On the Dash:

- At $45,000, the R2 brings Rivian closer to mainstream buyers, signaling more attainable EV options for customers.

- Higher import costs and the loss of tax credits will affect Rivian’s pricing power, potentially influencing how dealers position EVs.

- Plant upgrades in Illinois and Georgia show Rivian’s push toward scale, which could stabilize availability and reduce delivery delays.

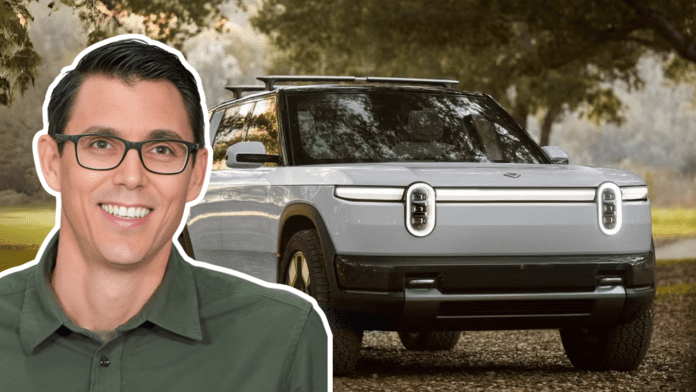

Rivian is banking on its new R2 SUV to cut costs and expand its market share as tariffs, tax credit changes, and a cooling EV market pressure the industry. The $45,000 mid-size SUV, scheduled for launch in early 2026, represents a critical test of the company’s ability to scale while keeping production expenses under control.

The company expects the R2 to cost less than half as much to build as its first-generation vehicles, thanks to streamlined architecture, smaller size, and pre-negotiated supplier contracts. Executives describe the R2 as Rivian’s most promising product to date, designed to strike a balance between affordability and the company’s signature adventure-focused brand identity.

Rivian will also pause production at its Normal, Illinois, plant for three weeks in September to prepare for the launch of the R2. However, it plans to restart construction on its $5 billion Georgia factory and open its East Coast headquarters in Atlanta later this year.

Financially, the EV maker remains under pressure. The automaker reported a second-quarter loss of $206 million, despite a 12.5% increase in revenue year-over-year. Tariffs are expected to add several thousand dollars to vehicle costs this year, while the expiration of EV tax credits will nearly halve regulatory credit sales, from $300 million to $160 million. Still, Rivian reaffirmed its 2025 delivery guidance of 40,000 to 46,000 vehicles and forecasted roughly break-even gross profit for the year.

Beyond vehicle sales, Rivian is working to deepen its technology capabilities. Its joint venture with Volkswagen will make Rivian’s proprietary electrical architecture compatible with VW vehicles, potentially leading to licensing opportunities and global platform development. The company is also investing heavily in autonomy, building a system that leverages extensive data to support future products.

Industry analysts view Rivian’s brand as a significant competitive advantage, comparing it to legacy adventure-focused automakers that built loyalty through distinct positioning. They argue that Rivian’s combination of rugged capability and modern EV technology could help it win share even as competition intensifies.

Despite the headwinds, Rivian maintains that the R2 launch is a core focus and a crucial step toward achieving its long-term goal of producing millions of vehicles annually.