Earlier this year, Chinese carmakers were attempting to be the first to crack into the American auto market. Brands such as GAC Motor and Vantas were expected to target the auto industry in the US with low-cost models, capturing a part of a 17 million-unit per year sector. Instead, the tables have turned as the Trump administration is considering blacklisting the Chinese tech industry.

Reports from Reuters and CNBC say that the US government is seeking to starve China of critical components for manufacturing tech in China that are typically sourced from Silicon Valley. China’s largest chipmaker, Semiconductor Manufacturing International Corporation, or SMIC, has been painted with a bullseye on its back.

Labeled a Security Concern

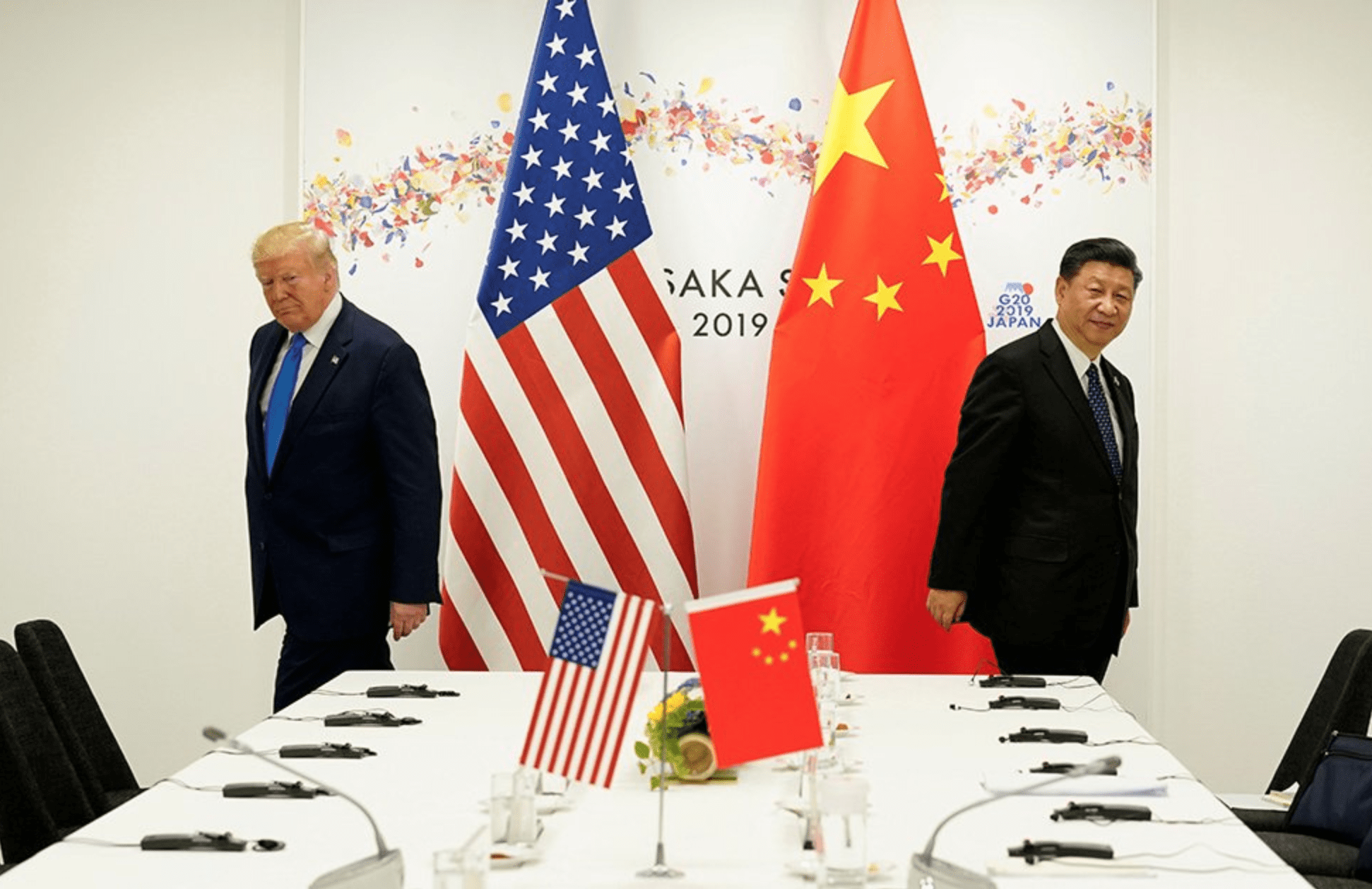

The move comes amid an escalating trade battle between Trump and China. Officials in the American government have long suspected that tech firms in China are closely tied to the government and are helping to collect data for the People’s Liberation Army – a claim that the Chinese administration denies.

A Virginia-based defense contractor reported last month that SMIC was connected to the Chinese defense sector, a claim that’s supposedly substantiated by research papers from China’s military researchers. SMIC has vehemently denied any connected, but the US government could be moving to restrict exports to SMIC. On news of the possible restriction, SMIC’s stock price plummeted 23 percent.

SMIC also manufactures chipsets for Huawei, the Chinese telecommunications corporation that the US is currently accusing of using 5G technology to spy on the US.

For China, sanctions against SMIC mean the chipmaker would have to source semiconductors elsewhere for their chipsets. And producers elsewhere in the world may not be accessible either. Richard Martin of IMA Asia said on CNBC Squawk Box Asia, “The problem with looking elsewhere is if you go to Europe or if you go to Japan, the companies in Europe and Japan are using U.S. machinery at some point in their production process. And therefore … they can be hit by this U.S. effort to choke it off.

“So what China needs to do is move the entire supply chain into China.”

Moving the complete manufacturing process for semiconductors would be a two or three-year process, according to Martin.

Reciprocity Should Be Expected

As the trade war ramps up, the United States can expect reciprocal actions from the Chinese government. Unfortunately for the automotive industry in the United States, more than $11 billion in auto parts are imported from China annually. These components are used to assemble new cars for market and for aftermarket resale. Should the Chinese government decide to dry up the supply of car parts exported to the United States, it could cause the same multi-year delay in production as SMIC would experience.

Any retaliation that disrupts manufacturing or assembly for American-made vehicles could be devastating. Popular models like the Chevrolet Silverado and Ford F-150 are still in short supply after the eight-week shutdown earlier in 2020, and a supply chain issue would ripple through every facet from auto service and parts sales to vehicle sales. Even incentives and low-interest loans necessary to bolster sales in the recover period could be affected.

The trade war with China doesn’t seem to have an end in sight. Despite tariffs on steel and aluminum, the US auto industry has been relatively stable so far and, with any luck, will stay clear of reciprocal trade actions from China this time around.

Did you enjoy this article from Jason Unrau? Read other articles from him here.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.