more focused on service quality, staff communication, and value than on global economic policy.

“The tariff conversation still isn’t dominating the customer experience, but the recent rise in mentions suggests it may be on the radar,” noted Murray. “Dealers seem to be getting ahead of it with proactive communication.”

From Ford’s PR-fueled rise to Lexus’s loyalty-driven dominance, one truth is clear: the modern auto battle is being fought and won in public. Widewail’s data shows that just a handful of additional reviews per month, better staff knowledge, or clearer communication can tip the balance in an increasingly crowded market.

Download the full Q1 2025 Automotive Voice of the Customer Report at: https://www.widewail.com/voc-q1

Methodology

The detailed methodology is available here.

About Widewail

Widewail is deeply integrated into the automotive industry, supporting over 5,000 dealership clients. Widewail’s suite of solutions powers the modern shopping experience by leveraging automation to drive and directly manage customer and prospect conversations in consumer reviews, video and social media. The Widewail Trust Marketing Platform helps businesses capture, distribute and shape the narrative of their business through the words of their customers with great reviews and video testimonial content, building trust between businesses and the communities they serve. The result: Widewail’s solutions improve search rankings and help companies understand how their actions affect customer satisfaction and overall reputation. For more information visit https://www.widewail.com/.