On this edition of the Kerrigan Report we are joined by Erin Kerrigan and we learn how car sales came in at a soar of 16.9 million. The Kerrigan Index started off the year very well, up 3.4% and about all the disruption coming to auto retail.

Video Transcript:

Bridget: Hello, everyone. I’m Bridget Fitzpatrick. Thanks so much for joining us on CBTNews.com for the Kerrigan Advisors Market Update. We’re joined now by Erin Kerrigan. Thanks so much for joining us, Erin.

Erin: Thank you, Bridget, for having me.

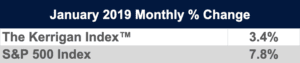

Bridget: How did The Kerrigan Index perform in January?

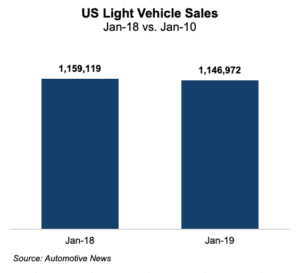

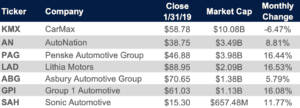

Erin: Well, The Kerrigan Index started off the year very well, up 3.4%. Very pleased with that. Now, mind you, it was lower than the S&P, which was up 7.9%, but that’s really because of one company in the index. CarMax was down quite considerably. If you dig in deeper, what you’ll find is that all of the other members of the index, namely AutoNation, Penske, Lithia, Group 1, Asbury and Sonic were all up for January. In fact, three of the companies were up over 15%, namely Penske, Lithia and Group 1. Great start to the year.

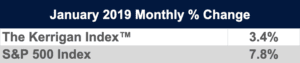

Bridget: How are car sales in January?

Erin: Car sales were down slightly in January. They came in at a soar of 16.9 million, but still relatively strong. Again, 16.9 million is not a bad start to the year. January is not usually a great indicator of the whole year, and we were dealing with the government shut down and a polar vertex, which certainly is not a great time to sell cars when it’s subzero degree temperature. I’d say all in all a good start to the year.

Bridget: Where do you think car sales were coming at for 2019?

Erin: We expect car sales to be around 17 million for 2019, and we t hink that because the economy is still very strong and growing. We have unbelievably low unemployment rate, which means that consumers have money in their pocket. We also think that because interest rates are not going to rise, it is expected for the remainder of the year that consumers will be in a position to finance their purchases of cars. If you read the news, it sounds like the lenders are in fact extending the terms of loans. They’re making it more and more affordable for consumers to buy vehicles. We may deal with that in the future if consumers loans are too long, but today we think that’s going to drive more car sales in 2019.

hink that because the economy is still very strong and growing. We have unbelievably low unemployment rate, which means that consumers have money in their pocket. We also think that because interest rates are not going to rise, it is expected for the remainder of the year that consumers will be in a position to finance their purchases of cars. If you read the news, it sounds like the lenders are in fact extending the terms of loans. They’re making it more and more affordable for consumers to buy vehicles. We may deal with that in the future if consumers loans are too long, but today we think that’s going to drive more car sales in 2019.

Bridget: We’re just coming off NADA. We hope it was a great one for you.

Erin: NADA was another amazing convention. We really enjoyed meeting with the dealers that we know out there and certainly our other colleagues in auto retail. We look forward to Las Vegas next year.

Bridget: We heard a lot of talk at the convention about all the disruption coming to auto retail and the need for mom and pop dealers to sell now. What do you think about that?

Erin: You know, we don’t agree with that comment. We think that dealers should really be thoughtful about the timing of their exit. While there is certainly lots of disruption talk in our industry, the fear factor of autonomous vehicles and changes in mobility, we don’t see those coming at a pace that would require a dealer to make a rush decision regarding usually the most valuable asset they own. For our clients, whether it’s consulting clients or our sell side clients, we really advice that they take time to decide when the time is right to sell their business and monetize often generations of work.

But we do not think that what we’re hearing and seeing in the marketplace would require a dealer to make a rush decision about the future of their business. The changes that are coming are going to take time, and we don’t think that they will have an immediate impact on valuation not in the next five years at least.

Bridget: What is your expectation for the buy/sell market in 2019?

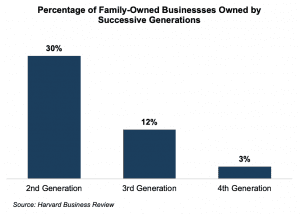

Erin: We think 2019 will be yet another year of over 200 buy/sell transactions. That would make it the sixth year in a row of over 200 transactions. We do think it’s going to be a very active year. What we’re seeing is more dealers deciding to come to market and sell not again because of the disruption as much as because of the cessation situation that much of our industry is facing. We believe that about 50% or more of our industry is in a second or third generation of ownership. What that means is that the risk factors of transitioning the business to yet another generation are ones that many dealers are facing today.

They’re in the process of trying to do that, and we all know that that’s a hard thing to do. Only 12% of businesses make it to the third generation of family businesses and 3% to the fourth. We think that’s the primary driver we’re seeing of dealers deciding the time is now to exit and certainly valuations are very strong, which makes dealers excited to monetize their businesses in this climate.

Bridget: Where does that leave the buyer community for 2019?

Erin: Well, we see a growing buyer community in 2019. Our firm literally gets a call every week from a new investor or buyer who is looking to expand in the auto retail market, both in the U.S. and we have a lot of international investors calling us who are very attracted to our franchise system, which really protects the value of an investment in auto retail. Interestingly, we certainly think this is a real testament to the fact that the auto retail business model definitely has longevity. We don’t see it going away. Certainly you wouldn’t have so many buyers looking to acquire dealerships if that was the case.

It really is another reason we think dealers who are thinking about selling can take their time to decide when the time is right for them and their family. But all in all, we think it’s going to be a very active 2019.

Bridget: Thanks so much for joining us, Erin. We appreciate you being here. We look forward to talking to you next month.

Erin: Thank you so much, Bridget. Have a great day.

Thank you for watching the official news source of the retail automotive industry. This has been a JBF Business Media production.