2021 was a robust and profitable year for many dealers and OEMs despite the industry’s shortages. But as automakers continue to scale back on rebates and incentives for consumers in this new year, how profitable does that leave the dealer? On today’s show, we’re pleased to welcome Rusty West, President and CEO of Market Scan Information Systems, to talk to us about rebates and incentives in the automotive industry today.

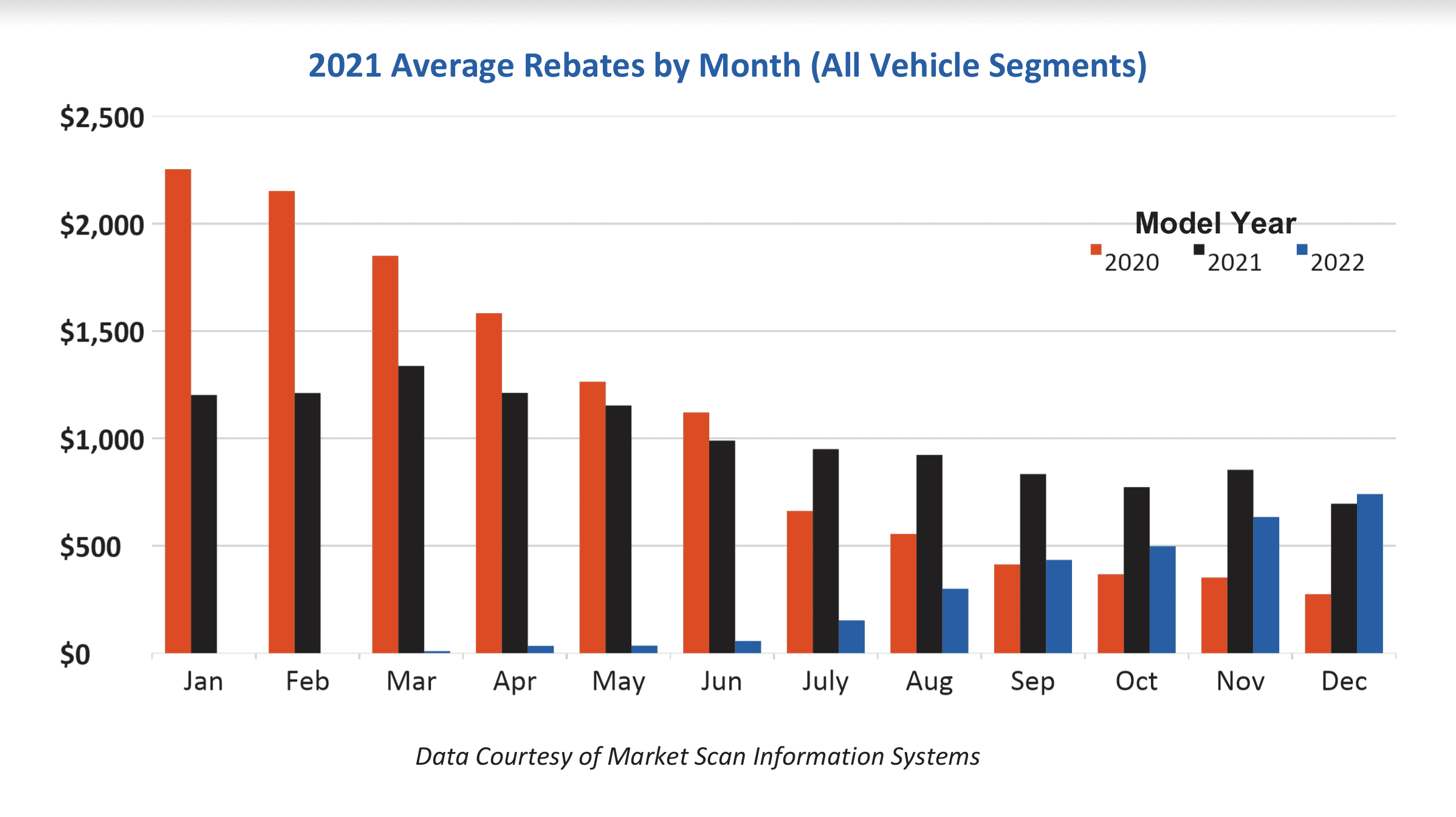

West begins by discussing the steady, linear decline in rebate offerings that are out there from the different manufacturers. The volume, or the dollar amount that is available for the rebates, is almost parallel to the inventory levels. So, as inventory has gone down, the rebate levels have gone down as well. Interestingly, the only segment that went up last quarter was the eco-vehicles.

“A few years from now,” says West. “We’re going to look back and we’re going to see this whole era as maybe being the best educational example of the dynamics of the laws of supply and demand.”

Vehicles are scarce and there is a lot of consumer demand. Car dealers are making more money and the manufacturers have to spend less in order to sell the vehicles. However, as inventory increases, West is cautiously optimistic that rebates and incentives will as well.

| Related: Market Scan’s Rusty West on how car dealers can differentiate themselves from other online retailers |

In today’s current climate, Market Scan believes it is very important to look at the auto industry through the eyes of the consumer. To influence consumer behavior, automotive retail professionals need to know what they see and what they think. A $100 per month higher payment for a vehicle that is comparable to a competitor’s right down the street will not get consumers to engage. Relying on historical data is a flawed approach in West’s opinion. That data only shows what has happened, not what can happen.

There’s a lot of highly funded lending institutions out there that are very aggressive on certain vehicles and market segments. So, if an OEM tries to figure out what its rebates and incentives spending will be, it will miss the mark by only looking at the captive lender. Always think about what the consumer will see.

If OEMs can find a new way of calculating rebates and incentives, Market Scan predicts that overall dealer profitability will increase. While Market Scan is not sure when, the company is predicting an exponential increase in the complexities of rebates and incentives, especially on the conquest sale. If manufactures can really get this right, they will be able to compete with a bunch of different vehicles for the right price. Then the dealership will be in a more competitive position and earn more conquest business.

Rebates and incentives can mean a difference in monthly payments for customers by $75 or even $100 per month, especially on a $300 or $400 per month vehicle. That is the determining factor of whether or not the consumer will go through with the transaction. This is just one of many circumstances that highlight the importance of having up-to-date predictive data at a car dealer’s fingertips.

Did you enjoy this podcast with Rusty West? Please share your thoughts, comments, or questions regarding this topic by submitting a letter to the editor here, or connect with us at newsroom@cbtnews.com.

Be sure to follow us on Facebook and Twitter to stay up to date or catch-up on all of our podcasts on demand.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.