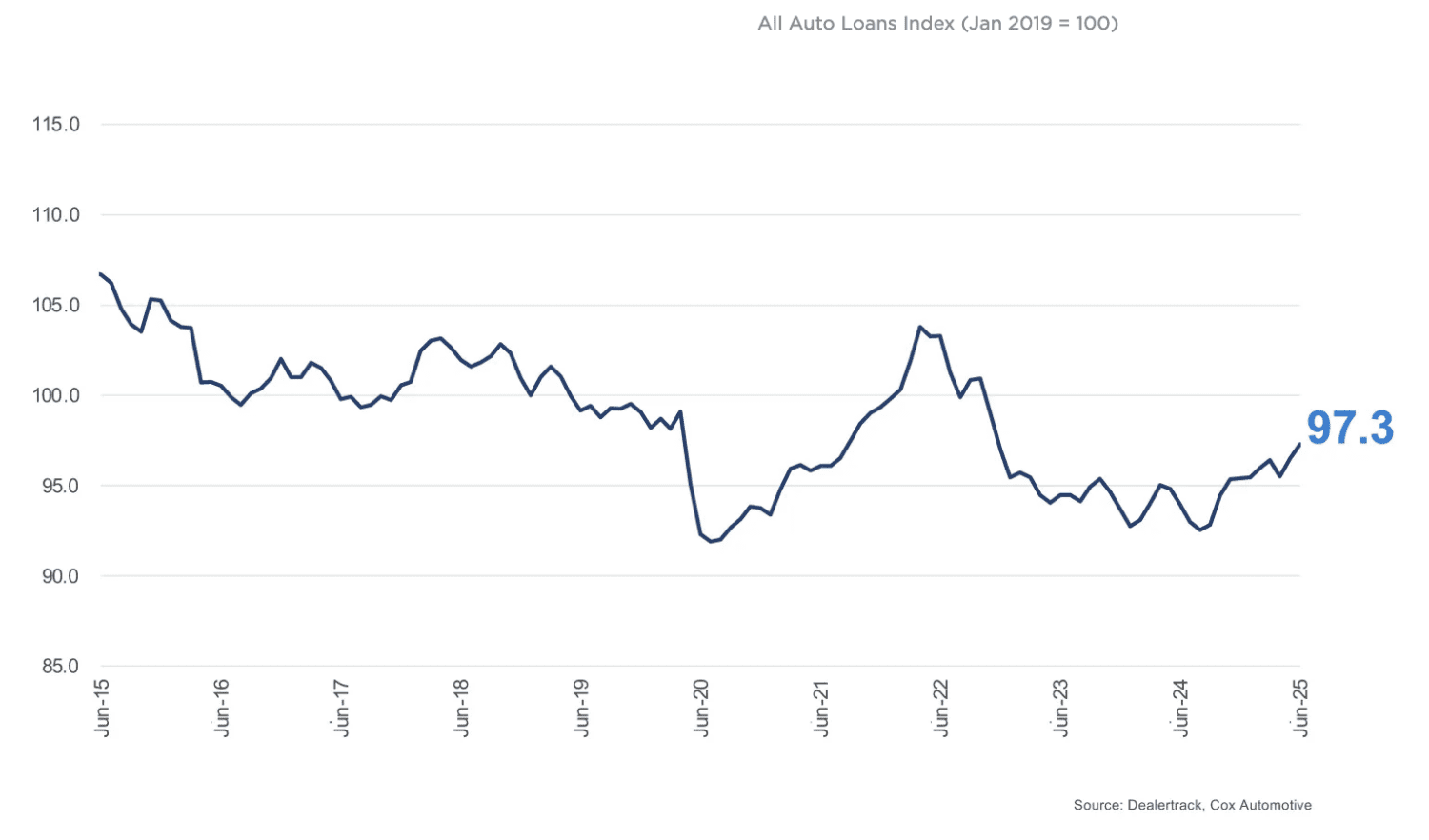

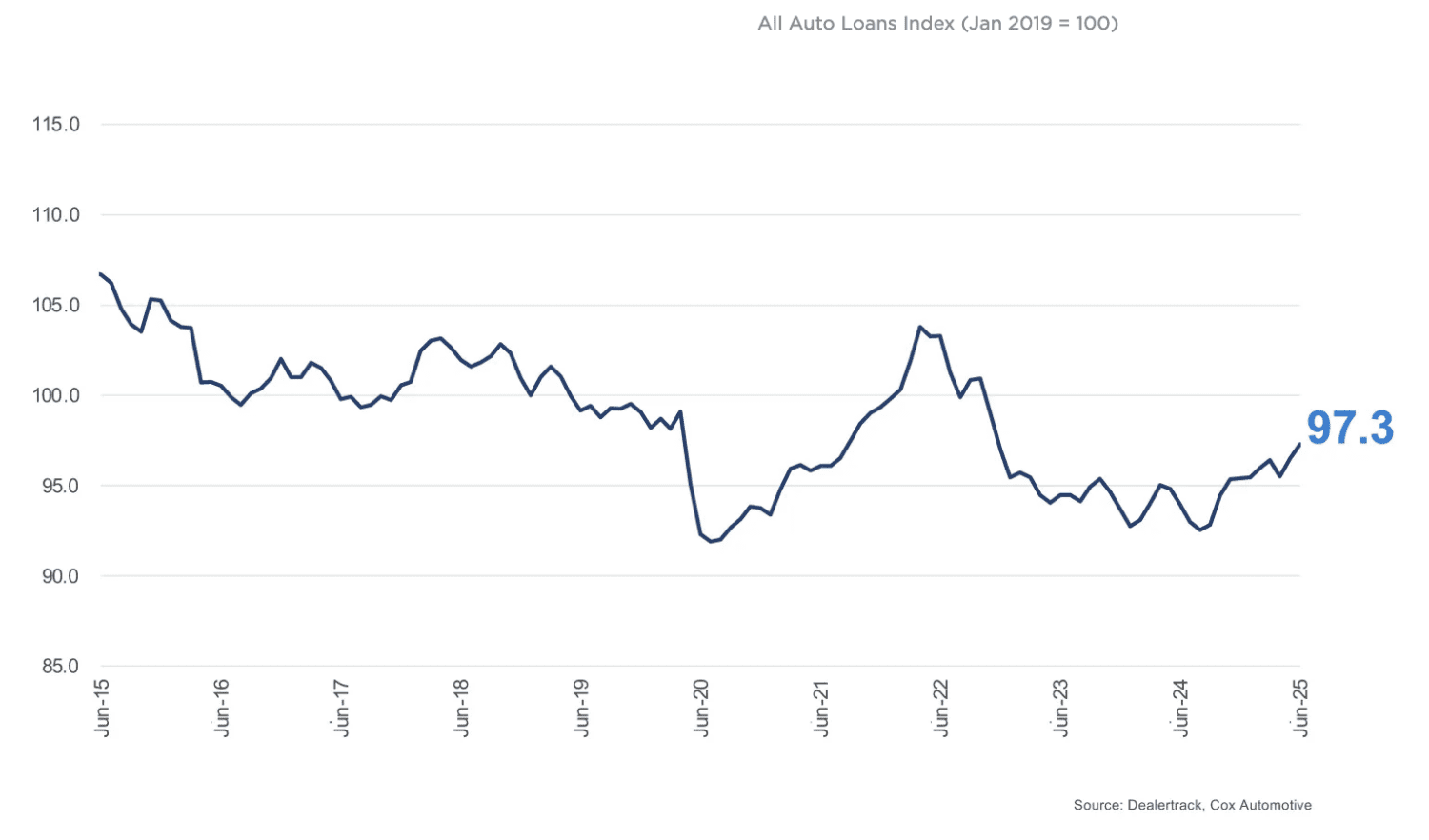

Auto credit access improved in June 2025 for the second consecutive month, according to the latest Dealertrack Credit Availability Index. The All-Loans Index rose to 97.3, up from 96.5 in May, continuing a broader trend of loosening credit conditions that began in late summer 2024. Stronger approval rates, longer loan terms, and broader lender participation contributed to improved credit availability. The only recent disruption was in April, linked to market volatility from tariff changes.

Here’s why it matters:

Improved credit availability is a critical driver for both new and used vehicle sales. Easier access to financing can expand the pool of eligible buyers, particularly in the subprime segment, and increase deal flow across franchise and independent dealers. As lenders loosen standards, dealers may also see faster approvals and improved consumer affordability, especially with the continued preference for longer-term loans. However, elevated negative equity levels and modest tightening from banks signal the need for continued diligence in structuring deals.

Key takeaways:

- Approval rates rose 70 basis points

Lenders approved more auto loan applications in June, reflecting greater confidence in consumer credit profiles or heightened market competition. - Longer loan terms help affordability

Loans longer than 72 months rose by 80 basis points, as consumers stretched payments to offset high vehicle prices and interest rates. - Subprime lending expanded slightly

The share of subprime borrowers increased by 10 basis points, indicating continued credit loosening for higher-risk applicants. - Used and non-captive new channels led gains

Independent used, all used, and non-captive new vehicle segments saw the most credit access improvement; only CPO saw a slight decline. - Finance companies and captives loosened most

Auto-focused finance companies and OEM-affiliated captives eased credit standards, while banks and credit unions showed slight tightening.

This upward trend in credit access offers a positive signal for car dealers heading into the second half of 2025. With broader financing options, dealers can cater to a wider range of buyers, particularly in the used and subprime segments, while maintaining awareness of the risks associated with longer terms and high negative equity.