Welcome back to the latest episode of The Future of Automotive on CBT News, where we put recent automotive and mobility news into the context of the broader themes impacting the industry.

I’m Steve Greenfield from Automotive Ventures, and I’m glad that you could join us this week.

This week, we’re taking a closer look at a looming crisis for the auto industry in Europe and North America. Established automakers are grappling with a harsh reality: demand for new cars and light trucks is slowing. That slowdown has left them with too much factory capacity, and costs that are simply too high.

At the very same time, new competitors—many of them based in China—are producing cars at about one-third the cost. And in today’s market, where price sensitivity is growing, that’s an enormous advantage.

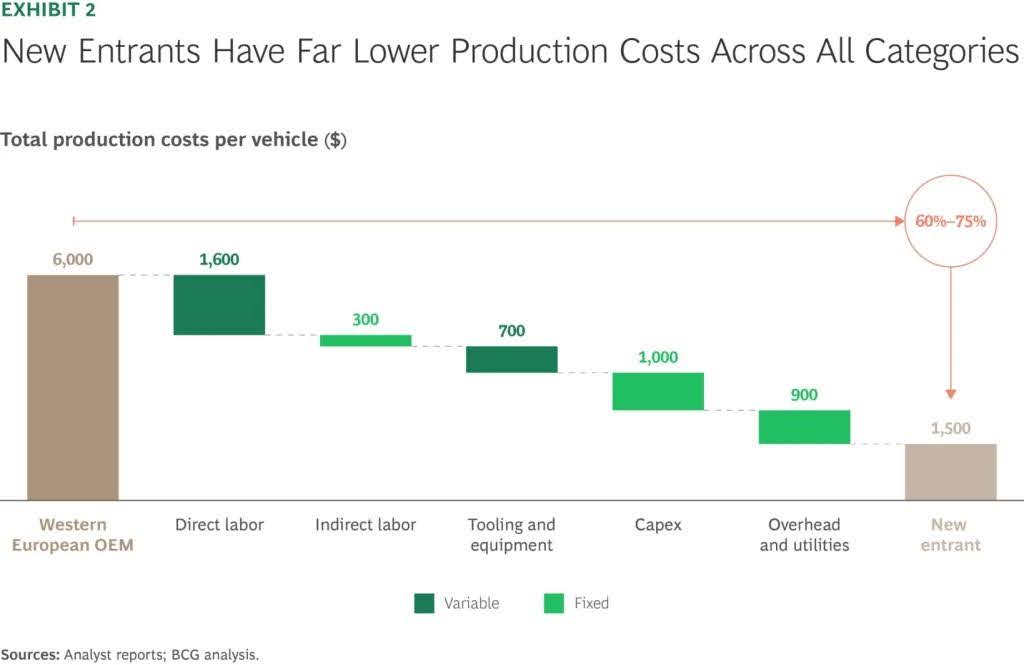

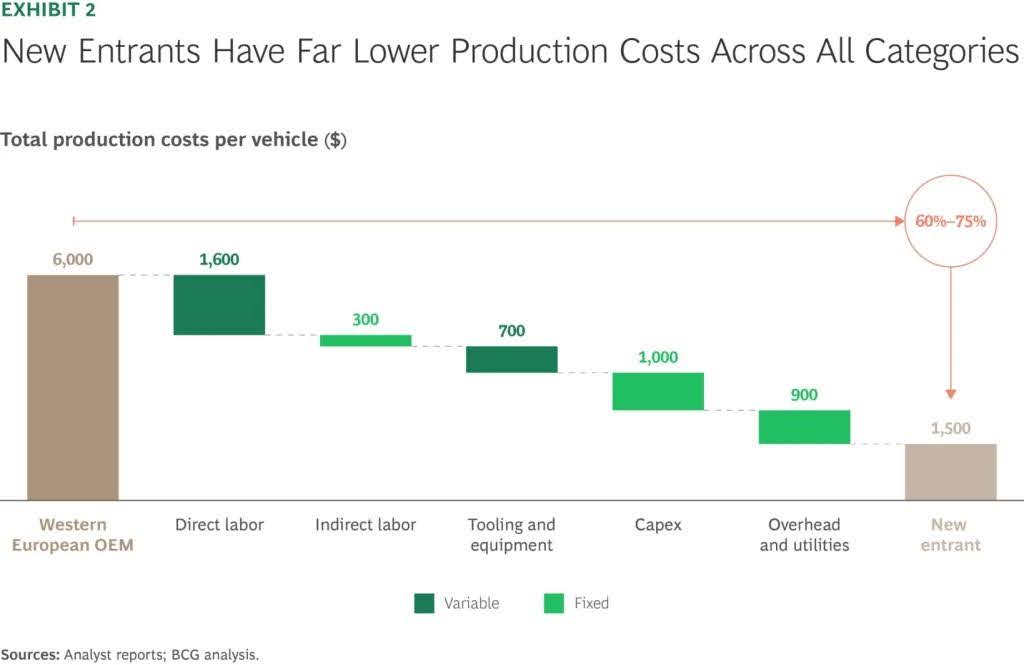

A recent analysis by Boston Consulting Group breaks down the numbers. They found that these newer companies—firms like BYD—benefit from simpler designs, often all-electric models, newer factories, and a far greater reliance on automation. The result? Production costs that are dramatically lower. In some cases, the cost difference in manufacturing alone is as high as 60 to 75 percent.

Global demand for cars isn’t going to bail anyone out here, either. It’s expected to grow just 1 to 1.5 percent a year through 2035. Meanwhile, China’s automakers are expanding aggressively. BYD’s sales have nearly tripled in the last five years. Compare that to stalwarts like Ford or Volkswagen, whose sales have been flat—or worse, declining.

And then there’s labor. Wages for frontline workers in Europe and North America are much higher than in other parts of the world. Unions, work councils, stricter regulations—all of these add costs that legacy automakers can’t simply wish away.

So what does it take to close that gap? Experts say it means tough choices: redesigning vehicles to be simpler, cutting production footprints, investing in automation, changing suppliers, even reshaping the culture of these companies. None of it will be easy—and all of it will take time, in an industry that may not have much to spare.

So, with that, let’s transition to Our Companies to Watch.

Every week we highlight an interesting company in the automotive technology space to keep an eye on. If you read my weekly Intel Report, we showcase a company to watch, and we then take the opportunity here on this segment each week to share that company with you.

Today, our new company to watch is Spark.

Spark optimizes automotive dealership Business Development Centers (BDCs) with AI-powered, data-driven & actionable coaching.

No more missed opportunities from poor objection handling. Spark parses through call recording data to serve reps the talk tracks they need to overcome likely objections.

Spark serves BDC reps insights on their peers’ winning talk tracks, while optimizing the approach most likely to result in an appointment based on a prospect’s vehicle, service needs, special offers, and persona.

Spark finally closes the feedback loop on coaching, measuring 1) the coaching prompt your reps receive, 2) if they’ve taken the feedback given, and 3) the outcomes it impacted on live calls.

If you’d like to learn more about Spark, you can check them out at www.SparkServ.com

So that’s it for this week’s Future of Automotive segment.

If you’re an AutoTech entrepreneur working on a solution that helps car dealerships, we want to hear from you. We are actively investing out of our DealerFund.

Don’t forget to check out my first book, “The Future of Automotive Retail,” and my new book, “The Future of Mobility”, both of which are available on Amazon.

Thanks (as always) for your ongoing support and for tuning into CBT News for this week’s Future of Automotive segment. We’ll see you next week!