Market participants expect greater simplicity for customers, but also more aggressive marketing and pricing. BY JON MCKENNA

The price tag for Cox Automotive Inc.’s planned purchase of Dealertrack Technologies Inc., approximately $4.6 billion, is certainly eye-popping. However, once you get past the shock and awe over how much money is involved, what might this deal mean for the dealership customers that buy from one or both of these prominent vendors?

To explore that subject, you need to know more about the companies involved in the proposed deal, which could close by Sept. 30. Lake Success, N.Y.-based Dealertrack has the industry’s largest online credit application network, connecting more than 20,000 dealers with roughly 1,500 participating lenders. That network, which is free to dealers, gives Dealertrack a great springboard from which to market its suite of subscription-based software and online platform products, and specialty and transportation services.

That suite comprise DMS platforms, car transportation services, an integrated F&I platform for dealers, digital marketing consulting, online and cross-state vehicle registration, and electronic titling. Probably the company’s best-known brand name is the Dealer.com digital marketing platform.

Dealertrack Adding Revenue Quickly

Dealertrack Adding Revenue Quickly

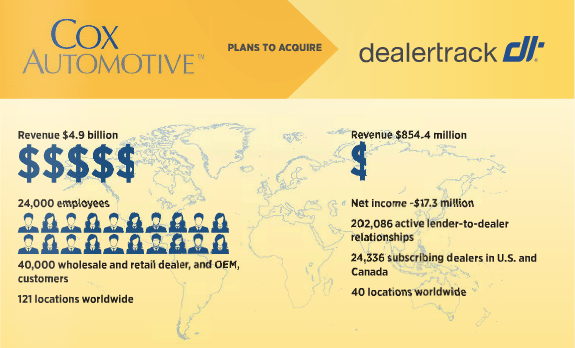

Dealertrack’s revenue had been growing nicely for several years even before it took a huge jump (thanks to acquisitions) in 2014, when it leaped 77.5 percent to $854.4 million. However, the company took small operating and net losses that year as it digested the buyout of incadea plc, a provider of DMS software and services, among other costs.

Its rosters of active lender-to-dealer relationships, and of U.S. and Canadian dealers with at least one active Dealertrack subscription, have been on healthy growth curves for several years, according to the company’s 10-K filing with the SEC. Those numbers stood at 202,086 and 24,336, respectively, in 2014.

Atlanta-based, privately held Cox Automotive is, of course, a heavyweight player in several dealership industry sectors: Media (it owns Autotrader and Kelley Blue Book), auctions and auto transport (Manheim is the biggest, but not the only, Cox provider), software (vAuto inventory management and VinSolutions in CRM are well-known brand names), financial services (including NextGear Capital dealer credit lines and GoFinancial subprime lending), and international sales of several of its products and services.

Complementary Product Lines

Despite its bulk, Cox actually has less overlap with Dealertrack than do two companies that might be seen as acquirers, CDK Global and Reynolds and Reynolds, according to the Dealertrack 10-K. Cox and Dealertrack directly compete for CRM, digital marketing and inventory management customers. However, Dealertrack hasn’t needed to worry about Cox going after its credit application, DMS and F&I customers.

Certainly the debt-rating services believe the lack of product overlap, and the resulting flexibility to market broader menus of products and services to customers of both companies, is a key driver in the deal. They are examining the transaction because of the large amount of debt Cox will need to incur.

“The partnership will allow the combined entities to provide broader and more efficient solutions to dealers, lenders, manufacturers and consumers,” wrote Moody’s Investors Service in a credit rating announcement.

Fitch Ratings analysts wrote that they expect “the growth prospects within Cox Automotive” with this deal to help offset the added debt’s stress on the company’s credit profile by the end of 2016.

Greater Ease Of Use

One of the nation’s largest dealership groups, the Sandy, Utah-based Larry H. Miller Group of Companies, extensively buys products and services from both Cox and Dealertrack. Senior Marketing Vice President Paul Nygaard said he thinks the deal more appropriately should be evaluated based on its impact on ease of customer use, rather than on future pricing or marketing strategies.

The more products and services in the automotive sector that are housed under one corporate roof, the easier for related business units to share data, frame-in one another’s web frames, etc., he pointed out.

“To me, it’s a real positive, a really refreshing deal from the landscape of where the industry needs to go,” Nygaard said. “Right now, you have all of these individual systems, and none of them are talking to one another. But we’re going to get a deal between two of the big providers where it actually makes sense.”

Debt’s Pressure On Prices

One DMS consultant, who didn’t want to be named, believes Cox inevitably must increase DMS fees and also lock dealers into long-term contracts that have built-in price hikes. After all, that was the case several years ago after Dealertrack purchased the Arkona Inc. DMS system, she said, and that was a price tag far below what Cox is paying in this transaction.

The marketplace generally considers the Dealertrack DMS product to be a “Tier 2” system that is very price-competitive but doesn’t have the same technological bells that higher-priced systems do. “It would take a huge [additional] investment for Cox to upgrade the Dealertrack DMS to be a Tier 1 system, and since they already spent $4 billion,” that consultant doesn’t look for such an investment to be made anytime soon.

Cross-Selling Inevitable

Certainly, it is logical for dealerships to expect Dealertrack to aggressively market Cox products such as the VinSolutions CRM to its existing customer base, either individually or in a package, she said. However, many of Cox’s products and services appeal more to large-volume dealership groups than to the smaller customers that Dealertrack has pursued, those cross-sold products will need to be chosen carefully, she added.

Dealerships should anticipate pitches to buy a suite of products, agreed Frank J. Lopes, vice president at Forest & Blake Marketing – Advertising in Clark, N.J., which performs digital marketing for dealer clients. “Let’s say a dealer advertises with Autotrader. The company now will be telling that dealer, ‘You need vAuto, and why isn’t your website with Dealer.com?’”

He also anticipates pricing going up over time for digital marketing and advertising services for customers of both Cox and Dealertrack. When a dealership also is buying several other of a large vendor’s product lines, Lopes argued, it’s harder for that customer to push back on price for a single service like digital marketing.

“Kudos to Cox for being able to grow and dominate in our space through acquisition,” he added. However, he admits to feeling somewhat nervous about the level of access that an even bigger Cox will have to dealership, customer and OEM data, with so many technology based business units that can share information.