Joining us today on CBTNews.com to review The Kerrigan Index for February 2019 is Ryan Kerrigan. We discuss the month’s winners, major industry announcements, the Buy/Sell market, and other strong takeaways from February’s numbers.

Video Transcript:

Bridget Fitzpatrick: Hello, everyone. I’m Bridget Fitzpatrick. Welcome to the Kerrigan Advisors Market Update. Today we’re joined by Ryan Kerrigan. Ryan, thank you so much for joining us today.

Ryan Kerrigan: Hey, Bridget. Great to be with you, and good to see you in San Francisco last month.

Bridget Fitzpatrick: So, how did the Kerrigan index perform for the month of February?

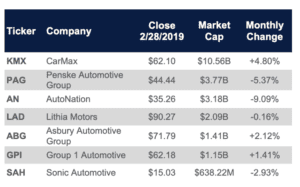

Ryan Kerrigan: The index was down slightly, about .1 percent for the month, while the S&P was up 2.9 percent, so some real underperformance on the part of automotive retail in February, relative to the broader market.

Bridget Fitzpatrick: And who were the biggest winners and losers?

Ryan Kerrigan: Well, it was a mixed bag. Three of the component stocks were up, CarMax, Asbury, and Group 1. However, AutoNation, Penske, Sonic, and Lithia were all down for the month, with AutoNation being down the most, at 9.1 percent.

Bridget Fitzpatrick: Were there any significant announcements made by the publics?

Bridget Fitzpatrick: And AutoNation had a major announcement.

Ryan Kerrigan: Yes, they certainly did. After a very public search for a new CEO, they announced that Carl Liebert would be coming in. Complete outsider of the automotive industry, was previously the COO at USAA, a very large insurance company. Prior to that, he was at Home Depot and GE. And AutoNation cited his unique background linking digital sales with supply chain credentials, and they found that to be a very compelling candidate for the next leg of AutoNation growth.

Bridget Fitzpatrick: How were auto sales in February?

Ryan Kerrigan: Sales were down 2.9 percent in the month. The industry’s attributing this to one-time issues, such as harsh weather conditions, the government shutdown, consumer concerns over their federal tax refunds. However, I will note that one other industry analyst is not buying it, and he said, “Hey, we’ve shifted into a lower gear for auto sales,” so in the coming months, we’ll see which is correct.

Bridget Fitzpatrick: What about the SAAR?

Ryan Kerrigan: SAAR came in at 16.6 million, and this marked just the second month that SAAR fell below 17 million since 2017. So, February was a very, very soft month.

Bridget Fitzpatrick: Do you think that February is a good barometer for what is to come?

Ryan Kerrigan: You know, I’m not convinced. We still see very strong economic growth, and unemployment remains historically low. Given that, I suspect we’re gonna see some solid months ahead. Recall that for each of the last three or four years, we’ve started very slow in the beginning of the year, and ended up with really strong annualized numbers. And I would not be surprised if 2019 is a repeat of that pattern.

Bridget Fitzpatrick: How is the buy/sell market starting off in 2019?

Ryan Kerrigan: The buy/sell market remains Robert, and I think will be in line with prior years. While it’s very early in the year, in the last five years, we’ve seen total transactions in our industry, over 200 transactions. I think we’re gonna see the same this year, and look for our Blue Sky Report, the full year report’s coming out this month, we’ll talk in a lot more detail about the buy/sell industry.

Bridget Fitzpatrick: I think we all understand that the aging dealer body is prompting many buy/sells. But educate us on the buyers.

Ryan Kerrigan: I think you nailed it. It’s intuitive as to who is selling, older dealers who are ready to hang up their cleats. But it is worth pointing out that this is a great business model, that allows owners to own their businesses well into their retirement years. I can assure you that a lot of other industries, I’ll say software entrepreneurs, for example, do not have the luxury of retaining ownership of their businesses, and then selling when they get to 80 years of age. Our industry is very unique and attractive, in that way.

Ryan Kerrigan: But getting back to your question on the buyers, we are literally contacted every week by new and prospective buyers looking to understand more, and think seriously about getting into automotive retail. Now, the private dealers in auto retail are still the most active. They’re seeking scale, and they’re seeking local and regional dominance in their respective markets. But we continue to see strong interest from automotive retailers, and automotive distributors from outside the US, looking at the US market. And we continue to get a regular stream of outside, professional capital seeking an entry point in automotive retail. As I’ve said before, the buyer pool has never been more varied, or more complex than it is today.

Bridget Fitzpatrick: Sounds like there’s a lot of new interest in our industry. What should dealers know about these players?

Ryan Kerrigan: It’s a great question, and this is really relevant to our industry because I would be troubled to find another industry in which the conversion of conversation about a transaction to actual deal is a lower a ratio as it is in our industry. And I just wrote an article to this effect. Dealers need to be careful and understand how professional capital works. As I outline in my article, outside investors are very active in generating deal flow, but very low probability of close. In the investment industry, they talk a lot about 100 to 1, and what that means is they look, and spend real time on 100 different deals to find one that they’re actually going to do. So, again, important that dealers understand this, and I walk through this in a lot more detail in that article.

Bridget Fitzpatrick: And you just announced a large transaction.

Ryan Kerrigan: We did. Last month we announced the sale of our client, Village Automotive Group, based in Minneapolis, with two Lexus dealerships, and one Chevrolet dealership to the Ed Napleton Automotive Group out of Chicago. Some really special stores in the Lexus network, and we are thrilled to represent our clients. Here again, we see very strong buyer demand for the right brands, in the right markets.

Bridget Fitzpatrick: Congratulations, Ryan. We look forward to talking to you again next month.

Ryan Kerrigan: Great. Thank you, Bridget.

Thank you for watching the official news source of the retail automotive industry. This has been a JBF Business Media production.