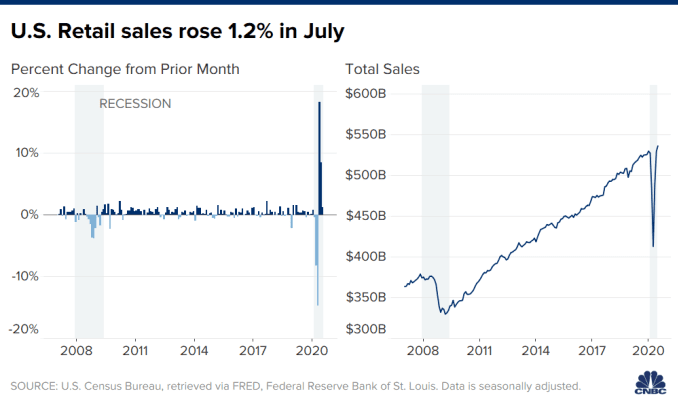

A recent US Census report revealed that American retail sales across all industries increased by 1.2 percent from June to July. Although it is below the 2.9 percent increase projected by analysts, it does reveal an important fact: individuals are still buying retail items, even in the midst of the pandemic. Most industries experienced a surge in sales (for example, electronics saw a 22 percent increase in sales).

The report, however, shows a slight decline in the overall automotive industry’s sales, despite many dealerships are reporting to have some of their best months in history. Inventory levels are depleted for most major carmakers, particularly with popular trucks and SUVs, as sales have been through the roof. What’s the real story behind this number, and how can dealers prepare for the future? Take a look at our takeaways.

New Vehicle Sales Month-To-Month vs. Year-Over-Year

According to the Independent Commodity Intelligence Services, new light-vehicle sales rose by 14 percent in July compared with June. While new car sales are down by 11 percent compared with 2019, the month-to-month rise is an important note.

The overall decline in automotive revenue can be attributed in large part to the parts sector and manufacturing. Since the pandemic recovery began, parts suppliers have struggled to keep up with demand, and assembly plants are still below normal operating capacity as a result.

Even though unemployment is still over 10 percent, consumers are still purchasing vehicles—even higher-priced new ones. While the industry will continue to go through a slow recovery, this data shows that consumers are not put off from buying from dealers. There has been talk of used vehicles becoming the focal point of dealer’s F&I strategies. Nevertheless, there is still a consumer preference for new cars.

The Problem of Inventory

While job losses and dwindling savings led to an initial drop in sales, much of which has since bounced back. Low inventory is also a significant problem. Cox Automotive found that there were only 67 inventory days in mid-July, below the 86 inventory days counted at the same time in 2019. Additionally, this July, many automakers had tight inventories as Toyota and Subaru had only 40 days of stock on hand. While some had more, most were experiencing shortages.

This information is crucial because it acts as another signal that sales could become more difficult. Dealers can take this information and dig into what is driving the consumer response at their dealership.

Cox Automotive also found that dealerships in southern states typically had around 100 days of inventory on hand, while dealers in northern locations like New York, had around half. Consequently, the consumer purchasing situation is unique, depending on the region. In places where inventory is limited, the economy may not be a primary factor.

The Impact of The $600 Unemployment Expiration

Since May, out-of-work customers have had access to an additional $600 in unemployment insurance. These benefits expired on July 31st, and have yet to be renewed at the time of this writing. While many were not able to access these benefits due to eligibility or logistical issues, many were. As a result, some were not as impacted by the economic uncertainty brought on by the COVID-19 outbreak. Many of these consumers were able to carry on purchases as usual, which likely explains the overall rise in consumer retail spending.

Nevertheless, if the $600 benefits fail to be renewed, it could mean a more considerable drop in revenue for most—if not all, industries. As a result, dealers will have to continue to embrace three ideals:

- Dig deeper into consumer needs– Those initial customer questions are going to be much more important as consumers become more price-conscious. Understanding customer budget constraints and aligning this information with inventory needs will be critical.

- Collecting more consumer data – If there are more factors driving customers to put off purchasing, it will take even more sophisticated data collection practices to determine how to appeal to their motivations. Sharper data collection strategies can give dealers the information they need to better reach customers who are ready to buy—or are close to making the decision.

- Focusing on lead generation – The sales funnel may become a lot longer. Consumers are likely going to take more time to research and purchase. Therefore, additional touchpoints may have to be included to encourage customers to move from interacting with dealers to making a purchase.

While it is easy to think that sales can become much tougher in the latter part of this year, the data composed by the US Census Bureau reveals that even amid uncertainty, consumers are still spending money. Again, the expiration of the $600 unemployment insurance payments can significantly impact consumer sentiment. Still, if dealers prepare, they can continue to find audiences with the motivations to buy.

Did you enjoy this article from Chanell Turner? Read other articles from her here.

While you’re here, don’t forget to subscribe to our email newsletter for all the latest auto industry news from CBT News.