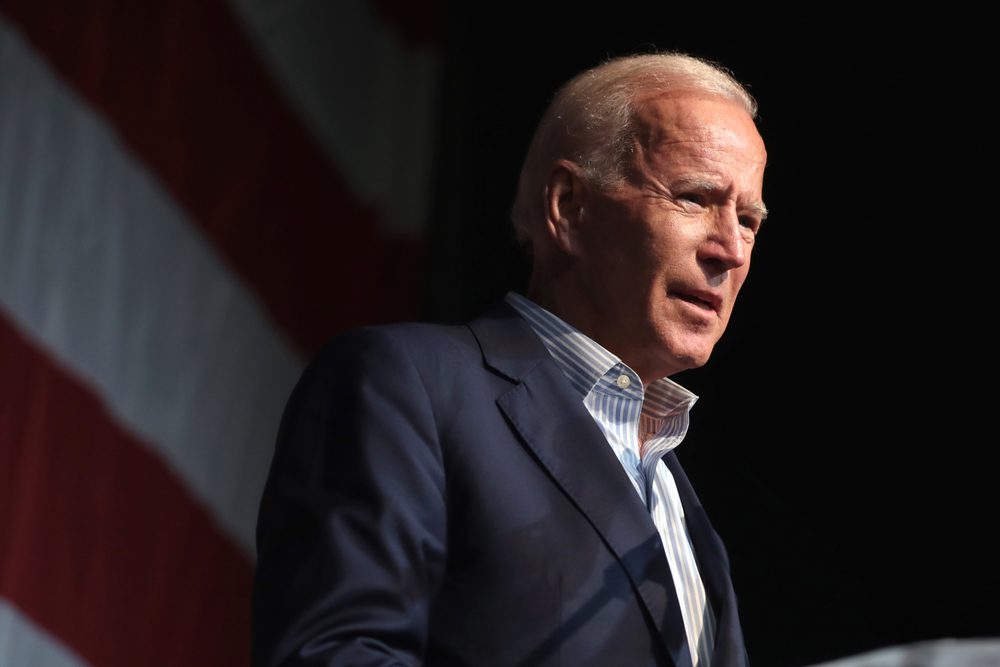

On Monday, President Joe Biden met with executives virtually in the auto, tech, consumer electronics, and biotech industries to discuss the semiconductor chip shortage that’s affecting manufacturing and supply not just nationwide, but globally. In attendance were key industry participants including GM’s Mary Barra, Ford’s Jim Farley, and Intel’s Pat Gelsinger. The virtual CEO Summit on Semiconductor and Supply Chain Resilience, as it was dubbed, was intended to review supply chains that have experienced shortages across various industries, and the auto industry specifically.

Production cuts in virtually every auto manufacturer’s North American factories have been documented. Some carmakers have idled car lines in order to keep producing high-value, top-selling pickup trucks and SUVs with the chips they have.

CEOs from top carmakers, as well as from other crucial American industries, were given the floor to speak about the issues they are facing. Ford is estimating that the shortage will directly affect the company’s earnings between $1 billion and $2.5 billion over the calendar year. General Motors is in the same boat, expecting a reduction in operating profit of $1.5 billion to $2 billion on the year.

While the virtual summit itself did not produce immediate results, CEOs received a fresh commitment from the president to find a solution. In the $2 trillion infrastructure plan recently introduced by the Biden administration, $50 billion has already been committed to investments in EV battery and semiconductor supply chain concerns.

Intel has plans to provide chips

In an announcement coinciding on the same day as the summit, Intel released news the company is in the works to address the chip shortage for the auto industry in part. But since manufacturing new chips requires a monumental investment in infrastructure that would take years, Intel intends to make use of current chips that weren’t initially destined for automotive.

Intel CEO Pat Gelsinger said in an interview with Reuters, “We’re hoping that some of these things can be alleviated, not requiring a three- or four-year factory build, but maybe six months of new products being certified on some of our existing processes. We’ve begun those engagements already with some of the key components suppliers.”

Intel’s announcement is good news for automotive, however it can’t address the immediate shortage. It does effectively shorten the window of recovery from years to months.

American chip autonomy

Of priority with Biden’s infrastructure plan is a move to become less dependent on other countries for important components like semiconductor chips. In the past 30 years, the United States has slipped from producing 37% of semiconductor chips worldwide to just 12%.

President of the Automotive Policy Council Mat Blunt said, “One of our hopes would be that we could come out of the meeting with a path and a road map to getting back to fulfilling 100% of automotive semiconductor orders and have some real insight and transparency into what that timeline might look like.”

Autoworkers want assurances that future shortages will be avoided by OEMs. Clarence Brown is the president of a United Auto Workers chapter in Kansas, and approximately 2,000 of his hourly workers were affected by GM’s Fairfax plant being idled. He said to CNBC, “I’ve been with General Motors for over 40 some years, and in all 40 some years, they’ve taught me one thing: Where is ‘Plan B’? If ‘A’ is not working, where is ‘Plan B?’ Something has to be done so this will never happen again.”

Brown says, “At this local, we have stuck together during the difficult times and we’re sticking together now. I just hope and pray that the shortage is over as soon as possible … and I’d like to think after this we have more of those jobs in the United States to make sure if something happens, we’ll be able to cover ourselves.”

Did you enjoy this article from Jason Unrau? Read other articles on CBT News here. Please share your thoughts, comments, or questions regarding this topic by submitting a letter to the editor here, or connect with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook and Twitter to stay up to date or catch-up on all of our podcasts on demand.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.