On the Dash:

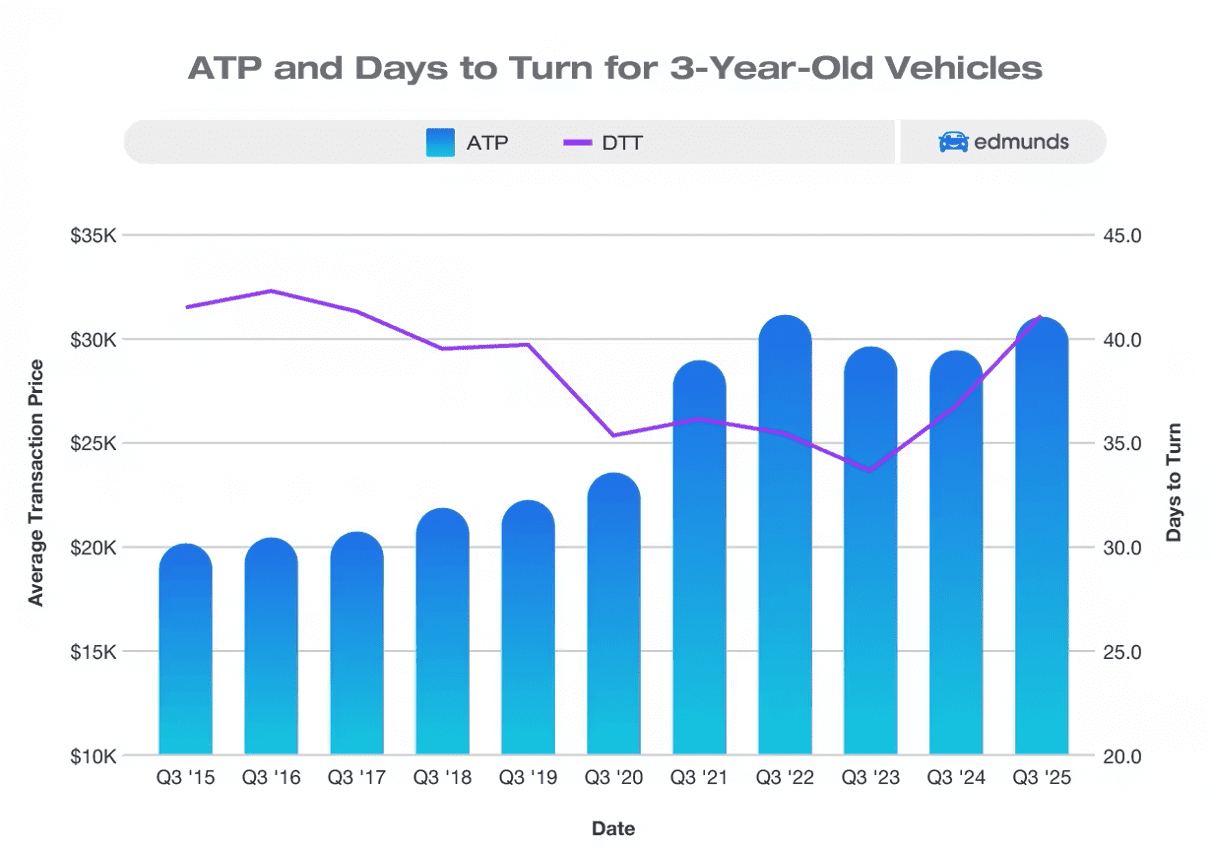

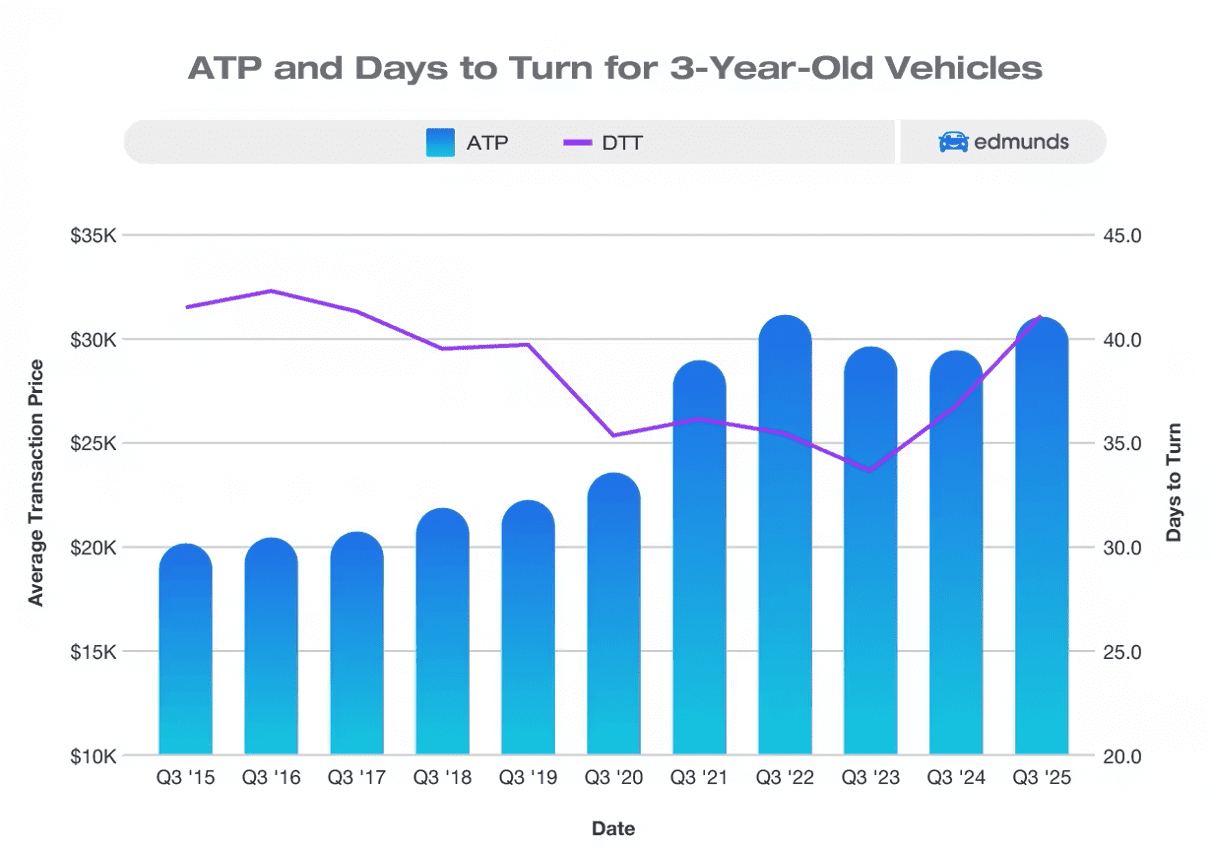

- Q3 2025 used-car sales slowed overall, with 3-year-old vehicles taking an average of 41 days to sell and ATP rising to $31,067.

- EVs led the market, averaging just 34 days to sell, benefiting from lower mileage, competitive pricing, and high buyer demand.

- The limited supply of used EVs (1.6% of inventory) keeps turnover high and presents opportunities for dealers as federal incentives for new EVs wane.

As affordability pressures slow the pace of used vehicle sales, EVs are bucking the trend, selling faster than any other powertrain in the third quarter of 2025.

According to a recent Edmunds report, the average transaction price (ATP) for 3-year-old vehicles rose to $31,067 in Q3, up 5% from $29,578 a year earlier, while the average number of days a vehicle sat on a dealer lot before selling increased to 41, marking the slowest third-quarter pace since 2017. These longer lot times reflect a more selective buyer base weighing high used-vehicle prices against new-car incentives.

Despite the broader slowdown, EVs were the fastest-selling powertrain, with an average of 34 days to sell. Eight of the 20 fastest-selling 3-year-old vehicles were fully electric, including the Tesla Model S, Model 3, and Model Y, underscoring strong demand for EVs among shoppers seeking value and lower operating costs.

EVs also benefit from lower mileage and competitive pricing. Used electric models averaged 35,661 miles, compared with 39,525 miles for gas vehicles, and sold for an average of $29,922, roughly $1,100 less than their gas counterparts. Nearly two-thirds of used EVs fell in the $20,000–$30,000 range, and 66.3% had fewer than 40,000 miles, offering buyers a broad selection of attainable, lightly used vehicles.

In the broader used vehicle market, buyers are gravitating toward two main segments. On one end, lower-priced vehicles, those priced between $10,000 and $15,000 and with 20,000 to 29,999 miles, are selling quickly, averaging just 24 days on the lot. On the other end, near-new vehicles priced between $30,000 and $35,000 with fewer than 10,000 miles are also in demand, averaging 34 days to sell.

However, vehicles in the mid-priced, mid-mileage range, which make up the majority of dealer inventory, are taking longer, generally over 40 days, to find buyers. Used EVs remain scarce, representing only 1.6% of 3-year-old inventory, a factor that drives quick turnover. Analysts say the limited supply will likely continue as newer EV models enter the used market in meaningful volume.

Notably, half of the top 20 fastest-selling cars were either fully or partially electric, while gas-powered models skewed toward reliable, proven brands like Toyota, Lexus, and Honda. The combination of strong value, advanced technology, and lower depreciation compared with original MSRP makes used EVs especially appealing to buyers.

For dealers, the end of federal incentives for new EVs may further push shoppers to the used market, creating opportunities to showcase the cost-effectiveness and technological advantages of pre-owned EVs.