Digital Retailing or DR for short is the latest and greatest thing, dominating press releases, blogs and discussions at NADA 2019, unseating ‘AI’, ‘machine learning’ and even ‘Big Data’ (remember that one?) at the buzz word table. While there is not solid consensus on what digital retailing is, most agree that DR is potentially a positive advancement for the industry, and that auto dealers will inevitably be forced to implement digital retailing strategies or risk becoming uncompetitive.

Dealers are smart. They know that even if it is unrealistic to think that car selling/buying is ever going to be as easy as ordering a toaster on Amazon, the future must be more digital than it is today. In fact, our surveys have consistently shown dealerships’ strong willingness to embrace ‘DR’ tools to the tune of 84%, although adoption lags desire. A true DR solution should simplify the process for dealers and consumers – allowing the customer to start and stop where they want to online and pick up where they left off when in the dealership. But, there are multiple touch points along this road where DR is stubbing its toe.

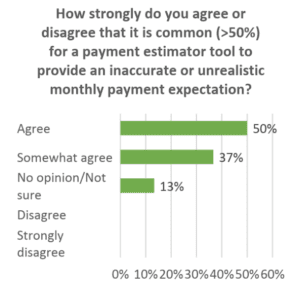

In a recent dealer survey, we drilled down into one particular, but especially impactful, bump in the DR road – and one that should be of significant concern: digital finance tools. Many digital retailing platforms, self-penciling tools and standalone payment estimator tools are quoting inaccurate and/or misleading payment information to consumers, ultimately creating more skepticism with buyers when the deal has to be renegotiated at the dealership. Our survey revealed that 87% of dealers agreed that it is common for payment tools to provide unrealistic or inaccurate monthly payment expectations.

The survey also revealed something we were not expecting – these tools are actually costing dealers sales and profit opportunities. 74% of dealers report that over a quarter of deals that included digital retailing-provided payment terms have to be reworked because they cannot be matched to the consumer’s credit profile or to the final deal structure or a lender program. The other 36% of dealers reported that between 51% and 100% have to be re-desked. For obvious reasons, re-desking adds extra effort and time to the transaction – aggravating time sensitive consumers and, because time is money, negatively impacting profitability. And success is far from guaranteed: the majority (70%) of dealers are unable to save 60% of those deals.

The survey also revealed something we were not expecting – these tools are actually costing dealers sales and profit opportunities. 74% of dealers report that over a quarter of deals that included digital retailing-provided payment terms have to be reworked because they cannot be matched to the consumer’s credit profile or to the final deal structure or a lender program. The other 36% of dealers reported that between 51% and 100% have to be re-desked. For obvious reasons, re-desking adds extra effort and time to the transaction – aggravating time sensitive consumers and, because time is money, negatively impacting profitability. And success is far from guaranteed: the majority (70%) of dealers are unable to save 60% of those deals.

Because most of these tools are returning unqualified payment quotes – unmatched to a customer’s credit profile, or specific vehicle, and, crucially, to any of the dealer’s lender programs – they are establishing unrealistic payment expectations leading to unavoidable conflicts at the dealership. And, for dealers striving to deliver a frictionless buying experience and ‘deal transparency,’ these less advanced digital finance tools actually get in the way of their desire to evolve.

The hard reality is that these unrealistic payment quotes often lead to re-worked deals, resulting in customer mistrust and dissatisfaction and dealership inefficiencies – exactly the opposite impact dealers intended when making traditional payment calculators and self-penciling tools available on their websites.

And yet, dealers remain bullish on digital retailing: nearly 60% who are using digital retailing solutions say that the average profitability of DR-initiated transactions is equal to or higher than non-DR transactions. But, logically, we have to assume that the reworking of many of those deals is having a negative impact on deal profitability – in fact, nearly 30% of dealers report that digital retailing-initiated deals are less profitable.

There are indications that unrealistic payment information is driving some dealers away from online payment calculator tools and digital retailing solutions in general. The majority of dealers who report they aren’t using digital retailing tools acknowledge that it is common for payment estimator tools to provide inaccurate or unrealistic payment expectations, and nearly 1 in 2 of these dealers agree that payment expectations hurt F&I product sales.

This is unfortunate, because the future of DR is bright. Its promise is to help dealers sell more cars, more profitably, in less time. Dealers want and expect digital retailing to remove inefficiencies – not create them. However, until digital retailing solutions can be powered with finance technologies that return realistic, qualified payment terms matched to the dealer’s lender programs, fulfillment of the DR’s promise will remain elusive.

So, what can a dealership do? Job one: re-examine the payment tools on your dealership website and do some tests to see where the discrepancies are. There are ‘dumb’ payment calculators and ‘smart’ payment calculators – be sure you know the difference. If you discover your payment tools could be harming your idealized customer experience and, very likely, your reputation, rest assured that “smart” consumer-facing, online and in-store ‘finance’ tools and technologies do exist and even more true end-to-end DR tools are on the horizon.

To download eLEND Solutions Digital Retailing survey report on Digital Retailing, click here.