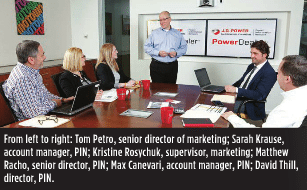

J.D. Power’s Power Information Network and PowerDealer are giving dealers the data they need to stay competitive in the marketplace. BY BARRY COURTER

Want to know whether young girls aged 12 to 16 prefer Coca-Cola in a bottle or in a can? You can bet Coke bottlers know that info and a whole lot more because there is power in numbers. Armed with that information they create entire marketing strategies.

Since 1993, researchers at J.D. Power and the Power Information Network (PIN) have been striving to compile and make available to manufacturers and dealers that level of research data in order to help them do a better job, not only on a daily basis, but also in planning week-to-week or month-to-month strategies.

“Coke knew more about a 20-ounce bottle or can of Coke than some of the manufacturers knew about a $15,000 or $20,000 automobile purchase,” said Matthew Racho, senior director of PIN.

Since its inception, PIN has been funded by auto manufacturers who value the information. That funding allows J.D. Power to offer PowerDealer, the platform that provides the data to the dealers, for free. It was originally delivered to dealers on a weekly basis in printed form, giving dealers lots of information to help them understand trends in the industry across the nation, but also in their own marketplace.

With the advent of the Internet, PIN and PowerDealer are now able to provide real-time information and decision-support tools based on the collection and analysis of daily new- and used-vehicle retail transaction data from thousands of automotive franchises.

PIN and PowerDealer are also available in Canada. Users of PowerDealer can log on to the site and quickly get an overview of either new or used vehicle sales at a glance, for example, and they can compare monthly sales over the prior year in almost two dozen categories such as average days to turn, ROI, percentage female/male, average buyer age and percentage financed. The Dashboard page gives the same information in the form of a tachometer-type graphic.

Racho said PowerDealer is just one tool dealers can and should use in assessing the market, but “I think what it does is make a good new or used car manager a great one.” It does so by giving dealer principals and general managers a wealth of data specific to their market. It gathers and collates the information without bias toward any particular fleet or market. “A particular manufacturer may have a wealth of their own data but what is lacking is that competitive view,” Racho said. “We can, and do, provide that data back to them. We are dedicated to benefiting the dealer and the auto industry.”

Racho said the PIN has an alliance with the National Automotive Dealers Association, and that NADA has “reviewed our dealer agreement and understands it and they feel we put the data and information in the right way. We can provide dealers with that market transparency.”

PIN and PowerDealer offers three key elements for dealers, Racho said. “The timeliness and the breadth of the data. We’ve got a lot of data here. And, it’s free.”

An example of how this might benefit a used car dealer, is in off-brand trade-ins. A Ford dealer who has a customer come in with a Fusion or an F-150 knows the trade-in and resale values of those vehicles because he deals with them on a regular basis. He is likely less familiar with a Honda Accord or Nissan Altima, Racho said, and while he might think he knows those values based on his own experience, the data can provide factual information regarding their value in that market. PowerDealer provides that dealer with what those cars sell for in that market, ensuring a quicker, profitable turn. “Every market has its own nuance in terms of vehicles that perform better than others,” Racho said.

Perhaps more importantly, PowerDealer allows dealers to see into the future a bit and adjust business strategies accordingly. If the data shows, for example, that a particular car sells well or doesn’t sell at all in your market plans can be implemented to take advantage of that knowledge.

Perhaps more importantly, PowerDealer allows dealers to see into the future a bit and adjust business strategies accordingly. If the data shows, for example, that a particular car sells well or doesn’t sell at all in your market plans can be implemented to take advantage of that knowledge.

Recently, PIN began integrating its data collection with Google Maps, allowing dealers to see where in the region it sells a lot of cars or not many at all. “You can see where certain cities and maybe zip codes where volume has gone down, and recapture those opportunities before someone else does,” Racho said.

GMs and principals can also use the website’s goal-setting element to set goals for the week or month based on the data at hand. Having that information available to the entire staff can go a long way towards getting everybody on board to the plan, Racho said.

In response to the many requests heard from interviewing many of those dealers, PIN developers are working on updating the systems to be able to send text updates and alerts regarding breaking developments. “We’ve spent a significant amount of time at premiere events and gone out and knocked on doors asking people what they want to see,” Racho said. Dealers want more granularity, more specific insight into their particular store’s performance, more insights into understanding what the potential drivers of increased profitability is.

“The third thing dealers will see is us being more proactive in providing that information to dealers. Letting dealers know where they may be out of statistical balance whether it is better or worse.”

Racho said that information will include not only the alert, but a possible solution.