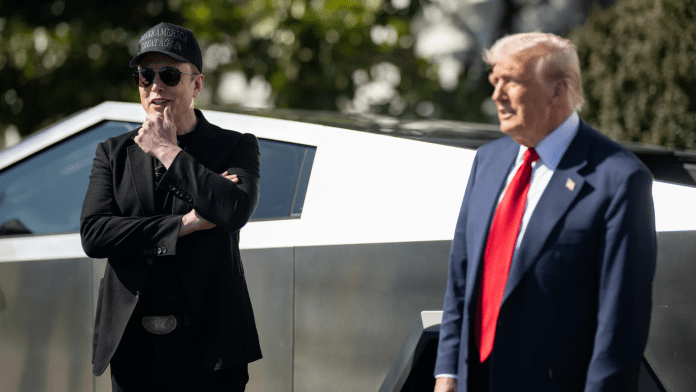

The public feud between President Donald Trump and Tesla CEO Elon Musk escalated on Tuesday. Trump threatened to revoke billions of dollars in federal subsidies to Musk’s companies after Musk renewed his public criticism of Trump’s “Big Beautiful Bill,” a tax-cut and spending bill that narrowly passed the Senate on Tuesday.

Here’s why it matters:

Elon Musk’s involvement with the Trump administration has caused significant damage to his brand and companies. Tesla’s sales declined for the fifth consecutive month in Europe, and analysts predict that Tesla’s Q2 deliveries could decrease by as much as 20%. The elimination of the federal EV tax incentives would likely slow consumer demand for electric vehicles and strain dealership margins tied to new and used EV inventory.

Key Takeaways:

- Tesla’s bottom line will shrink further

JP Morgan analysts estimate that the elimination of the federal EV tax credit will cost Tesla $1.2 billion in earnings and 17% of operating income. - Tesla’s shares are dropping—again

Following President Trump’s subsidy threats, Tesla’s shares dropped by 5.5%. - Elon Musk’s hypocrisy

Although Musk has publicly stated that government subsidies should be eliminated, his companies have greatly benefited from billions in tax credits and policy benefits. - Robotaxi rollout now faces political headwinds

Musk is betting Tesla’s future on a successful launch of its robotaxi service. However, it could face regulatory delays as tensions with the White House grow. - EV market volatility widens beyond Tesla

Shares of other EV makers, such as Rivian and Lucid, also fell on Tuesday, revealing broader investor concerns over subsidy cuts.