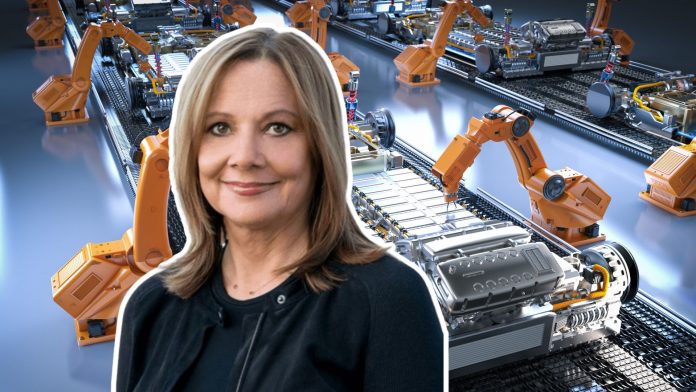

General Motors plans to import lithium iron phosphate (LFP) batteries from China’s CATL to power its second-generation Chevrolet Bolt, a move that allows GM to keep its most affordable EV on track despite facing steep tariffs under President Trump’s trade policy. The Wall Street Journal reports the imports will serve as a two-year stopgap while GM and its Korean partner LG Energy Solution ramp up U.S.-based battery production.

The new Bolt, expected to begin production at GM’s Fairfax Assembly Plant in Kansas by late 2025 and arrive at dealerships in 2026, will retail around $30,000, making it a key part of GM’s strategy to deliver a lower-cost EV amid a highly competitive and price-sensitive market.

While GM has emphasized U.S. battery manufacturing in recent years, executives acknowledge that domestic supply chain limitations and the maturity of China’s LFP battery expertise make temporary imports necessary. The LFP chemistry, although originally developed in the U.S., is now largely commercialized and perfected in China. Despite the roughly 80% import duties on Chinese batteries, GM aims to keep the new Bolt profitable, or close to it, until its U.S. supply comes online by 2027.

Here’s why it matters:

This development has significant implications for dealers awaiting the return of GM’s most affordable EV. The decision to import LFP batteries from China ensures the new Bolt won’t be delayed, giving dealers a low-price EV option to attract cost-conscious buyers. It also signals GM’s flexible, cost-driven approach to EV strategy during a volatile policy environment. With the federal EV tax credit ending next month, the Bolt won’t be penalized for using Chinese components, leveling the playing field. Dealers should prepare for increased demand around the new Bolt’s launch, especially from first-time EV buyers and price-sensitive segments.

Key takeaways

- GM turns to China’s CATL for Bolt batteries

The automaker will source low-cost LFP batteries from CATL for about two years to support its next-gen Chevrolet Bolt production. - Bolt production resumes in Kansas

The new model will be GM’s most affordable EV, which can be expected to start around $30,000 and hit dealerships in 2026. - Tariffs won’t block GM’s pricing strategy

Despite 80% import duties, GM expects the Bolt to remain marginally profitable, especially with cheaper LFP battery chemistry. - Tax credit changes ease compliance pressure

With the $7,500 EV credit ending next month, GM avoids penalties it would have faced for using Chinese-made components in the Bolt. - U.S. battery supply remains behind China

GM and LG’s Tennessee plant won’t begin making U.S.-based LFP batteries until 2027, highlighting America’s ongoing supply chain gap.