Ryan Kerrigan, Managing Director of Kerrigan Advisors joins CBT News to update viewers on the automotive dealership buy and sell market for the close of 2017 and provides insight on the outlook for 2018.

VIDEO TRANSCRIPTION

Joe: Ryan, tell us about the Kerrigan indexes results for the month of December.

Ryan: The Kerrigan index was down 6.3% December versus the overall S&P being up 1%. Analysts were predicting a weaker finish to the year, and these stocks drifted down the final days of trading in 2017.

Joe: So how did 2017 finish?

Ryan: The overall industry finished on a strong note and stronger than many of us expected. December SAR was the second highest run rate month in 2017, and for the year, we were down just 300,000 units versus 2016. About half of that difference was a pullback in fleet sales. So yet another very robust year for auto retail

Joe: All right. What is the outlook for 2018 then?

Ryan: Broadly, the macroeconomic indicators are very positive. NADA is projecting SAR in a high $16 million range. Unemployment is at 4.1%, which is a 17 year low, and we’re finally seeing some wage growth. The latest numbers indicating about 2.5%. The one issue that will impact our industry is rising interest rates. The consensus is for multiple interest rate hikes in 2018 and this is going to impact dealers in two ways. It drives up the cost for consumers to finance cars. It also drives up dealers expenses as interest rates affect their floor plan expense, any business debt they may have, and eventually, as they reset their mortgage expense. That said, the overall picture is very positive.

Joe: How does that impact the buy-sell market?

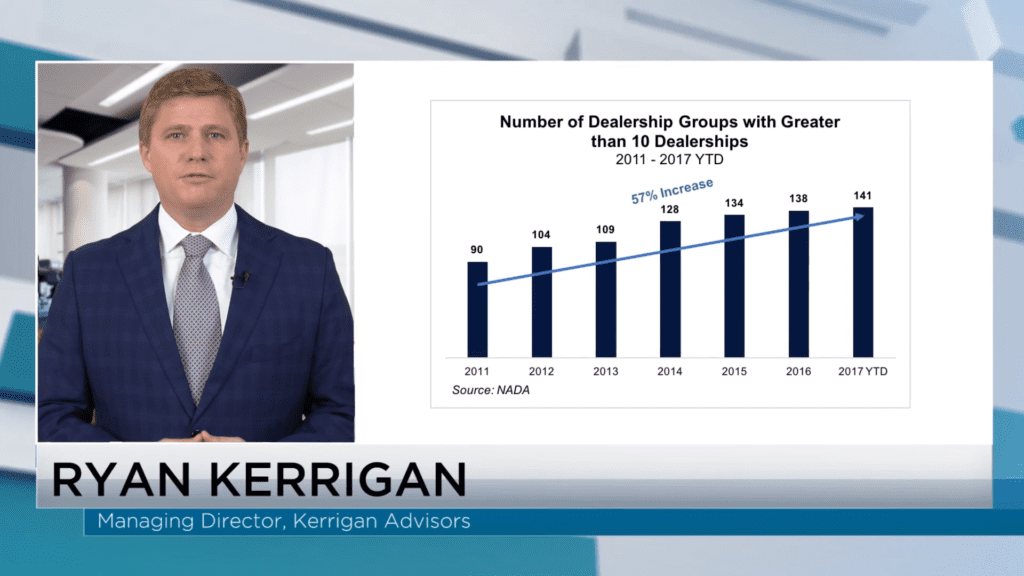

Ryan: We just finished a very strong year of buy-sell activity. The number of transactions is tracking towards 200, which is the third highest buy sell activity in our industry’s history, and the big continue to get bigger. The number of groups with more than 10 dealerships has grown by over 50% in the last five years. I can say that we here at Kerrigan Advisors ar talking with increasingly larger groups about their strategic options, and there are some that believe that regional dominance is becoming the key strategy to staying relevant. For example, the Prime Automotive Group, one of the largest groups in the northeast, sited size as being one of the primary reasons for their link up with GPB Capital. For as big as they are, they see the need to continue getting bigger.

Joe: Ryan, I know a lot of people are probably wondering this, what does the buyer community look like right now?

Ryan: As we’ve discussed, we see a very deep buyer pool and a broader buyer pool. As I mentioned the last time we spoke, we’re under contract with multiple international buyers, each making their first acquisition in U.S. auto retail. We see east coast players evaluating deals on the west coast and vice versa. Regularly we are approached by new sources of private capital seeking opportunities in our industry. The good news is for dealers who are wondering, “Is there a buyer for me?” The answer is yes. For all the uncertainty in the marketplace, the buyer pool remains deep, and at Kerrigan Advisors, we’ve spent a lot of time tracking this large, diverse set of buyers.

Joe: All right. But there is talk of disruption in the industry. Tell us a little bit about that.

Ryan: Yeah. There certainly is. In our view, 2017 marked a real change in the conversation. For years there were outsiders, particularly those in Silicon Valley that talked about disrupting our industry, but in 2017 dealers themselves have started talking about disruptive technologies in a very serious way. Many are recognizing that other segments of retail are fundamentally changing. For example, in 2017 over 6,000 stores closed in the United States. We don’t yet know how this all impacts auto retail, but we do know the markets evolving. More and more dealers believe they too need to evolve with these new trends or consider an exit. We think this is one of the reasons that the publicly traded auto retailers were down slightly in 2017 despite the S&P is up a very strong 20%.

Joe: Do you expect dealership valuations to change in 2018?

Ryan: Our outlook on multiples is stable for most brands. We don’t see them changing considerably in the near future. Now, the other part of valuations is adjusted earnings, and there we see more movement with some franchises doing better than others. For those that are interested, contact us here at Kerrigan Advisors for the Blue Sky Report. We cover valuation trends and multiples in a lot more detail on that report.

Joe: All right. Once again Ryan Kerrigan, managing director of Kerrigan Advisors.