On the Dash:

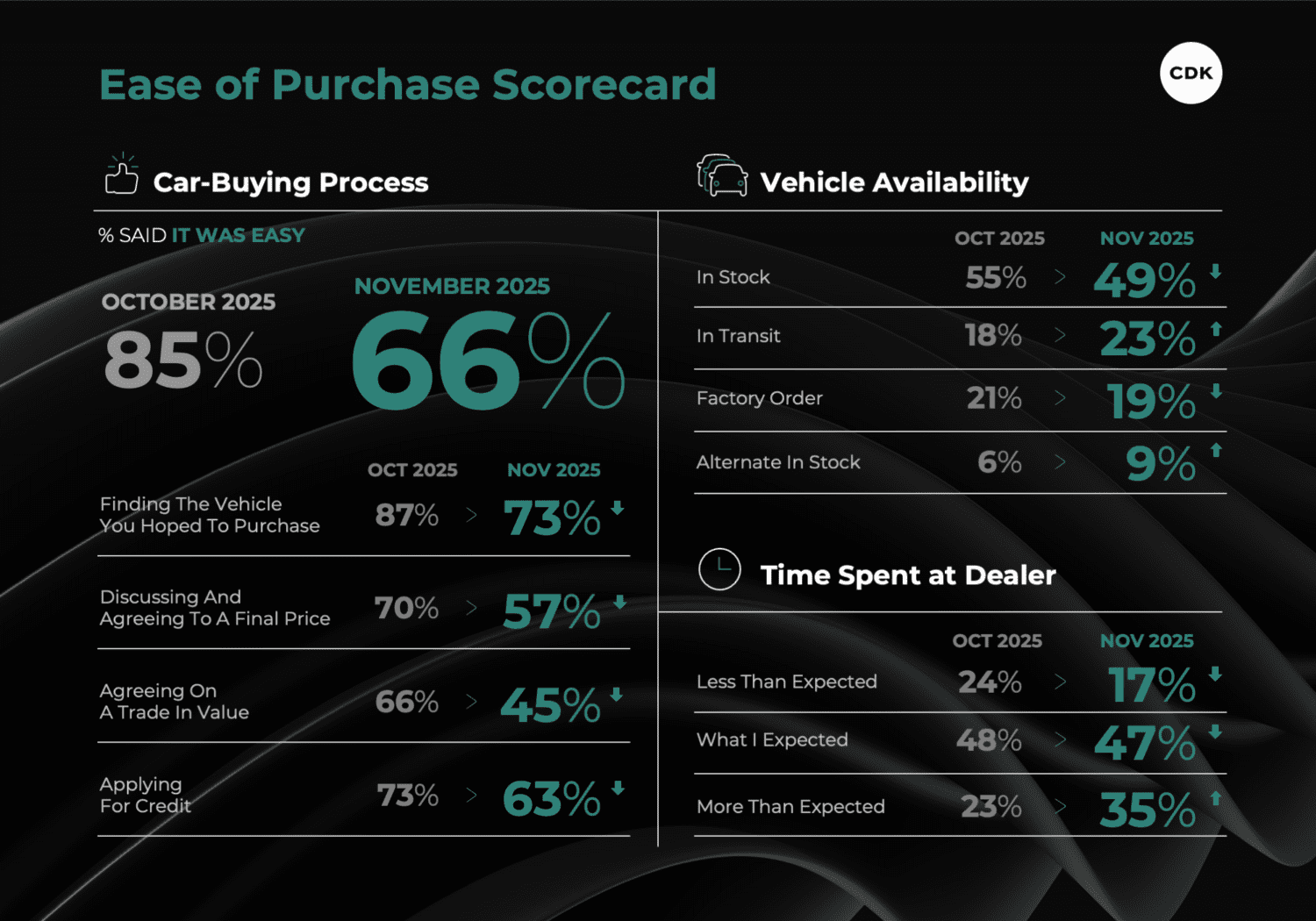

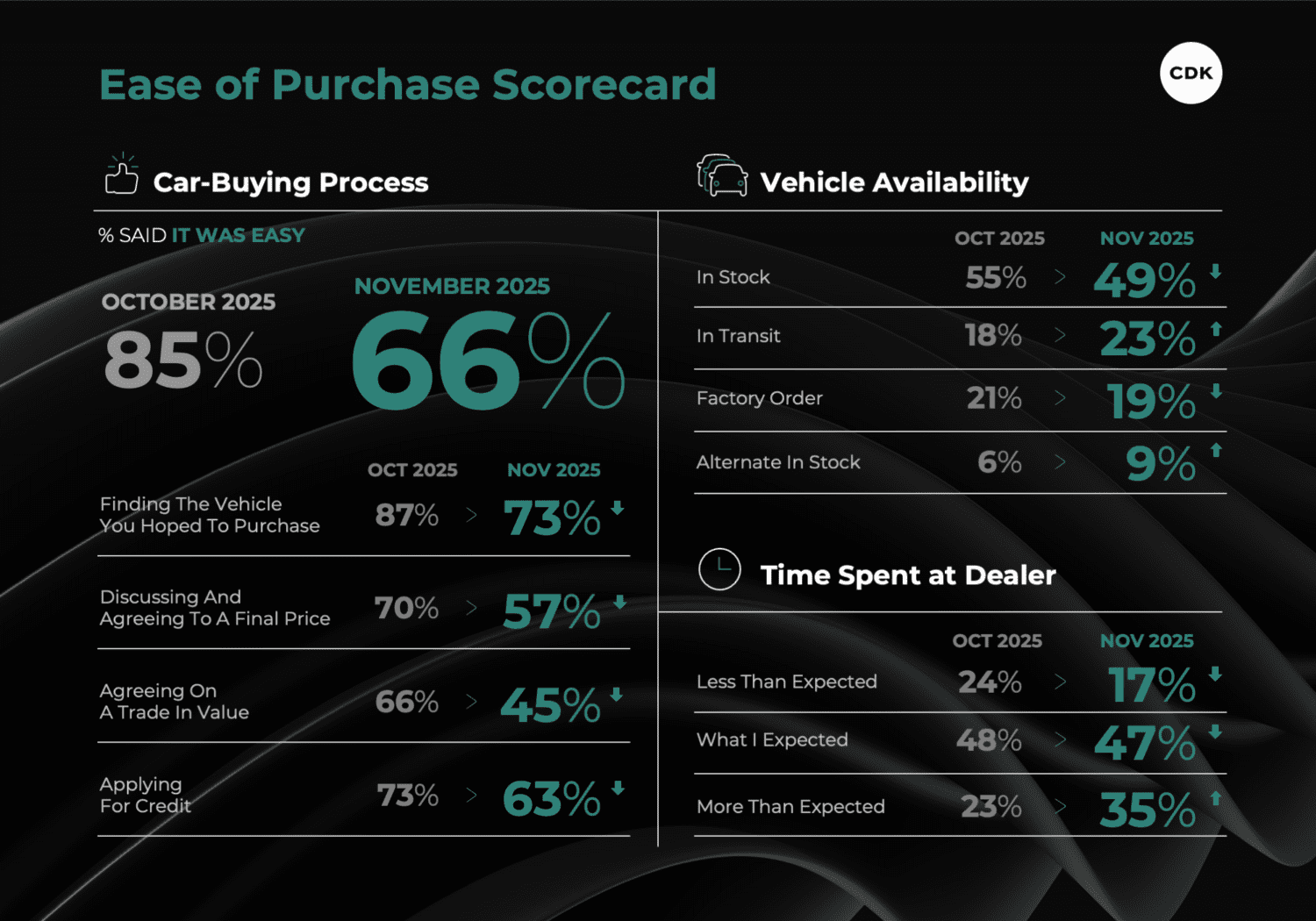

- November Ease of Purchase score drops to a historic low of 66%, with double-digit declines across most steps of the buying process.

- Trade-ins and test drives experienced the largest drops, underscoring challenges in the customer experience despite steady online purchase numbers.

- Dealers have an opportunity to improve processes during slower sales months to maintain satisfaction and counter market volatility.

For the first time in more than three years, car buyers’ satisfaction with the purchasing process has fallen below 70%. CDK’s November Ease of Purchase survey recorded a 66% score, down greatly from 85% in October and 89% in September, marking an unprecedented decline in customer sentiment.

Nearly every step of the car-buying journey experienced double-digit drops. The biggest declines were seen in trade-ins and test drives, with 45% of buyers saying it was easy to agree on a trade-in value, down from 66% in October. Similarly, 65% reported that test-driving a vehicle was easy, falling from 80% the previous month.

The drop in overall scores comes despite the number of buyers completing purchases at dealerships remaining steady, and online purchases holding at just 2%. While the number of cars in stock fell to 49% from 55%, it remains higher than September’s 48%, when the Ease of Purchase score was 89%.

Moreover, survey comments offered mostly constructive feedback rather than major complaints. Buyers cited issues with registration processes, online appointment systems, or a sense that the dealership experience felt unorganized. One respondent mentioned that the finance manager “was a little rude,” while another suggested improving the online scheduling process.

Market factors may have also played a role, with volatility in the used-car market and low trade-in equity levels appearing to have contributed to declines, particularly in trade-in satisfaction. However, some traditionally dealer-controlled steps, such as test drives and paperwork completion, also showed sharp drops, highlighting challenges across the board.

CDK researchers noted that, historically, higher scores have occurred during months with strong sales volume, suggesting that dealers and staff thrive during busy periods. With potential economic headwinds and slower sales expected in the coming months, dealerships have an opportunity to refine processes, improve customer interactions, and maintain satisfaction even in lower-volume periods.